Be vigilant with your information online!

Don’t take the bait!

Scammers take advantage of common channels such as email, calls, and SMS to lure in their victims. This allows them to mask their identity and it becomes difficult tracking them after a fraudulent transaction occurs.

Here are the most common types of scams used by fraudsters and how to avoid them:

1. Phishing Emails

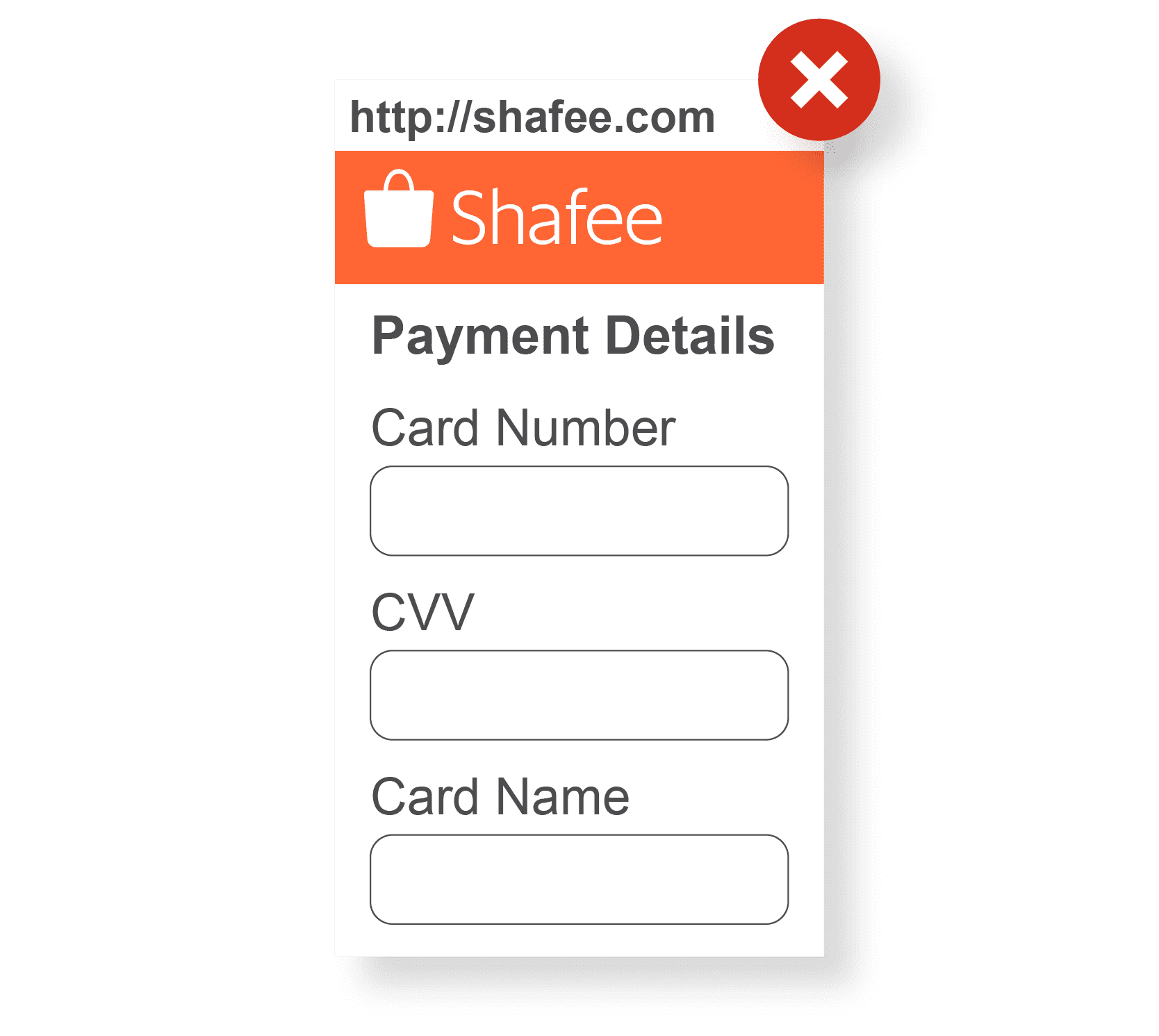

A tailored email to mimic the look of a valid sender. Usually includes a link leading to a page wherein targets are asked to enter sensitive information.

Watch Out:

Double check the actual email address of the sender before clicking any links. Phishing emails will use email addresses or domains that closely resemble the valid ones.

2. Voice Phishing

A scammer will impersonate an established person or company via call (i.e. Viber call, phone call, etc.) to retrieve information from the target.

