Hitting $100M revenue run rate this year, GrabAds is one of Southeast Asia's fastest growing advertising platforms

To Southeast Asian consumers, Grab (NASDAQ:GRAB) is the place to order food or book a ride.

But to merchants and brands, the platform offers another attraction: it’s a place to catch the attention of customers with advertisements.

Across its ride-hailing, deliveries and financial services offerings, Grab processes over 10 million transactions daily. The volume of people transacting daily on Grab across the region means there are ample opportunities to get noticed by new audiences–and potential buyers.

Grab’s revenue from merchants and brands buying ads has grown into “a sizable business,” said Ken Mandel, Regional Managing Director & Head of GrabAds at Grab. Based on this year’s first and second quarter data, Grab’s ad division will contribute approximately $100 million to overall revenue on an annualised basis.

“Grab is one of Southeast Asia’s fastest-growing advertising platforms and gives advertisers new ways to reach consumers”, according to Anita Munro, Chief Investment Officer at GroupM Asia Pacific. GroupM is a major media buyer.

The rise of retail media

The maturing of Grab’s ad tools comes at an opportune time when alternatives to traditional digital ad platforms are attracting interest due to an increasing focus on privacy.

People don’t like ads that follow them around from search and social networks into other contexts. Google, for instance, plans to phase out third-party cookies from early 2024––that’s the ad technology that enables tracking user behaviour across different websites. With third-party tracking undergoing a major shift, interest for new types of digital ad formats is on the rise.

One solution is placing ads on platforms which people have joined with the intent to buy something––as opposed to searching for information, or interacting with friends.

Grab is one of Southeast Asia's fastest-growing advertising platforms and gives advertisers new ways to reach consumers.

Anita Munro, Chief Investment Officer at GroupM Asia Pacific.

