Grab Announces Strong First Quarter 2021 Results as Company Progresses Towards U.S. Public Listing in Partnership with Altimeter Growth Corp.

Grab today announced financial results for the quarter ended March 31, 2021. Grab and Altimeter Growth Corp. today also filed with the U.S. SEC a draft registration statement on Form F-4.

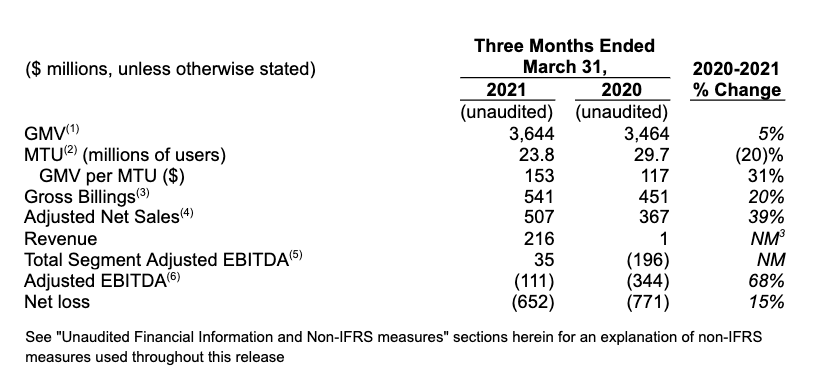

- Q1 2021 Adjusted Net Sales reached an all-time high of $507 million and grew 39% year on year. Revenue presented in accordance with IFRS was $216 million, also a record for Grab

- Quarterly Adjusted EBITDA improved by $233 million year on year to $(111) million

- Grab has filed a registration statement on Form F-4 with the U.S. Securities and Exchange Commission in connection with its proposed business combination with Altimeter Growth Corp.

- Provides updates on revenue presentation contained in the Form F-4 and proxy materials as well as post-merger Board of Directors

SINGAPORE & MENLO PARK, Calif. – August 2, 2021 – Grab Holdings Inc., Southeast Asia’s leading superapp, today announced financial results for the quarter ended March 31, 2021. Grab and Altimeter Growth Corp. (Nasdaq: AGC) today also filed with the U.S. Securities and Exchange Commission (“SEC”) a draft registration statement on Form F-4 (the “Registration Statement”), in connection with their recently announced proposed business combination. While the registration statement has not yet become effective and the information contained therein is subject to change, it provides important information about Grab’s business and operations, proposed business combination with Altimeter Growth Corp. (“AGC”) and the proposals to be considered by AGC’s shareholders.

“We are pleased with our progress toward becoming a publicly-traded company, which we expect to occur in Q4 2021,” said Anthony Tan, Group CEO and Co-founder of Grab. “As we prepare to become a listed company, we’re sharing our first-ever quarterly financial results and we continue to deliver strong growth, despite the ongoing impact of COVID-19. Southeast Asian consumers trust Grab to meet their everyday needs in a growing number of ways, and we are excited about the emerging growth opportunities we see in our grocery delivery and financial services offerings.”

“We exceeded our internal targets for Adjusted Net Sales and Adjusted EBITDA for Q1 2021, and continued the strong growth momentum of our deliveries business,” said Peter Oey, Chief Financial Officer of Grab. “We saw robust topline growth, even compared to the first quarter of 2020 that saw limited impact from COVID-19, and took strides towards profitability. In the second quarter we saw the continuing resilience and strong performance of our business, combined with disciplined operational execution. We are confident that our diversified geographical and vertical footprint puts us in a strong position to capture the massive opportunity in Southeast Asia.”

Strong First Quarter 2021 Financial Results (for the three months ended March 31, 2021)

First Quarter 2021 Financial and Operational Highlights:

- Gross Merchandise Value (GMV) grew 5% year on year to reach $3.6 billion. Deliveries GMV demonstrated strong year on year growth of 49%, offset by weakness in mobility as a result of the lockdowns and other restrictions imposed by governments on the back of the COVID-19 pandemic.

- Adjusted Net Sales reached an all-time high of $507 million, up 39% year on year. Revenue achieved a record $216 million.

- Grab achieved its strongest quarter for Adjusted EBITDA at $(111) million, which improved by $233 million year on year.

- Total Segment Adjusted EBITDA, which excludes regional corporate costs, was $35 million, an improvement of $231 million year on year.

- Net loss, which includes non-cash items related to interest accrued on Grab’s convertible redeemable preference shares and depreciation, was $(652) million, compared to $(771) million in Q1 2020.

