Consumers are always looking for more flexible ways to stretch their payments. One of the most common flexible payment methods are credit cards. But if consumers don’t own one, is there an alternative way to extend the payment period?

Lucky for them, there’s a new way to help consumers afford their online purchases! The “buy now, pay later” payment option lets consumers purchase and make payments in monthly instalments at a later time.

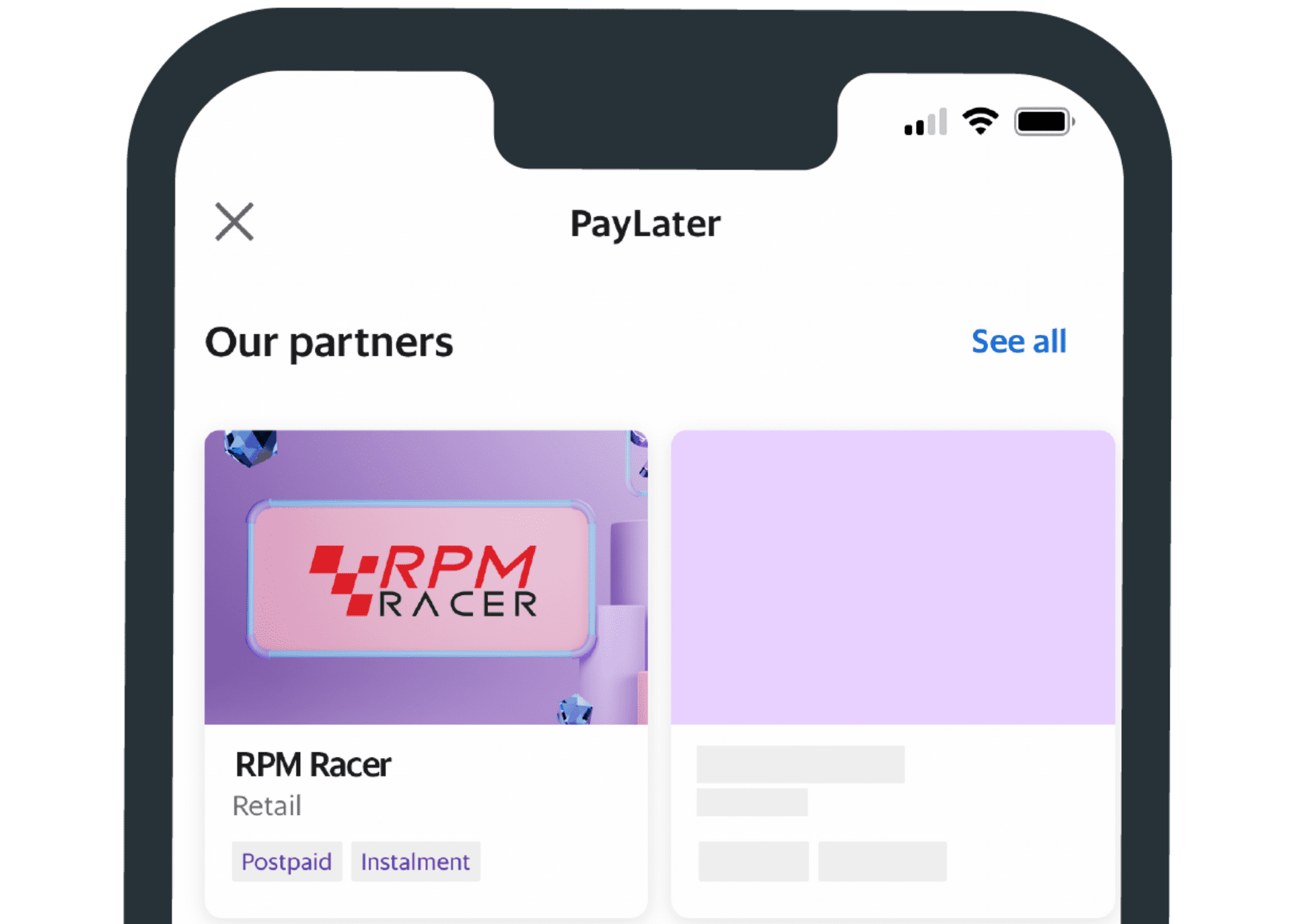

Grab is here to help you give consumers the payment options they need to do this. PayLater by Grab provides a flexible and seamless checkout experience for both you and consumers.

