Overview of GrabCar for Cyclists’ Group Bicycle Insurance

Because you and your bicycles are important to us, it is our top priority to ensure your peace of mind during your Grab rides.

We work with our insurers to innovate new solutions, and most importantly, choose only the most reliable and relevant insurance products that fit your needs.

Introducing Group Bicycle Insurance, a coverage ensuring that your bicycles are protected from pick-up to drop-off, from damage caused during the ride.

What is covered by this policy?

A maximum of 3 bicycles mounted onto the bicycle trunk rack or stored in the vehicle boot are covered up to a total of S$600 per ride.

Our Group Bicycle Insurance is designed to compensate the Bicycle Owner(s) for their Insured Bicycle’s damage arising from the ride.

It does not cover scratches except when caused by an accident during the mounting or dismounting of bicycles(s) and those that happen within the trip duration.

It does not cover 3rd party damage & 3rd party cyclist/passenger liability.

Where and when does the cover commence?

The Group Bicycle Insurance covers the trip in its entirety from the moment the bicycles are mounted to the moment the bicycles are unmounted.

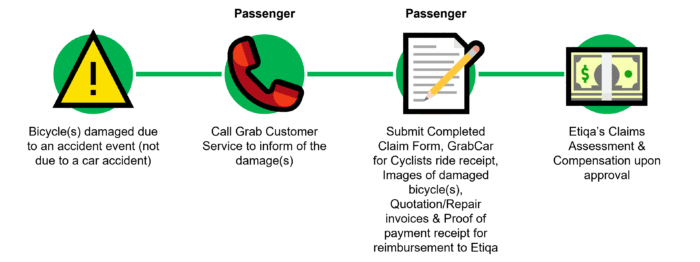

How to report accidents and claims?

- Please report any accident to our customer service immediately if your bicycles are damaged from an accident during a GrabCar for Cyclists trip.

- Our Help Centre is available 24/7 to respond to any issue.

- You may be required to provide more details to ascertain the accident information.

Terms of application

Our Grab Customer Service will be on hand to advise you about the claim process.

Notice and proof of claim

All accidents should be reported to Etiqa by submitting the claim form within the stipulated agreement period, no later than 30 days from the day of the accident.

Documents for submission to Etiqa:

- Completed Claim Form (download Claims-Form-GrabCar for Cyclists)

- GrabCar for Cyclists ride receipt

- Images of damaged bicycle(s)

- Quotation/Repair invoices

- Proof of payment receipt for reimbursement

How to submit Claim

Please email and submit your claims request to: motorclaims@etiqa.com.sg or alternatively contact Etiqa’s Customer Care Hotline at +65 6887 8777.

Important Notes

This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K).

GRABCAR PTE. LTD. (Company Reg. No. 201427085E) is the master contract policyholder.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the General Insurance Association (GIA) or SDIC websites (www.gia.org.sg or www.sdic.org.sg).

FAQs

General

You will be automatically enrolled into the Group Bicycle Insurance Cover if you are taking a GrabCar for Cyclists ride. Note that the Group Bicycle Insurance only covers up to three (3) bicycles.

It is mandatory for your Grab driver to take images of your bicycle(s) before and after the ride. This is to facilitate the claims process in the event of accident or damage to your bicycle(s) during the trip. In the event of a claim incident, these images will be used to facilitate the claim assessment.

The Cover starts from the moment the bicycles are mounted (upon arrival at pick-up point) to the dismounting of bicycles (upon arrival to the destination point).

The Group Bicycle Insurance is automatically provided by Grab for all GrabCar for Cyclists rides.

Plans / Coverage

A maximum of 3 bicycles mounted onto the bicycle trunk rack or stored in the vehicle boot are covered up to a total of $600.

No, the Group Bicycle Insurance covers up to only a maximum of 3 bicycles onto the bicycle trunk rack or stored in the vehicle boot.

The 3 bicycles covered will be chosen at random.

The Group Bicycle Insurance covers the trip in its entirety from the moment the bicycles are mounted (upon arrival at pick-up point) to the moment the bicycles are dismounted (upon arrival to the destination point).

It provides cover anywhere in the Republic of Singapore.

Unfortunately we are unable to cover everything and some of the exclusions are:

- Damage and/or Scratches on the bicycle(s) except when caused by an accident during the mounting or dismounting of bicycle(s) and within the trip duration

- Third-party Damage

- Third-party Cyclist/Passenger Liability

Claim

Please report any accident to our Grab Customer Service immediately if your bicycles are damaged from an accident during a GrabCar for Cyclists trip.

Our Help Centre is available 24/7 to respond to any issue. You may be required to provide more details to ascertain the accident information.

A claim must be notified to Etiqa as soon as possible and in any case within thirty (30) days after the occurrence of any event which may give rise to a claim.

All accidents should be reported to Grab Customer Service and claims should be made to Etiqa, no later than 30 days from the day of the accident.

Documents for submission to Etiqa:

- Completed Claim Form

- GrabCar for Cyclists ride receipt

- Images of damaged bicycle(s)

- Quotation/Repair invoices

- Proof of payment receipt for reimbursement

Please email and submit your claims request to: nonmotor@etiqa.com.sg or alternatively contact Etiqa’s Customer Care Hotline at +65 6887 8777.

A passenger is limited to two (2) claims per policy year.

Forward Together

3 Media Close,

Singapore 138498