- Spend per user, defined as GMV per Monthly Transacting Users (MTU), increased by 31% year on year, highlighting the strength of Grab’s superapp synergies across its business segments.

- As of March 31, 2021, Grab had $4.9 billion of cash and cash equivalents, an increase of $1.4 billion from $3.5 billion as of December 31, 2020. This was primarily due to the closing of Grab’s first senior secured term loan facility (the Term Loan B Facility) of $ 2.0 billion at the end of January 2021.

- In Q1 2021, Grab was the most downloaded app and had the highest number of average smartphone monthly active users in Southeast Asia [1] for the mobility and delivery category [2], according to App Annie. This is across both iOS and Google Play combined. Grab’s cumulative downloads from launch through Q1 2021 and average smartphone monthly active users base in Q1 2021 were also more than 2x higher than the next largest mobility and delivery app in the region.

Deliveries

- Grab continued to see strong growth in deliveries during Q1 2021, generating GMV of $1.7 billion, representing an improvement of 49% from GMV of $1.1 billion in Q1 2020, driven by increases in both the number of transactions and order value as it witnessed a strong upsurge in new MTUs coming onto the deliveries segment over the past year.

- Adjusted Net Sales for deliveries was $293 million, up $144 million and 96% year on year, while Revenue was $53 million, a $152 million increase year on year.

- Deliveries Adjusted EBITDA of $(4) million was up $147 million year on year.

- Grab continued to scale GrabMart, an everyday goods delivery offering that has expanded across Grab’s 8 Southeast Asian markets. GrabMart’s GMV for Q1 2021 increased by 21% quarter on quarter compared to Q4 2020, and was 36x higher compared to Q1 2020.

Mobility

- Due to the ongoing impact of the COVID-19 pandemic and the lockdowns and restrictions imposed in Grab’s various markets, mobility GMV in Q1 2021 represented approximately 64% of Q1 2020 levels.

- Mobility Adjusted Net Sales was $167 million, a 14% year on year decline, while Revenue increased by 18% year on year to $145 million.

- Mobility Adjusted EBITDA was $115 million, an increase of $34 million, or 42%, year on year, and Grab continues to be Segment Adjusted EBITDA positive in all of its core markets.

- Grab anticipates that the demand for mobility services will continue to experience volatility as resurgence in COVID-19 cases have impacted its markets, leading to renewed restrictions.

Financial Services

- In Q1 2021, Grab’s financial services segment achieved its highest quarterly Total Payments Volume (Pre-InterCo) [4], demonstrating year on year growth of 18%, supported by strength in payments generated from both on-Grab platform and off-Grab platform use cases. This was in spite of COVID-19 impacting Grab’s mobility segment and footfall to physical stores.

- Financial services saw Adjusted Net Sales increase by 31% year on year to $23 million, while Revenue increased by $29 million year on year to $8 million.

- Financial services Adjusted EBITDA improved by $39 million year on year to $(78) million.

- Loan disbursals via the on-Grab platform increased by over 45% year on year as Grab continued to improve credit scoring models and launched new lending products in Q1 2021.

- Insurance offerings demonstrated strong growth and gross written premiums more than tripled year on year as mobility-related product sales increased.

Enterprise and new initiatives

- Grab saw strong year-on-year growth in enterprise and new initiatives in Q1 2021, with GMV growing more than 3.5x to reach $26 million.

- Adjusted Net Sales for enterprise and new initiatives improved 388% year on year to $25 million, while Revenue was $10 million in Q1 2021.

- Enterprise and new initiatives Adjusted EBITDA also turned positive to $2 million.

As of March 31, 2021, Grab had $4.9 billion of cash and cash equivalents, an increase of $1.4 billion from $3.5 billion as of December 31, 2020. Total outstanding debt as of March 31, 2021 was $2.1 billion, a $1.9 billion increase from the $212 million balance as of December 31, 2020, primarily due to the closing of its Term Loan B Facility in January 2021 of $2.0 billion.