Watch Out:

Be mindful before giving in to any requests over the phone. Vishers will try to keep you on the line for as long as possible and urge you to take immediate action.

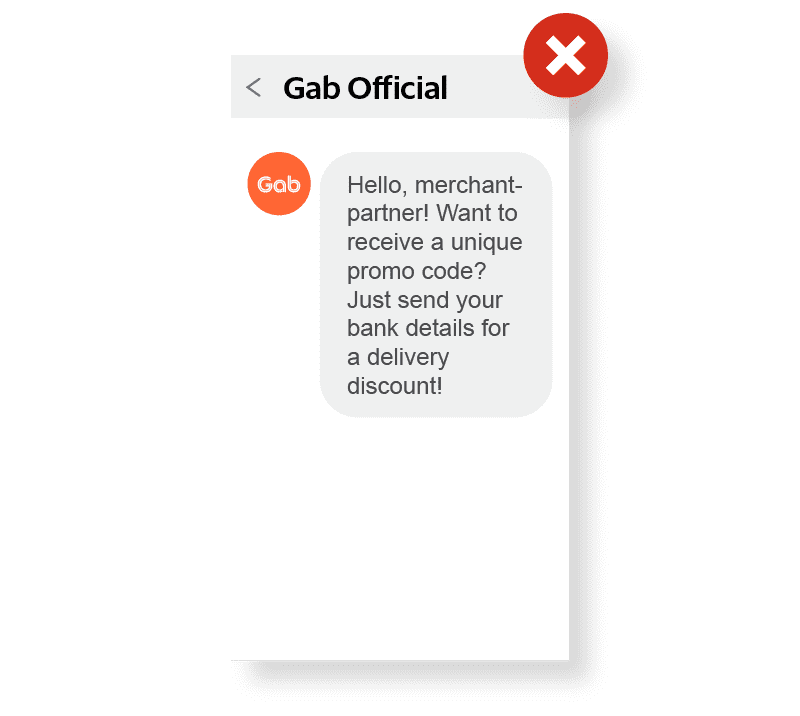

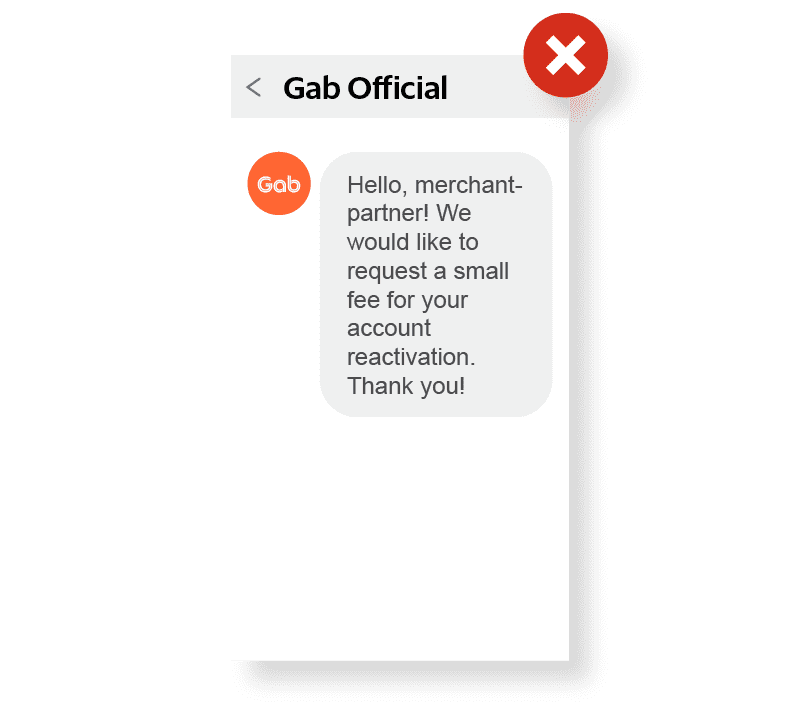

3. SMS/Mobile Message Phishing

Similar to voice phishing, will imitate a short urgent message from a valid sender. Commonly with an external link to enter sensitive information.

Watch Out:

Confirm the validity of the sender by looking at previous message history. Scam messages are usually short and will try to evoke urgency or excitement for you to click.

Be informed on different threats to data usage

User Impersonation

Impersonating another individual by using their personal information to trick users and/or businesses

Excessive Disclosure

Divulging more information than what is necessary to complete a transaction

Unauthorized Access

Providing unauthorized individuals access to sensitive assets and information

Social Engineering

Manipulating users through social interaction to gain access to information or give in to requests

Remember these tips to avoid online scams:

Take time to assess the situation and don’t fall victim to these tactics!