What is PayLater by Grab?

PayLater is a flexible payment solution that helps consumers buy what they need today, but pay for it later without interest. It caters to different consumers via PayLater Postpaid and PayLater Instalments.

This gives you the advantage of attracting a wider pool of consumers with different buying habits and needs.

Give consumers a reason to buy now

Make it easy to sell more or higher-value items

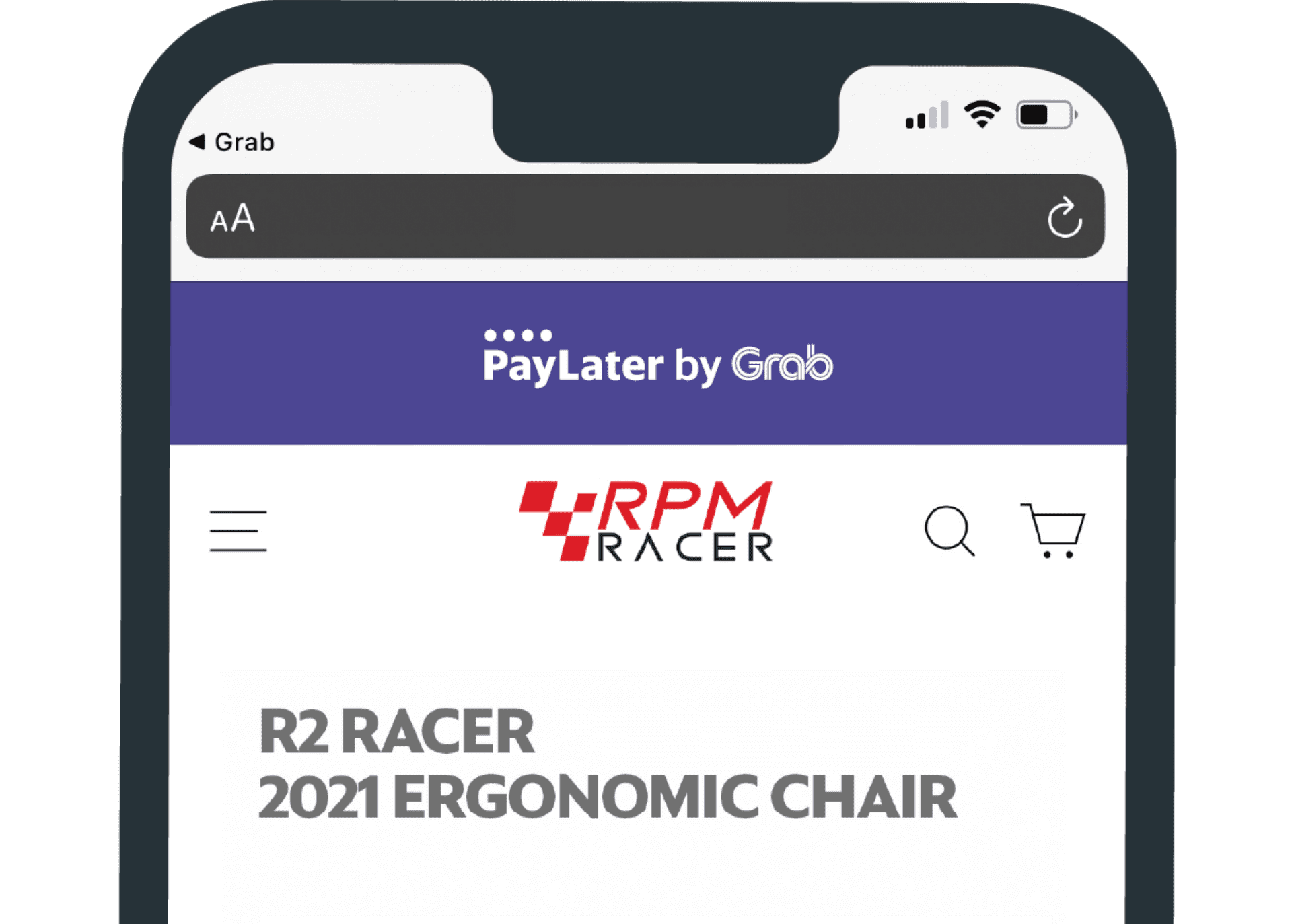

STEP 1

A consumer shops on your website and goes to the checkout page.