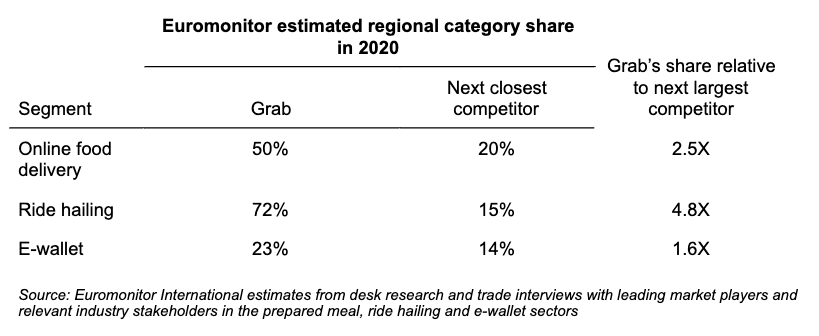

Category Leadership and Market Opportunity Supports Long-Term Growth Trajectory

Euromonitor conducted research to quantify the market opportunity in Southeast Asia and determine category share across Grab’s three core verticals: deliveries, mobility and financial services. Based on Euromonitor’s independent analysis, Grab was the category leader in 2020 by GMV in online food delivery and ride-hailing, and by TPV in the e-wallet segment of financial services in Southeast Asia [1].

With Grab’s scale and category leadership, Grab continues to be well-positioned to capture a total addressable market that is estimated to grow from approximately $52 billion today to more than $130 billion by 2025 across online food delivery, ride-hailing and e-wallet, according to Euromonitor.

“We’re pleased by the team’s execution and the growth and resilience of Grab’s diversified business model in Q1,” said Brad Gerstner, founder & CEO of Altimeter Capital. “Altimeter is thrilled to support Grab as a long-term partner in their journey to become a public company, so they can continue to meet the needs of millions of people in Southeast Asia.”

More detail on Euromonitor’s analysis is available in Grab’s F-4 filing.

Update on Revenue Presentation

“Adjusted Net Revenue” has been renamed “Adjusted Net Sales”, with no material change to the definition or historical data presented to PIPE investors in April 2021. Adjusted Net Sales is a non-IFRS metric. Adjusted Net Sales is a key measure used by Grab’s management to evaluate top-line performance, normalized for excess driver, merchant [5] and consumer incentives [6], which are expected to continue to decline over time as Grab’s business matures. Accordingly, Grab believes that Adjusted Net Sales is useful to investors and others in understanding and evaluating the company’s top-line results in the same manner as Grab’s management team and board of directors.

Through a consultation process with the SEC ahead of the F-4 filing, Grab has received certain guidance that has been reflected in our F-4 filing. An alternate accounting judgment has been made that consumers should also be recognized as Grab’s customers for accounting purposes. As such, under IFRS accounting principles, consumer incentives are now recognized as a contra revenue item rather than a marketing expense, as Grab previously reported. This is a change in presentation, with reported revenues now reduced by consumer incentives, along with driver- and merchant- partner incentives. There is no impact from this change on historical GMV, Gross Billings, Adjusted Net Sales, Adjusted EBITDA, balance sheet, or cash flow.

Update on Post-Merger Board of Directors

Grab also provided an update on its post-merger Board of Directors, which is expected to initially consist of six directors, four of which are expected to be independent. Following the consummation of the Business Combination, Rich Barton, Dara Khosrowshahi, Ng Shin Ein, Oliver Jay, Anthony Tan, and Hooi Ling Tan, are expected to become directors of Grab.

Grab co-founder Hooi Ling Tan and Rich Barton will be new additions to Grab’s board of directors. Barton is the co-founder and CEO of Zillow Group, Inc. He returned as CEO in 2019 after previously serving as CEO from the company’s inception in 2005 through 2010. Prior to co-founding Zillow, he founded Expedia and later co-founded Glassdoor. Barton currently serves on the board of directors of AGC, and also serves on the board of directors of Netflix, Inc. and Qurate Retail, Inc.

Anthony Tan, Dara Khosrowshahi, Ng Shin Ein and Oliver Jay currently serve on Grab’s board of directors. Khosrowshahi has been Chief Executive Officer of Uber since September 2017 and previously served as President and Chief Executive Officer of Expedia, Inc. Ng currently serves on the board of directors for StarHub Limited, CSE Global Limited, and Avarga Limited. Jay is the Chief Revenue Officer at Asana and previously worked at Dropbox as the Head of Asia Pacific and Latin America.

Update on Grab’s COVID-19 Response

Grab continues to engage with governments in Southeast Asia to help combat COVID-19 and mitigate its effects. This includes efforts to increase vaccination rates, help partners weather continued impact from COVID-19, and utilizing technology and other initiatives to support small business digitalization.

