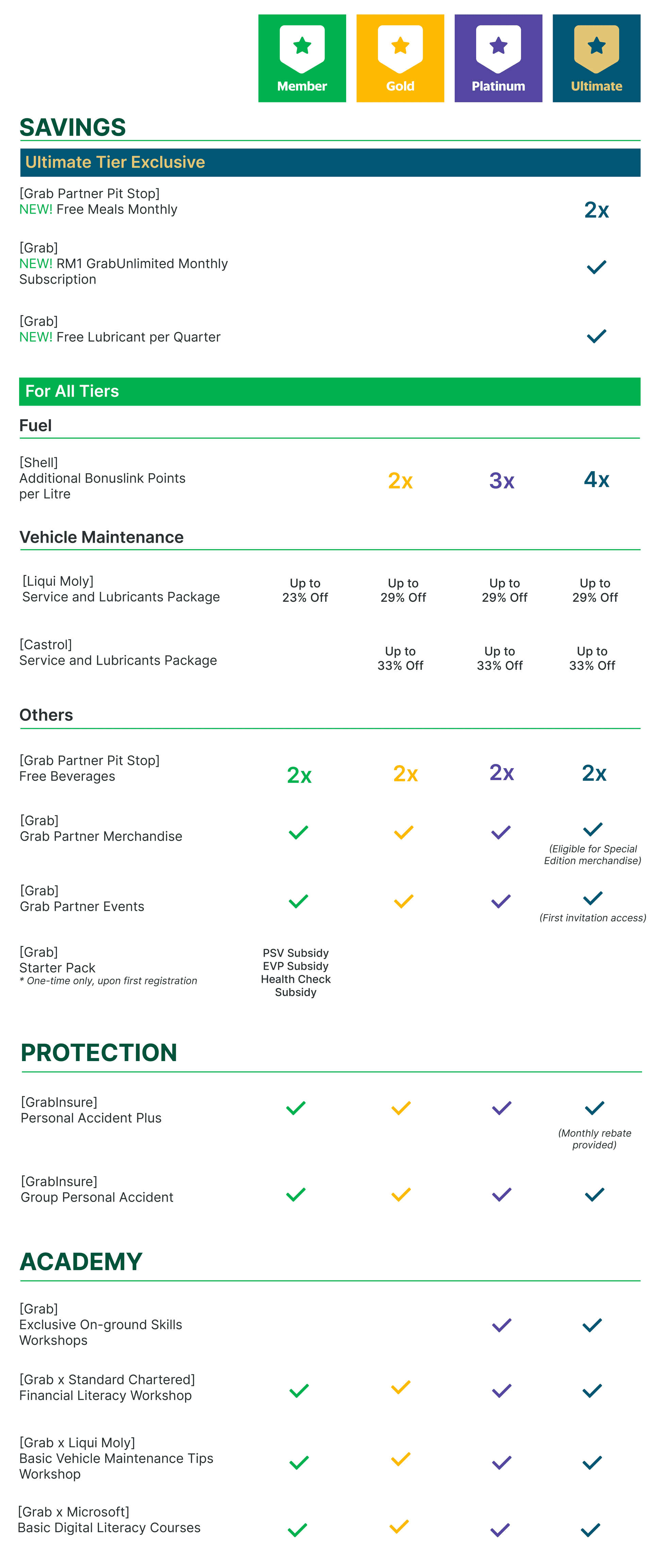

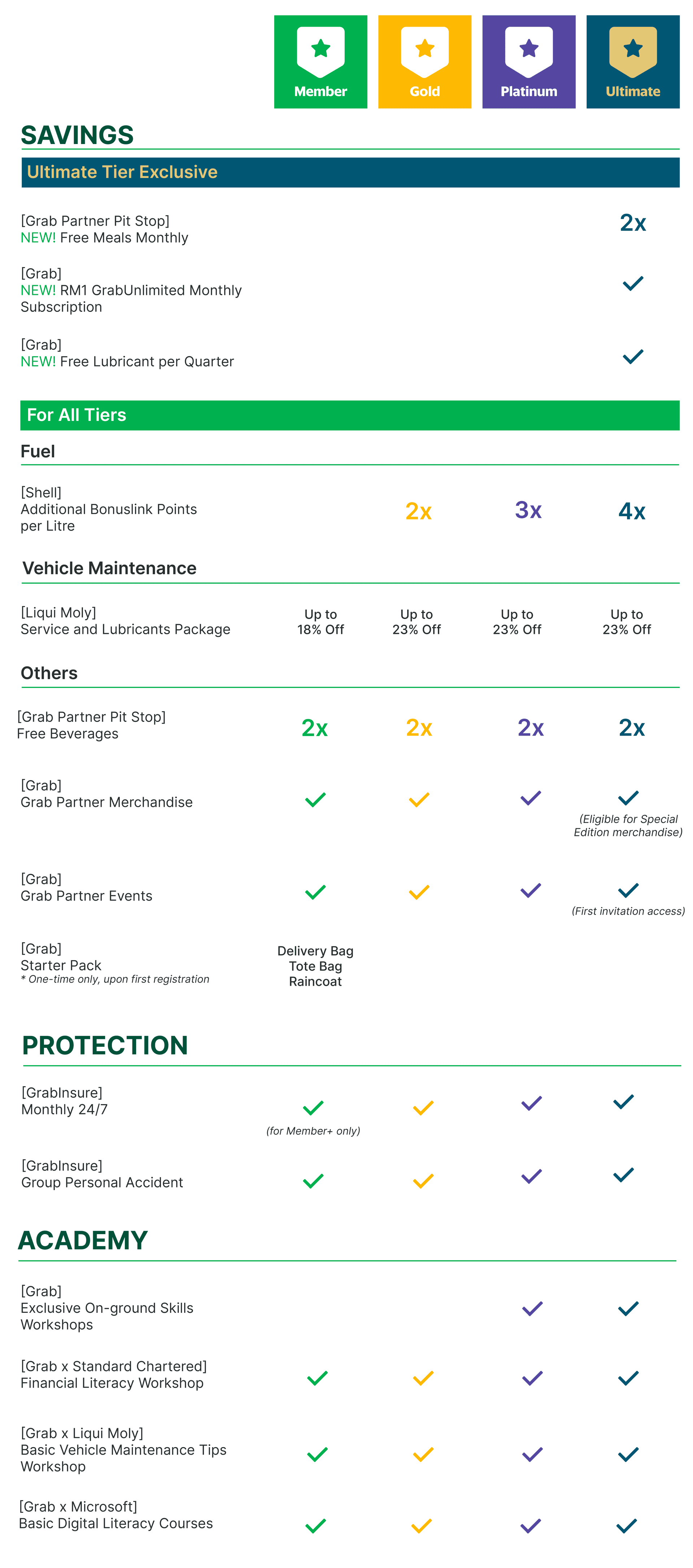

GrabBenefits is a programme that looks into different aspects of our Grab partners’ well-being, while they continue to earn on Grab. It has three main branches – Protection, Savings and Academy. Partners get progressively better perks as they rise in their tier standings!

Tier System

Each Grab partner will fall into one out of four tiers (Member, Gold, Platinum or Ultimate), based on their performance on our platform. Partners will unlock more perks, such as subsidies, reimbursements and exclusive offers, when they are placed in higher tiers!