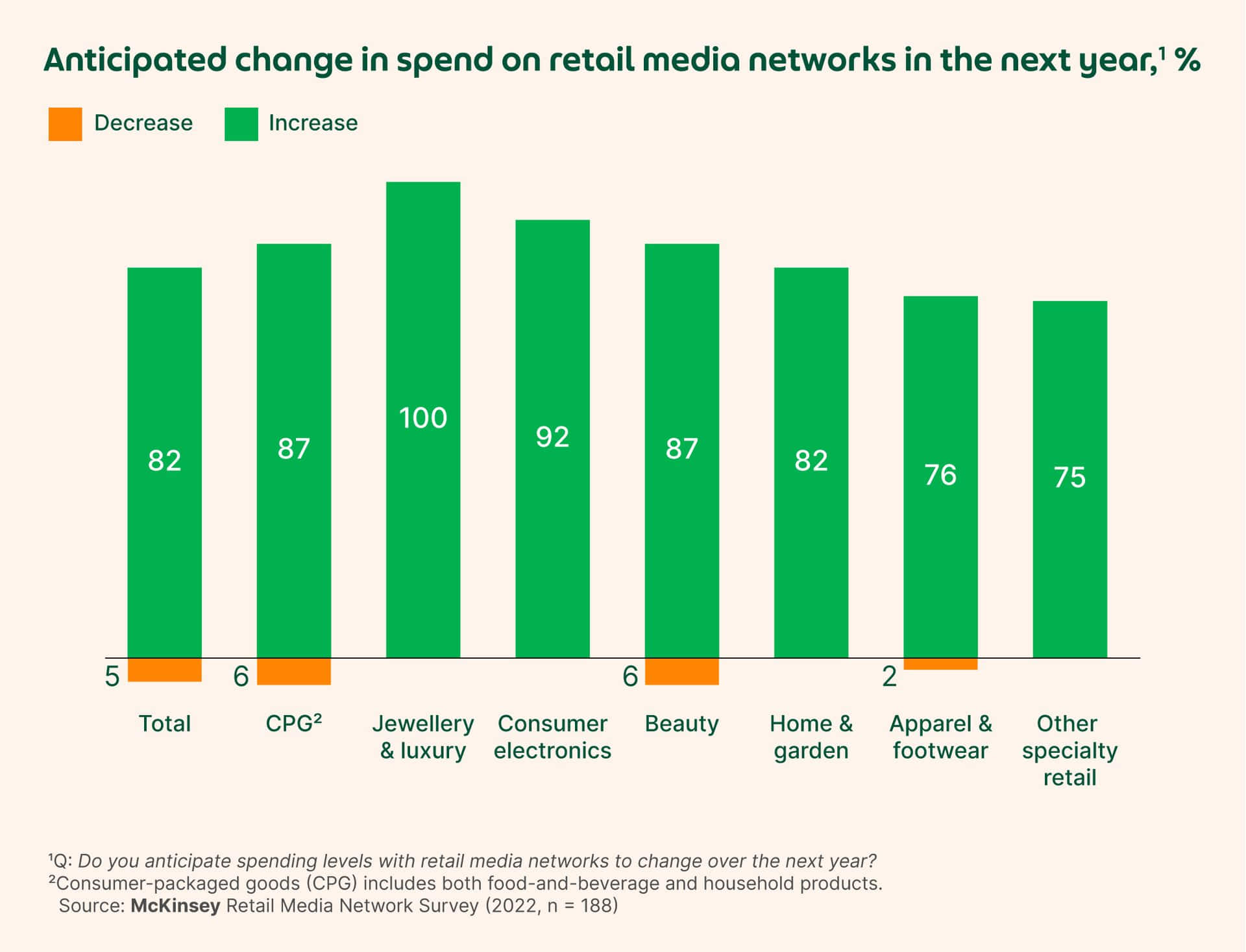

Marketers have dubbed large online shopping platforms “retail media networks,” and the trend is going towards spending on ads that exist within this retail world.

GroupM estimates that retail media networks will attract $126 billion in advertising spend this year. It forecasts this channel to exceed television revenue by 2028.

To Mandel, this shift makes sense “If you think about the marketing funnel, why would you drive traffic to a website where a consumer can’t buy? It’s like going into a retail store, but there’s no cash register.”

With retail media, brands can build awareness, launch products, induce trials, and then convert that into attributable purchases––all in one platform.

“This “closed loop attribution” lets advertisers connect their advertising placements directly to their sales, giving them a clear understanding on their return of investments.” said Mandel. “Making every dollar count is now more critical than ever, while reaching the right customers as cost-effectively as possible”

On-demand platforms like Grab, where consumers come regularly to purchase food or groceries, and to organise their rides, are part of this retail media landscape.

Grab’s growing suite of ad tools

To cater to this growing trend, Grab is evolving its ad products within two broad categories, explained Gaurav Dosi, Head of Product at GrabAds.

The first are endemic ads, geared towards the millions of F&B merchants that exist on Grab.

“The merchant ecosystem is what already lives and breathes on Grab, they contribute the largest share to our ads business at this point” said Dosi. “We’re building more and more solutions for that ecosystem.”

The number of merchants using Grab’s ad tools has grown significantly in the past six months. “More than 70 per cent growth,” estimated Dosi.

Meanwhile, the average spend per merchant on Grab’s self-service ad tools saw a 54.5 per cent YoY increase in Q3 2023.

That’s because the tools have undergone some significant shifts from a product perspective. They’ve become simpler and more effective for merchants.

Simplification is the key

Historically, Grab offered merchants many options. For example, they could run search ads, very much like on Google; or they could run image ads, which are similar to banner ads. They could also boost their listing to gain more visibility in certain categories.

“The simpler approach we have been moving towards means that merchants no longer have to worry about how their ad shows up,” said Dosi.”Our system now figures out the best approach for them, it happens under the hood.”