Some key highlights are as below:

- In Indonesia, Grab has collaborated with Good Doctor to support the Ministry of Health’s national vaccination efforts by setting up vaccination centers across 54 cities and regencies, facilitating vaccinations for over 140,000 driver-partners and members of the public.

- Grab similarly set up and funded the administration of vaccines to thousands of Grab driver-partners in the Philippines with support from the national vaccine program.

- In total, Grab has allocated up to $20 million in cash from the GrabForGood Fund to subsidize the cost of COVID-19 vaccines and help with vaccine administration for eligible driver- and merchant-partners who are not covered by a national vaccination program.

- Grab also launched GrabConnect in Vietnam to utilize technology along with Grab’s extensive network and ecosystem to connect farmers with consumers through a safe, fast and convenient delivery process.

- In view of the Phase 2 Heightened Alert restrictions in Singapore, Grab launched new support programs including enhanced earnings protection for driver-partners affected by COVID-19, full commission rebates for hawkers in partnership with Enterprise Singapore, and rental rebates for eligible driver-partners who are renting their vehicles from GrabRentals.

- In Malaysia, Grab introduced the GrabFood Small Business Programme to help small businesses adapt to the growing demand for delivery services. This includes “Grab Online Shop”, a solution to help small businesses set up their own branded website as an additional sales channel.

- In Thailand, Grab is creating access to approximately 2.8 billion Thai baht (approximately $85 million) in working capital for local small and medium businesses through the Grab Financial Group. This will enable more than 18,000 merchant-partners to potentially access working capital from Q3 2021 onwards.

In June 2021, Grab also released its first ESG report outlining the company’s progress to support socioeconomic empowerment and sustainable growth in Southeast Asia.

Investor Webcast

Grab’s management will host an investor webcast via Zoom to present its first quarter 2021 financial results.

Call Details:

Date: Monday, August 2, 2021

Time: 8:00 a.m. U.S. Eastern Time / 8:00 p.m. Singapore Time

Please register at the link below and webcast details will be provided to the email address provided.

Registration Link: https://grab.zoom.us/webinar/register/WN_EePA-bXRT6CN_2WQvQu9pA

A replay of the webcast will be available at the Company’s investor relations website

— END —

Footnotes

[1] Refers to Singapore, Indonesia, Philippines, Thailand, Vietnam and Malaysia

[2] Consists of apps included in Lifestyle, Food and Drink and Travel, Navigation Travel & Local, Maps & Navigation categories across iOS and Google Play

[3] Not measured

[4] Total Payments Volume (TPV) is defined as the value of payments, net of payment reversals, successfully completed through the Grab platform for the financial services segment. Pre-InterCo means this segment data includes earnings and other amounts from transactions between entities within the Grab group that are eliminated upon consolidation.

[5] Excess incentives occur when payments made to driver-/merchant-partners exceed Grab’s revenue received from such driver-/merchant-partners

[6] Consumer incentives refer to promotions offered to consumers in the form of discounts that reduce the fare charged by the driver and merchant partners.

About Grab

Grab is Southeast Asia’s leading superapp based on GMV in 2020 in each of food deliveries, mobility and the e-wallets segment of financial services, according to Euromonitor. Grab operates across the deliveries, mobility and digital financial services sectors in over 400 cities in eight countries in the Southeast Asia region – Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. Grab enables millions of people each day to access its driver- and merchant-partners to order food or groceries, send packages, hail a ride or taxi, pay for online purchases or access services such as lending, insurance, wealth management and telemedicine, all through a single “everyday everything” app. Grab was founded in 2012 with the mission to drive Southeast Asia forward by creating economic empowerment for everyone, and since then, the Grab app has been downloaded onto millions of mobile devices. Grab strives to serve a double bottom line: to simultaneously deliver financial performance for its shareholders and a positive social impact in Southeast Asia.

About Altimeter

Altimeter Capital Management, LP is a leading technology-focused investment firm built by founders for founders with over $15 billion in assets under management. Altimeter’s mission is to help visionary entrepreneurs build iconic companies, disrupt markets and improve lives through all stages of growth. Altimeter manages a variety of venture and public funds and serves as an expert long-term partner to companies as they enter the public markets.