Do not share sensitive data!

Avoid sharing personal information such as your Grab Merchant App credentials, bank details, pins or OTPs with anyone.

Be careful when you answer.

Be wary of messages or calls from individuals posing as Grab. Grab representatives will NEVER ask for banking information such as account passwords, pins or OTPs.

Keep an eye on odd requests.

Do not entertain requests such as sending money for account validation or turning off your internet connection.

Read before you click.

Watch out for fake links that ask for personal information. Only answer sign-up or survey forms from official Grab Viber and SMS accounts or through your Grab Merchant App.

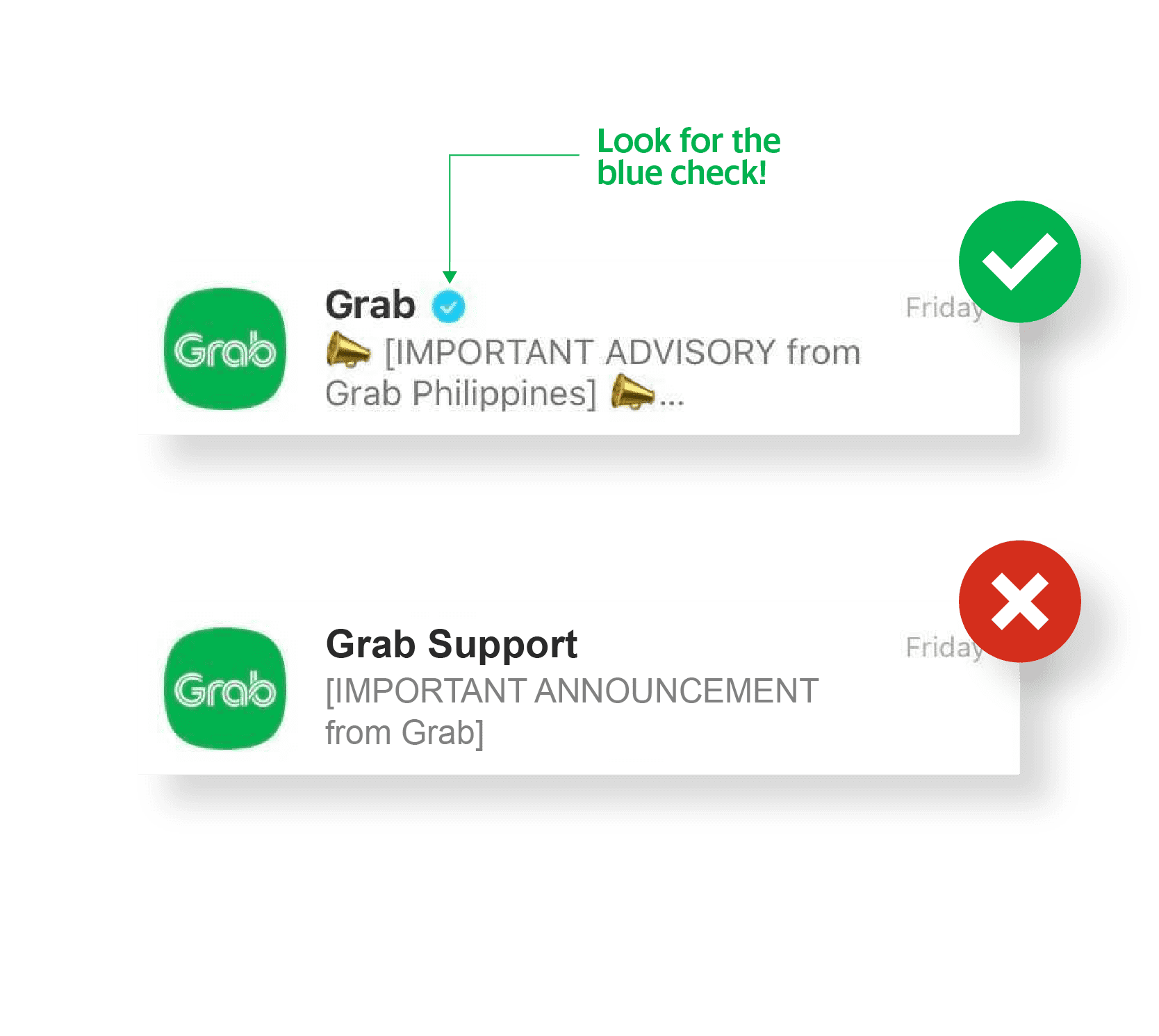

Look for the blue check!

Official promos from Grab Philippines will only be coursed through our official social media accounts, SMS, email, or through your Grab Merchant App.