The CPO breakthrough

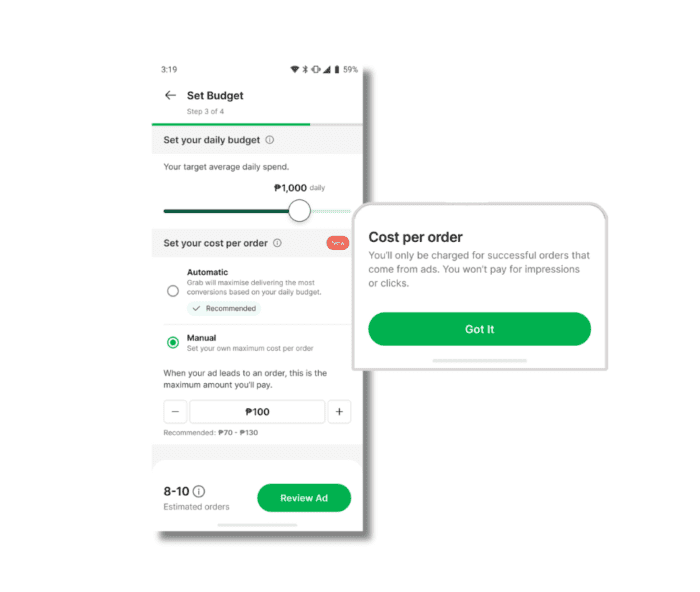

Grab’s simplified ad campaign planning tool includes experiments with a new pricing mechanism, an option created for small merchants who may not have the marketing sophistication that bigger brands do.

“Digital advertising has what’s called CPM, which stands for cost-per-mille. You pay for each thousand impressions of your ad. Then there’s CPC, cost-per-click. You pay only when someone clicks your ad. The third is cost-per-acquisition. You pay only when your ad directly leads to a sale,” explained Mandel.

Starting in the Philippines, Grab has begun piloting with small merchants an alternative model it calls CPO, or cost-per-order pricing.

“CPO is so attractive to our merchants because they take no risk, they only pay for the ad when they get an order from it,” said Dosi.

This is particularly relevant in Southeast Asia, with its many micro- and small F&B merchants. These price-sensitive businesses want to ensure they spend their ad dollars effectively.

The CPO pricing model makes Grab a pioneer among on-demand platforms. “I would say, the only other company that is doing that right now is DoorDash. Outside of DoorDash, actually, no one has gone that far.”

A world of branding opportunities

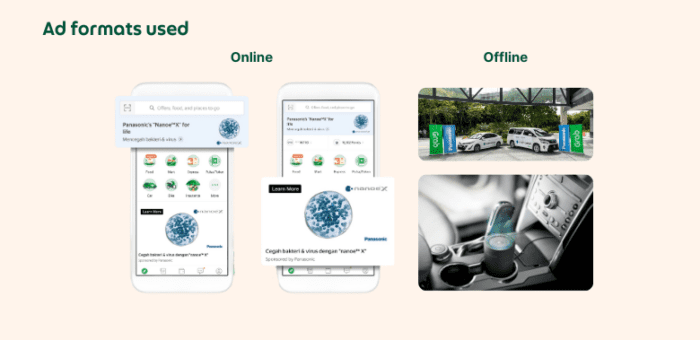

An exciting new business for Grab is the category of ads for brands that are not on the platform, but who want to explore running branding ads on Grab. The inventory of ads in Grab’s non-endemic ad ecosystem is also becoming more sophisticated.

“The Grab app and user experience presents many novel opportunities for brands to engage with an audience,” said Dosi.

For instance, when Grab users book a ride, they spend more time on the app as they are waiting for the car to arrive, or as they check the distance to their destination.

“This transit time is a place where we can surface ads which don’t need to be merchant-specific, because that intent is not merchant specific. It’s much broader,” explained Dosi. You might be shown ads from a brand that is available at the mall you are headed to.

Brands can also make creative use of the hundreds of thousands of cars and two-wheelers in Grab’s network.

As part of a brand engagement campaign with Panasonic, Grab placed Panasonic’s air purifiers inside the vehicles of its on-demand Premium Car service. This allowed Grab users to experience the product first-hand.

Grab is also experimenting with ads on two-wheelers, which allows advertisers to target specific neighborhoods they want to show their ads in.

“This world of non-endemic ads has a lot of potential to grow, we’re just at the starting point,” said Dosi.

Digital ad spend in Southeast Asia still has a lot of room to grow compared to other markets. And retail media networks are going to play a role in the mix.

3 Media Close,

Singapore 138498