Contact Information

For inquiries regarding Grab, please contact:

Media

In Asia: press@grab.com

In the United States: Grab-SVC@sardverb.com

Investors

Grab: investor.relations@grab.com

Blueshirt Group: GrabIR@blueshirtgroup.com

For inquiries regarding Altimeter, please contact:

Forward-Looking Statements

This document and the announced investor webcast may include “forward-looking statements” within the meaning of the federal securities laws with respect to the proposed transaction between Grab Holdings Inc. (“Grab”), Grab Holdings Limited (“GHL”) and AGC and regarding Grab’s future business expectations which involve risks and uncertainties. All statements other than statements of historical fact contained in this document and the investor webcast, including, but not limited to, statements as to future results of operations and financial position, planned products and services, business strategy and plans, objectives of management for future operations of Grab, market size and growth opportunities, competitive position, technological and market trends and the potential benefits and expectations related to the terms and timing of the proposed transactions, are forward-looking statements. Some of these forward-looking statements can be identified by the use of forward-looking words, including “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,” “could,” “would,” “may,” “will,” “forecast” or other similar expressions. All forward-looking statements are based upon estimates and forecasts and reflect the views, assumptions, expectations, and opinions of AGC and Grab, which are all subject to change due to various factors including, without limitation, changes in general economic conditions as a result of COVID-19. Any such estimates, assumptions, expectations, forecasts, views or opinions, whether or not identified in this document, should be regarded as indicative, preliminary and for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. The forward-looking statements contained in this document and the investor webcast are subject to a number of factors, risks and uncertainties, some of which are not currently known to Grab or AGC. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of GHL’s registration statement on Form F-4, the proxy statement/ prospectus therein, AGC’s Quarterly Report on Form 10-Q and other documents filed by GHL or AGC from time to time with the U.S. Securities and Exchange Commission (the “SEC”).

These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. In addition, there may be additional risks that neither AGC nor Grab presently know, or that AGC or Grab currently believe are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. Forward-looking statements reflect AGC’s and Grab’s expectations, plans, projections or forecasts of future events and view. If any of the risks materialize or AGC’s or Grab’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements.

Forward-looking statements speak only as of the date they are made. AGC and Grab anticipate that subsequent events and developments may cause their assessments to change. However, while GHL, AGC and Grab may elect to update these forward-looking statements at some point in the future, GHL, AGC and Grab specifically disclaim any obligation to do so, except as required by law. The inclusion of any statement in this document or the investor webcast does not constitute an admission by Grab nor AGC or any other person that the events or circumstances described in such statement are material. These forward-looking statements should not be relied upon as representing AGC’s or Grab’s assessments as of any date subsequent to the date of this document. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Unaudited Financial Information and Non-IFRS Financial Measures

Grab’s unaudited selected financial data for the three months ended March 31, 2021 and 2020 included in this document and the investor webcast is based on financial data derived from the Grab’s management accounts that have not been reviewed or audited and are subject to further review and updates.

This document and the investor webcast also include references to non-IFRS financial measures, which include: Gross Billings, Adjusted Net Sales, Adjusted EBITDA, Total Segment Adjusted EBITDA and Segment Adjusted EBITDA. However, the presentation of these non-IFRS financial measures is not intended to be considered in isolation from, or as an alternative to, financial measures determined in accordance with IFRS. In addition, these non-IFRS financial measures may differ from non-IFRS financial measures with comparable names used by other companies.

Grab uses these non-IFRS financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons, and Grab’s management believes that these non-IFRS financial measures provide meaningful supplemental information regarding the its performance by excluding certain items that may not be indicative of its recurring core business operating results. For example, Grab’s management uses: (i) Gross Billings as an indicator of Grab’s growth and business performance as it measures the dollar volume of transactions on its platform; (ii) Adjusted Net Sales as a key metric to measure top-line growth of Grab’s business segments as it adjusts its revenue by adding back consumer incentives and excess driver/merchant incentives; and (iii) Total Segment Adjusted EBITDA as a useful indicator of the economics of Grab’s business segments, as it does not include regional corporate costs.

There are a number of limitations related to the use of non-IFRS financial measures. In light of these limitations, we provide specific information regarding the IFRS amounts excluded from these non-IFRS financial measures and evaluating these non-IFRS financial measures together with their relevant financial measures in accordance with IFRS.

This document and the investor webcast also includes “Pre-InterCo” data that does not reflect elimination of intragroup transactions, which means such data includes earnings and other amounts from transactions between entities within the Grab group that are eliminated upon consolidation. Such data differs materially from the corresponding figures post-elimination of intra-group transactions.

Explanation of key business non-IFRS measures:

(1) GMV means gross merchandise value, an operating measure representing the sum of the total dollar value of transactions on Grab’s platform, including any applicable taxes, tips, tolls and fees, over the period of measurement.

