Grab Thailand Revamps Merchant Loan Portfolio, Extends Maximum Credit Limit to THB 10 Million

.

Grab Thailand has upgraded its cash loan portfolio for merchant-partners, offering three loan products designed to better serve food merchants and restaurant business owners, from small businesses to medium-sized enterprises. The revised loan offerings include an option for larger business operators, featuring a maximum credit limit of up to THB 10 million with a competitive monthly interest rate of just 1%. This initiative is aimed at providing business owners with the capital needed to improve liquidity, support growth, and navigate challenging economic conditions.

Chantsuda Thananitayaudom, Senior Director of Commercial & Marketing at Grab Thailand, commented, “Amidst the ongoing economic slowdown driven by both local and global factors, Thai banks have experienced weak loan growth this year, with only a 0.3% increase in the second quarter compared to the same period last year1. High household debt levels have further constrained borrowers’ access to credit, while government and business loans have seen increased repayment rates. Kasikorn Research Center (K-Research) has consequently revised its loan growth projection for the banking industry in 2024 down to 1.5% from the earlier forecast of 3%2.”

“Despite the overall slowdown in the lending market, Grab Thailand’s lending business has demonstrated strong performance and continued growth, particularly in cash loans for our merchant-partners. This is evidenced by a notable 15% increase in approved loan borrowers during the past 6 months and a Non-Performing Loan (NPL) rate of 2.35%, which is below the national average3. This underscores the quality and financial responsibility of our applicants.”

Grab has integrated AI technology and Big Data into its risk assessment process, employing a behavioral scorecard for loan approvals to effectively mitigate the risk of defaults. Most of Grab’s merchant-partners in Thailand seek loans primarily to enhance their business liquidity, utilizing funds for purposes such as sourcing raw materials, managing inventory, staff and cash flow, store renovations, technology upgrades, or business expansion.

“To continue supporting our merchant-partners and stimulating the economy, we’ve revamped our cash loan portfolio, introducing three loan options tailored to different target groups and extending the maximum credit limit to THB 10 million,” added Chantsuda.

Grab Thailand’s Quick Cash Loans for Merchant-Partners is designed to support micro, small, and medium enterprises (MSMEs) by offering loan amounts, interest rates, and tenures tailored to match the size and type of businesses. Key features include a streamlined, paperless application process with approvals completed within just one day, and the flexibility of daily installment payments. The loan options include:

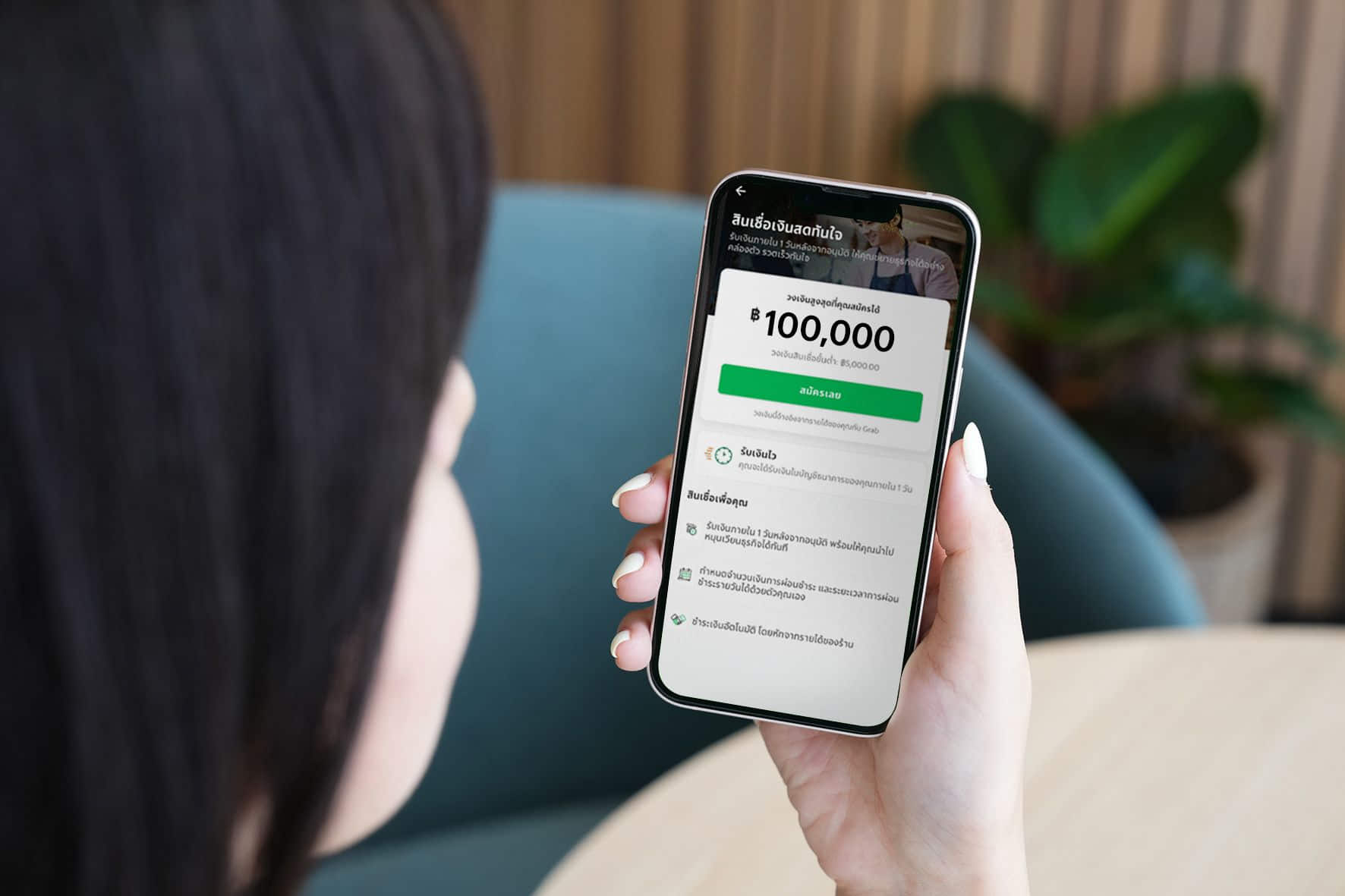

- Quick Cash Loans: Designed for micro-entrepreneurs such as small shop owners, food merchants, or street food vendors, this program offers a maximum loan amount of THB 100,000, with an interest rate of up to 2.75% per month4 and a tenure of up to 9 months.

- Quick Cash Loans (Plus): Aimed at larger-scale micro-entrepreneurs who own bigger shops or restaurants with multiple branches, this program offers a maximum loan amount of up to THB 1 million, with an interest rate of up to 2.08% per month5 and a tenure of up to 12 months.

- Quick Cash Loans (Extra): Targeted at high-potential SMEs or franchise owners operating as juristic entities, this program offers a maximum loan amount of up to THB 10 million, with an interest rate of up to 1% per month and a tenure of up to 12 months.

In addition to lending services, Grab Thailand has recently partnered with Chubb Samaggi Insurance Public Company Limited to introduce “Business Cover Insurance,” designed to provide peace of mind to merchant-partners. This tailored insurance plan offers comprehensive coverage against unexpected events such as fire and flooding, with a maximum coverage of up to THB 5 million and a premium of just 14 baht per day.

“Grab will continue to innovate and enhance our financial products, including e-payment services, loans, and insurance, with the goal of advancing financial inclusion for underserved communities and addressing the needs of our ecosystem — users, drivers, and merchant-partners,” concluded Chantsuda.

1,3 Source: Bank of Thailand

2 Source: Kasikorn Research Center

4 Based on the Bank of Thailand’s annual interest rate of 33% (calculated on an effective interest rate with daily repayments)

5 Based on the Bank of Thailand’s annual interest rate of 25% (calculated on an effective interest rate with daily repayments)