General

Q: Why are you offering us funds?

A: We are committed to helping our partners expand their businesses by fulfilling their micro financing needs and better management of cash flows through a hassle-free repayment structure. This is an exclusive beta launch currently offered only to selected GrabFood merchants.

Q: How do I know if I qualify?

A: You would have received an email in your GrabFood-registered email entitled ‘Grow your business with funding from Grab‘ with details of your offer from Grab.

Q: Are you a P2P (peer-to-peer) lending company?

A: No. We are an excluded money lender under Moneylenders Act regulated by Monetary Authority of Singapore (MAS) for financing activities to limited liability partnerships and companies.

Q: Is there a statement to be issued? / Can I know the outstanding balance of my account?

A: A monthly statement with all repayment transactions will be issued to your designated email address.

Q: Can I exit the GrabFood platform while I’m still servicing the facility?

A: At the moment, you need to pay up all outstanding loan amounts, accrued interests and related fees before you may proceed with the termination of your GrabFood Merchant Agreement.

Q: My friend’s company is not an F&B merchant or a merchant on GrabFood, can his/her business borrow from Grab?

A: Thank you for the interest. We are currently in the beta phase and therefore the facility is only extended to a selected group of existing GrabFood Merchants.

Application

Q: How long does it take for the loan to be approved and disbursed?

A: The approval will take 1 business day upon receipt of the completed Offer Pack and required documents. Upon approval, we will process your disbursal immediately. However, it is subject to the bank processing time. We will send out a Notice of Facility Approval indicating an expected disbursal date.

Q: Can I sign up for 2 separate facilities without breaching the total limit offered?

A: Currently, each Merchant is only entitled to one funding facility at a time.

Q: Can I request for higher/lower loan amount?

A: Please let us have your intended loan amount and tenure, we shall review and get back to you on your request.

Charges and fees

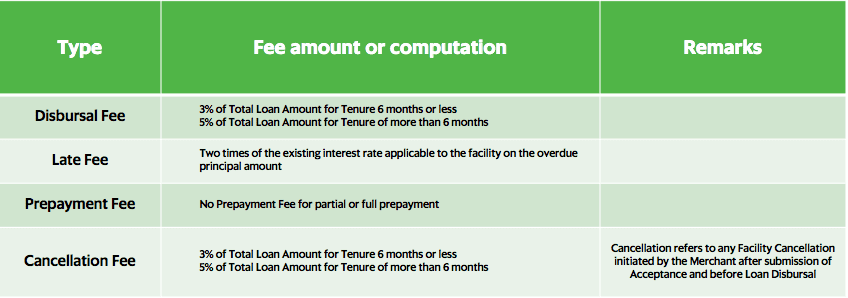

Q: What are the additional fees that I should be aware of?

A: Please refer to the table below:

Repayment

Q: How is my repayment amount calculated?

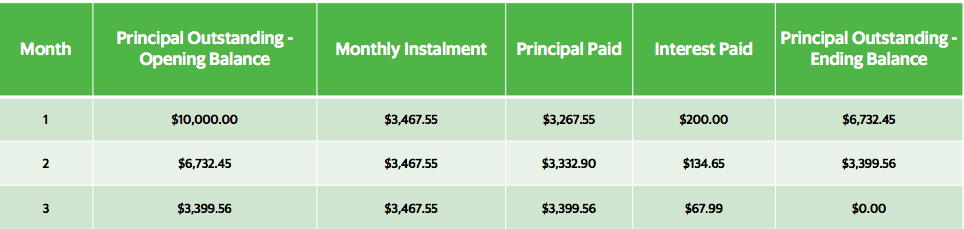

A: The loan repayment will be amortised over the entire loan tenure with a fixed monthly instalment. The interest will be calculated on a reducing balance basis. E.g. Assuming you signed up for a S$10k facility with an interest rate of 2% per month for a tenure of 3 months. Please refer to the Repayment Calculation below:

For the first monthly instalment, the interest component is calculated based on the Total Loan Amount (S$10K), Interest = S$10K * 2% = $200. In the subsequent instalments, the interest component will be decreasing as the principal is being paid up during each monthly instalment.

Q: How do I make my repayment?

A: To ensure the repayment process is hassle free, we will offset your bi-weekly (twice-a-week) GrabFood Merchant Payment. In the event that there’re more than one outlet registered under your entity, we will offset payments from all outlets.

Example:

S$120 repayment due as of month-end,

6 cycles of GrabFood Merchant Payment in the month,

the offset for each payment cycle is S$20.

Condition: the exact offset amount for each cycle and each outlet account may vary from time to time.

Any remaining amount not offset via GrabFood Merchant Payment before month-end will be collected via direct debit of Merchant’s bank account.

T&Cs

The information provided here is intended as a guide only and does not constitute a loan application or an offer of finance. Any finance or loan request is subject to assessment against Grab’s lending criteria, standard disclaimers and terms and conditions. Other T&Cs apply.