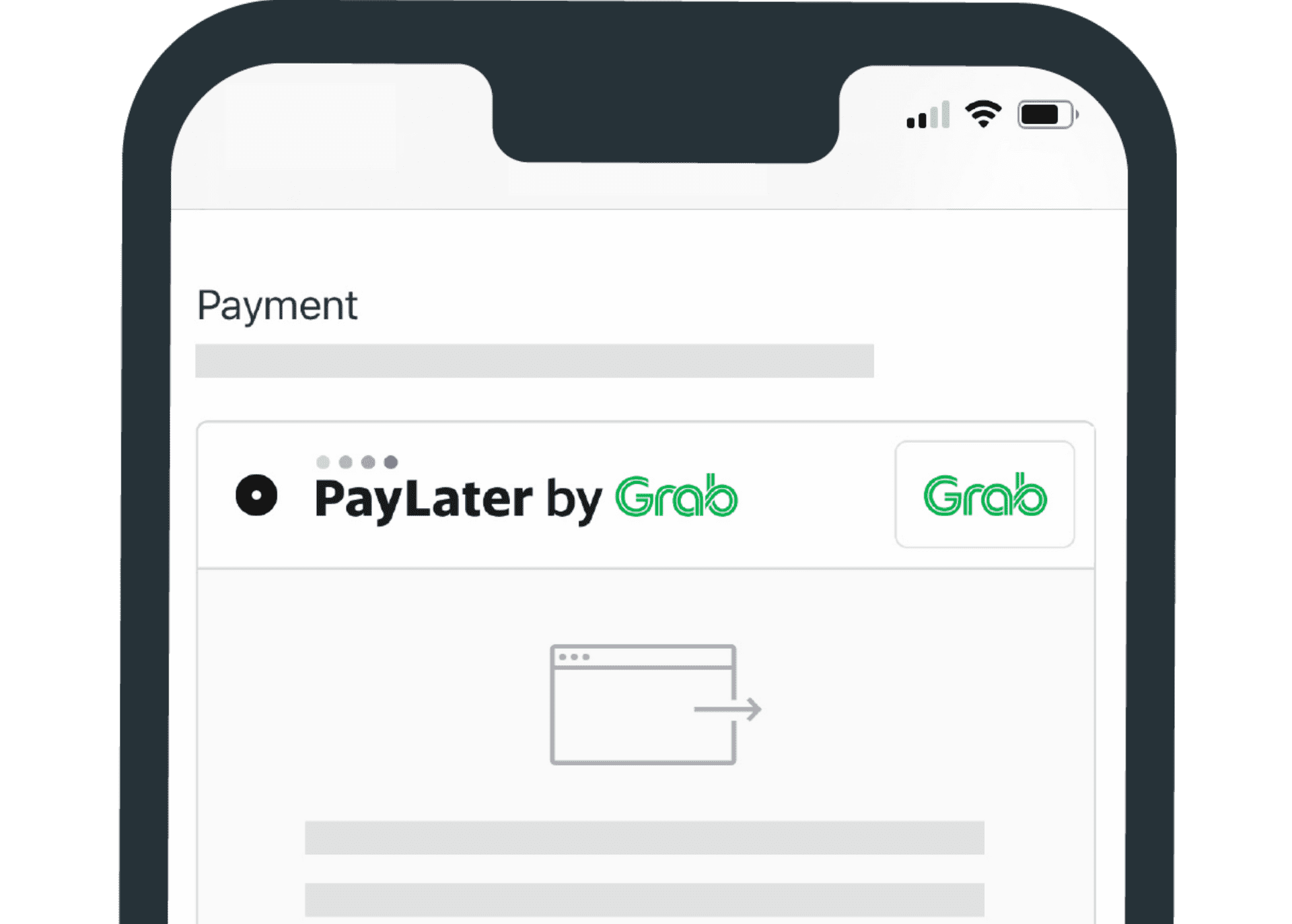

STEP 2

STEP 3

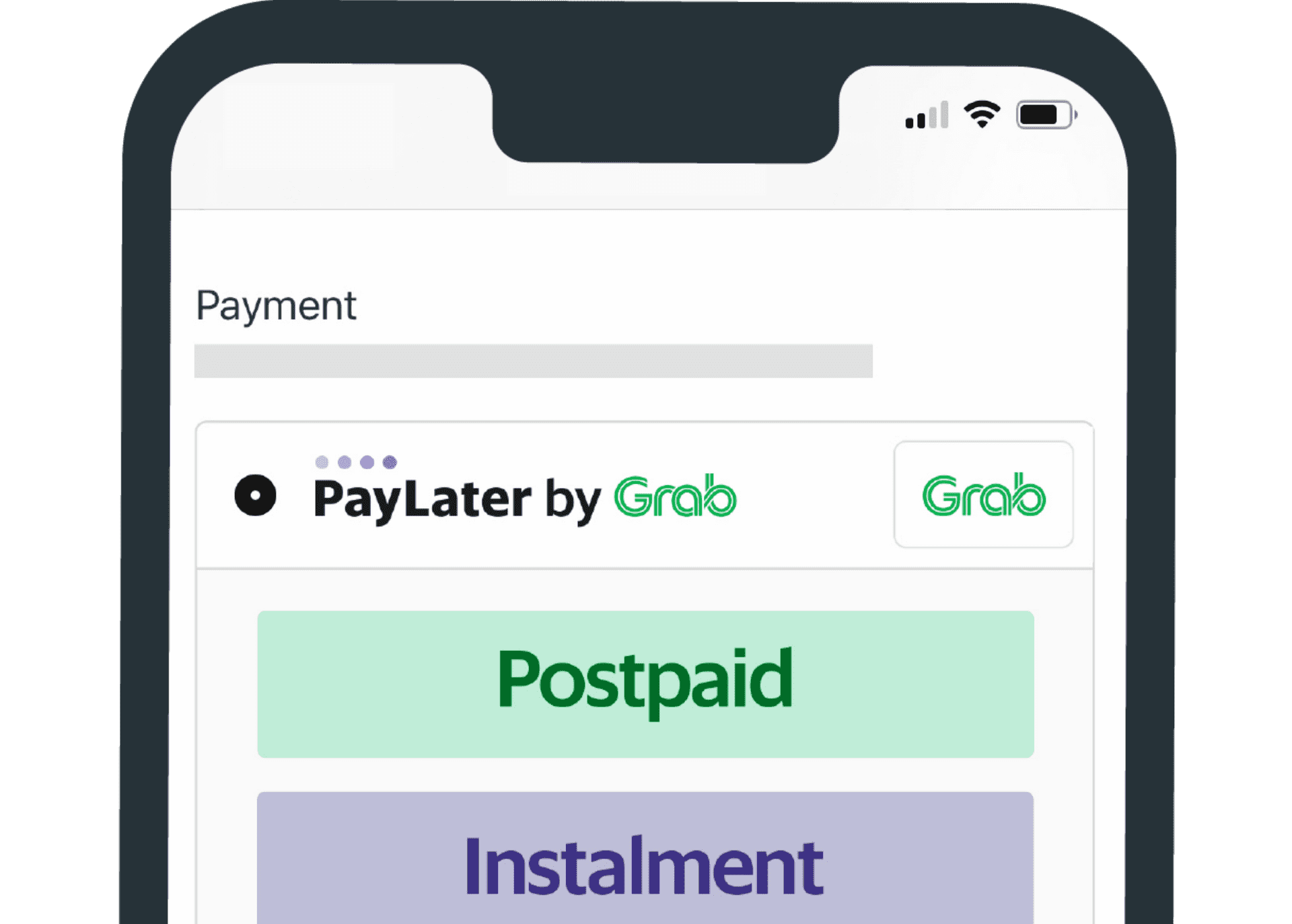

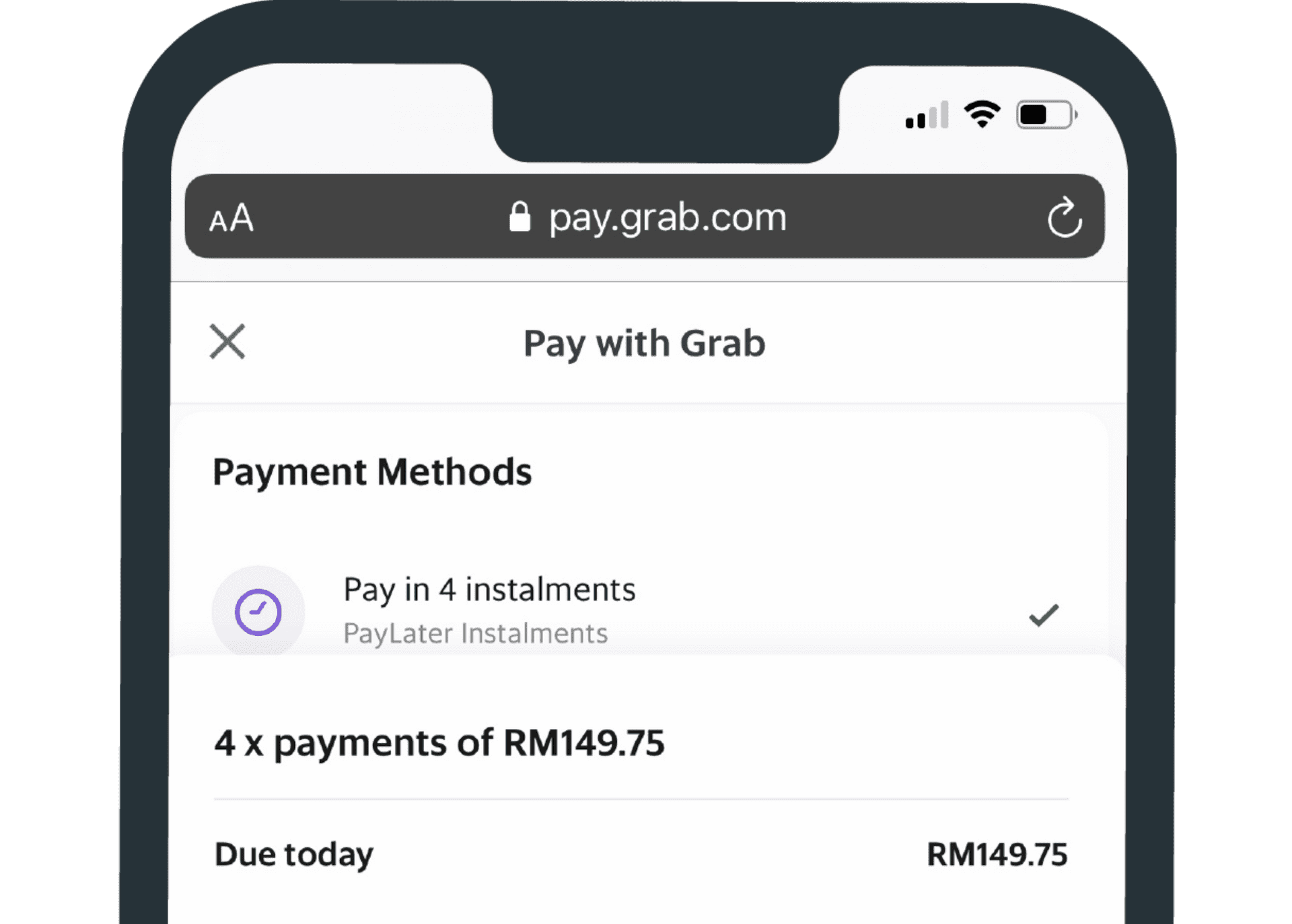

The consumer chooses PayLater by Grab. This means they can pay via PayLater Postpaid or PayLater Instalments.

STEP 4

STEP 5

Grab will cover the payment and send you the total sales value in full within 3 working days. You don’t need to wait until the end of the month or for the instalments to come in!