(2) MTUs means monthly transacting users, which is defined as the monthly number of unique users who transact via Grab’s products, where transact means to have successfully paid for any of Grab’s products.

(3) Gross Billings is a non-IFRS financial measure, representing the total dollar value attributable to Grab from each transaction, without any adjustments for incentives paid to driver- and merchant-partners or promotions to end-users, over the period of measurement.

(4) Adjusted Net Sales is a non-IFRS financial measure defined as Gross Billings less driver- and merchant-partner base incentives, over the period of measurement. Base incentives refer to the amount of incentives paid to driver- and merchant-partners up to the amount of commissions and fees earned by Grab from those driver- and merchant-partners.

(5) Total Segment Adjusted EBITDA is a non-IFRS financial measure representing the Adjusted EBITDA of Grab’s four business segments excluding regional corporate costs.

(6) Adjusted EBITDA is a non-IFRS financial measure calculated as net loss adjusted to exclude: (i) interest income (expenses), (ii) other income (expenses), (iii) income tax expenses, (iv) depreciation and amortization, (v) stock-based compensation expenses, (vi) costs related to mergers and acquisitions, (vii) unrealized foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs and (xi) legal, tax and regulatory settlement provisions.

Industry and Market Data

This document also contains information, estimates and other statistical data derived from third party sources, including research, surveys or studies, some of which are preliminary drafts, conducted by third parties, information provided by customers and/or industry or general publications. Such information involves a number of assumptions and limitations, and you are cautioned not to give undue weight on such estimates. Grab and AGC have not independently verified such third-party information, and make no representation as to the accuracy of, such third-party information.

Important Information About the Proposed Transactions and Where to Find It

This document and the investor webcast refer to a proposed transaction between Grab and AGC. Nothing in this document or the investor webcast will constitute an offer to sell or exchange, or the solicitation of an offer to sell, subscribe for, buy or exchange any securities or solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The proposed transactions will be submitted to shareholders of AGC for their consideration.

In connection with the business combination, GHL has filed a registration statement on Form F-4 (the “Registration Statement”) with the SEC that includes a preliminary proxy statement of AGC to be distributed to AGC’s shareholders in connection with AGC’s solicitation for proxies for the vote by AGC’s shareholders in connection with the proposed transactions and other matters as described in the Registration Statement, as well as the preliminary prospectus of GHL relating to the offer of the securities to be issued in connection with the completion of the proposed business combination. AGC and GHL also will file other documents regarding the proposed transaction with the SEC.

After the Registration Statement is declared effective, AGC will mail a definitive proxy statement and other relevant documents to its shareholders as of the record date established for voting on the proposed transactions. This document or the investor webcast is not a substitute for the Registration Statement, the definitive proxy statement/prospectus or any other document that AGC will send to its shareholders in connection with the business combination. AGC’s shareholders and other interested persons are advised to read the preliminary proxy statement/prospectus and any amendments thereto and, once available, the definitive proxy statement/prospectus, in connection with AGC’s solicitation of proxies for its extraordinary general meeting of shareholders to be held to approve, among other things, the proposed transactions, because these documents will contain important information about AGC, GHL, Grab and the proposed transactions. Shareholders and investors may also obtain a copy of the preliminary or definitive proxy statement, once available, as well as other documents filed with the SEC regarding the proposed transactions and other documents filed with the SEC by AGC, without charge, at the SEC’s website located at www.sec.gov or by directing a written request to AGC’s proxy solicitor, Okapi Partners LLC, by emailing info@okapipartners.com or mailing Okapi Partners LLC, 1212 Avenue of the Americas, 24th Floor, New York, NY 10036. The information contained on, or that may be accessed through, the websites referenced in this document and during the investor webcast is not incorporated by reference into, and is not a part of, this document.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

AGC, GHL and Grab and certain of their respective directors, executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitations of proxies from AGC’s shareholders in connection with the proposed transactions. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of AGC’s shareholders in connection with the proposed transactions and a description of their direct and indirect interests in such transactions is set forth in the proxy statement/prospectus contained in the Registration Statement. You can find more information about AGC’s directors and executive officers in AGC’s final prospectus filed with the SEC on September 30, 2020. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests is included in the proxy statement/prospectus contained in the Registration Statement. Shareholders, potential investors and other interested persons should read the proxy statement/prospectus contained in the Registration Statement carefully before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

No Offer or Solicitation

This document is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to sell, subscribe for or buy any securities or solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.