STEP 6

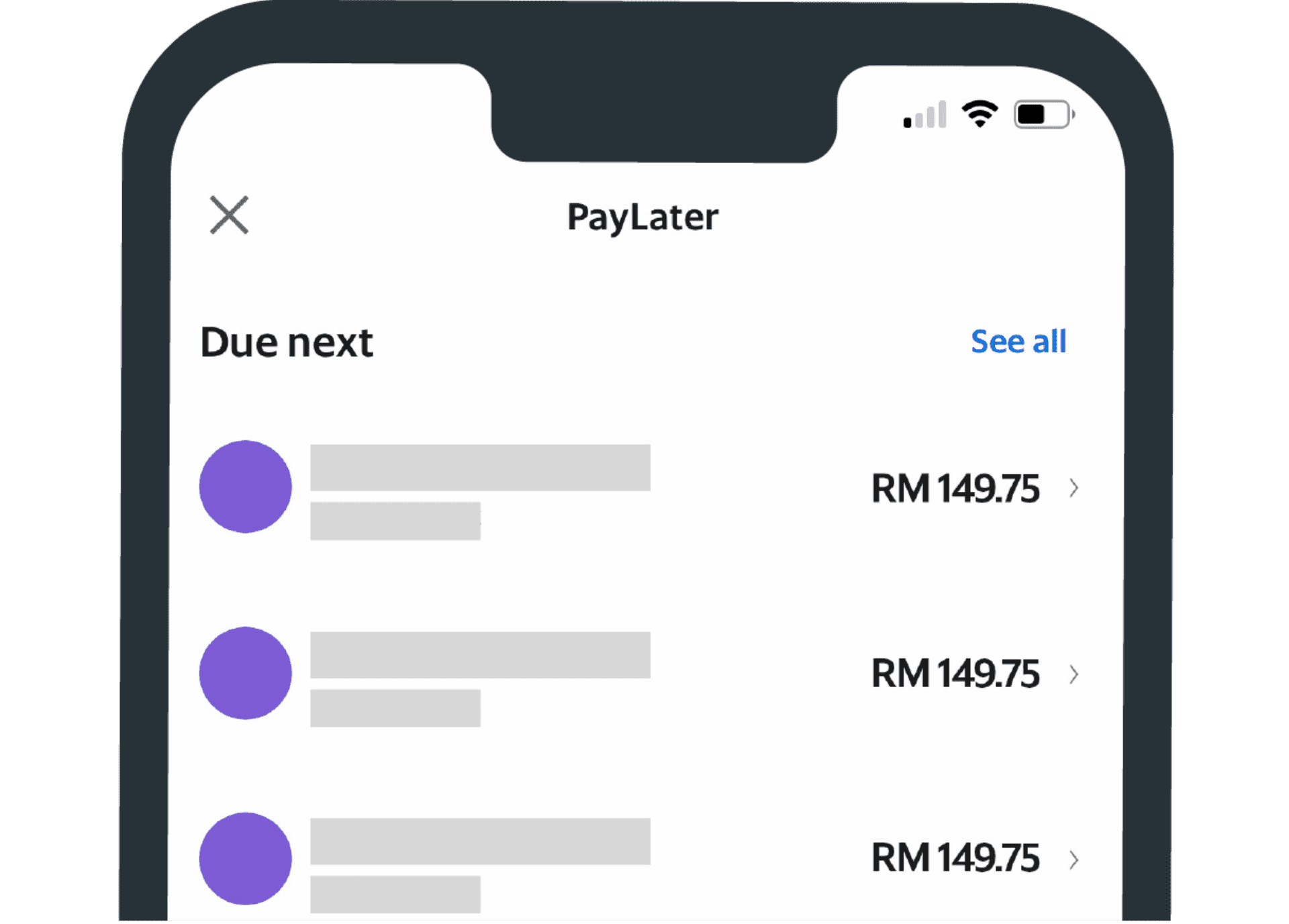

The consumer will then pay Grab

for their purchase in the next month (via PayLater Postpaid) or in four instalments (via PayLater Instalments). You don’t need to worry about the consumer’s repayment!

Why should you offer PayLater by Grab ?

PayLater by Grab allows you to offer two alternative payment options, which can help you attract consumers with different needs. Consumers shop for more higher-value items, generating you higher revenue too! Our current PayLater merchant-partners have already experienced this growth.

Here’s what they enjoyed on average:

Up to

increase in new consumers

Attract a wider range of consumers with different payment options.

Up to

more checkouts and sales

Make it easier for consumers to purchase from you any time.

Up to

larger in order values

Consumers tend to purchase higher value items when they are able to pay later in affordable instalments.

Risk-free upfront payouts

Grab takes on all the credit and fraud risk, while you enjoy the payout!

New competitive edge

Be one of the first to offer flexible payment options for your consumers.

*The performances above are captured from PayLater merchants regionally across South East Asia.

Enjoy additional support from PayLater by Grab.

PayLater is not just a flexible payment option – as a merchant-partner that offers PayLater , you will also receive additional support to help you improve and grow your business in a variety of ways.

Comprehensive consumer insights

Increased visibility on the Grab App

Show that you offer PayLater

Get ready-made assets from us, such as digital banners, and use them as marketing materials on your website. Drive conversions when consumers know that you offer a payment option that provides them flexibility.

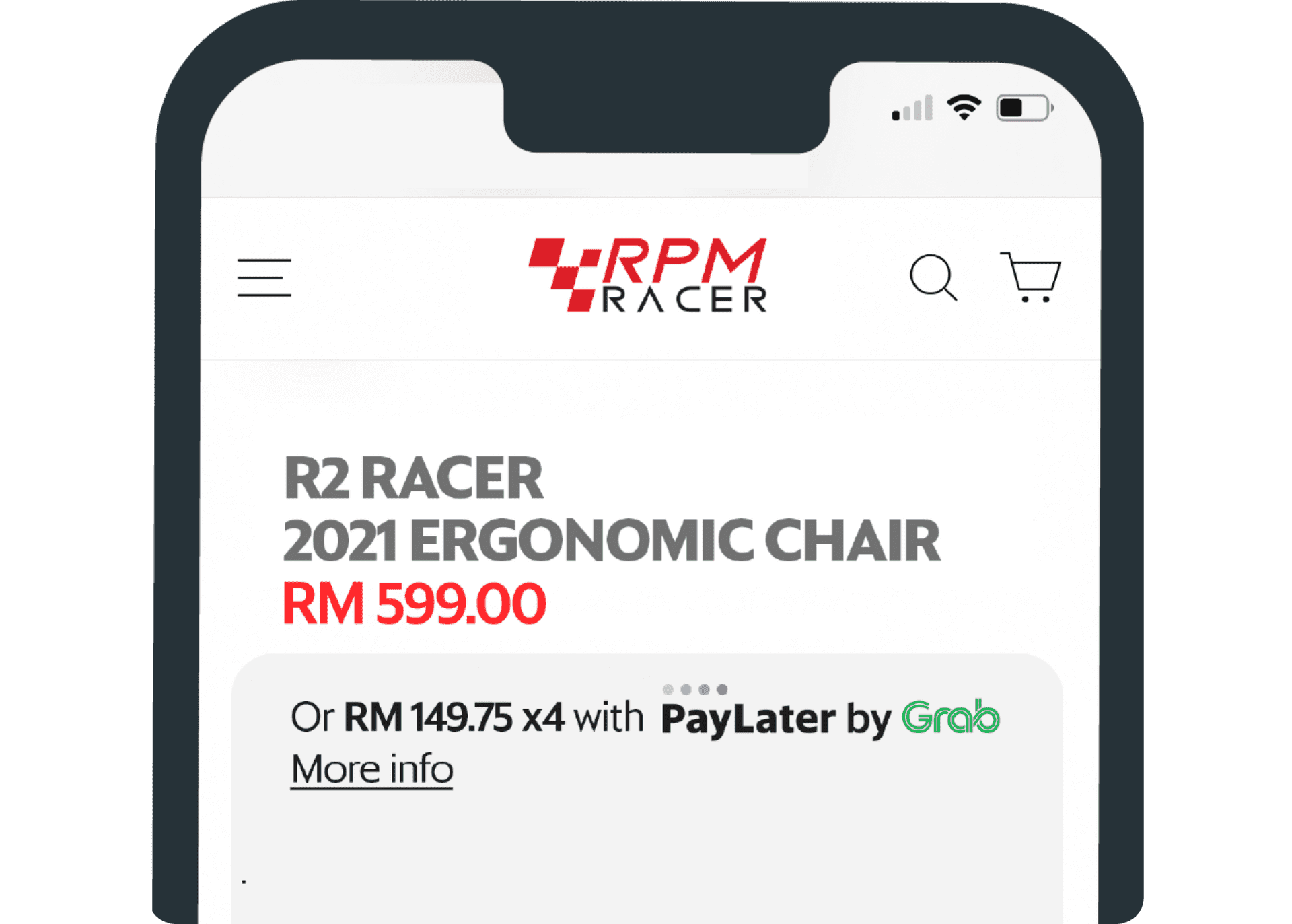

Show your products' affordability

Instal an easy-to-set-up price divider plug-in on your website. This will help consumers see how affordable your products are when the prices are broken down into instalments.

Participate in marketing collaborations

Empower your business further with seasonal marketing campaigns that will help drive sales and visibility for your store.

How PayLater helps merchants like you

ana tomy

There has been an average growth of 20% in average order value after activating PayLater by Grab in ana tomy.

Bottoms Lab

We enabled PayLater by Grab back in March and partnered with Grab on various campaings which helped to grow our sales month on month.

Thousand Miles

Grab has been the key partner for Thousand Miles as we believe in the brand. It has helped to boost our average order value by 15% ever since we started collaborating with Grab.