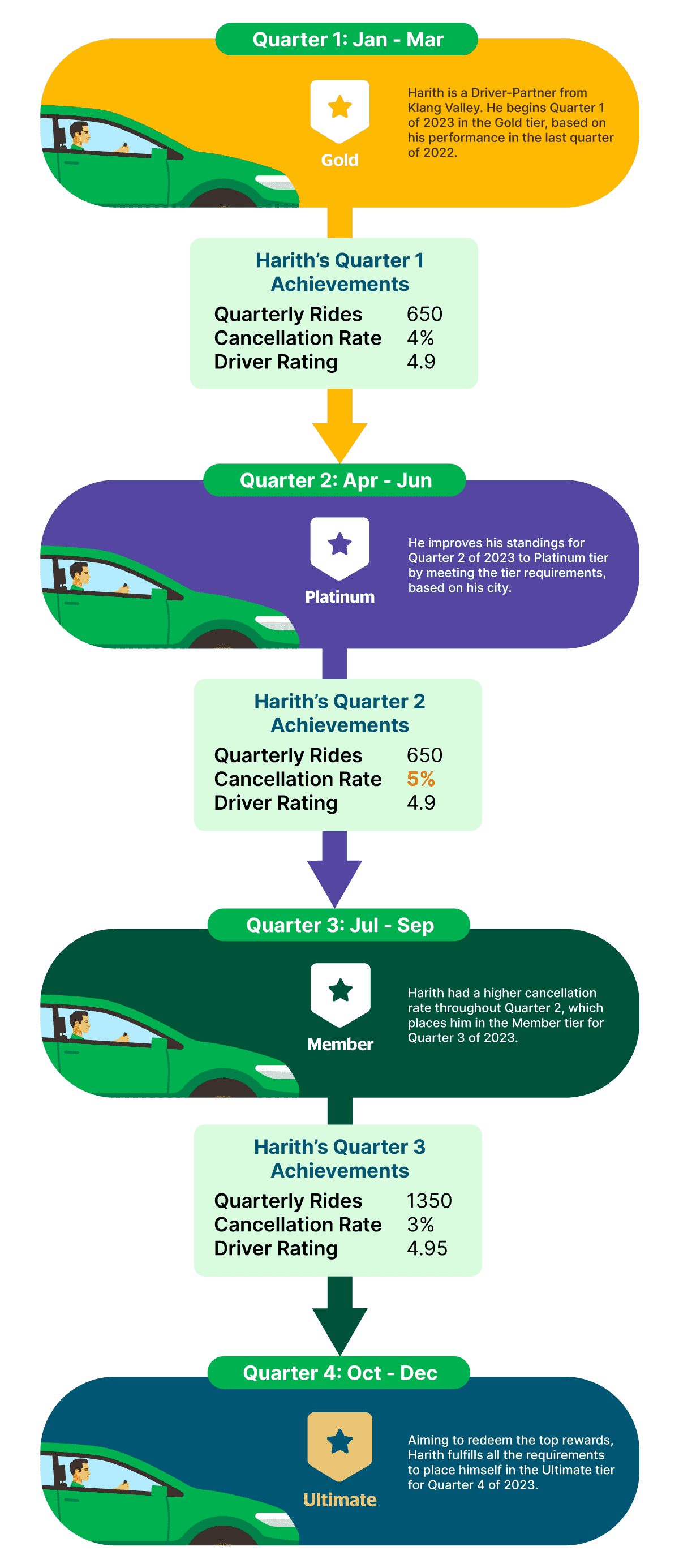

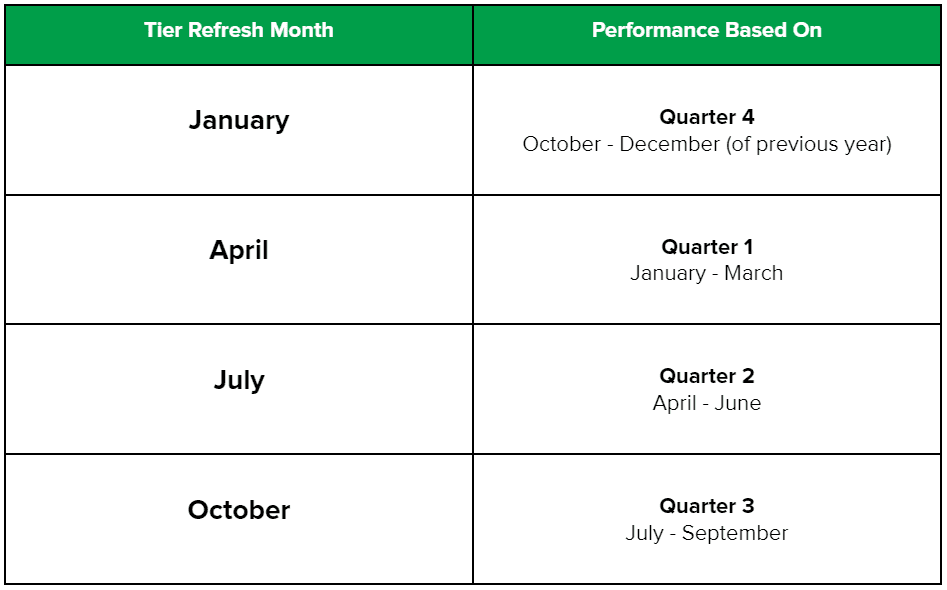

Refresh Period

Both driver-partner and delivery-partner tiers will be refreshed every yearly quarter (3 month intervals).

With tiers only refreshing every 3 months, you can enjoy more flexibility between planning your work and rest days, and also have a longer period to redeem your tier perks!

* Any violation of Grab’s Code of Conduct may affect your tier standing.

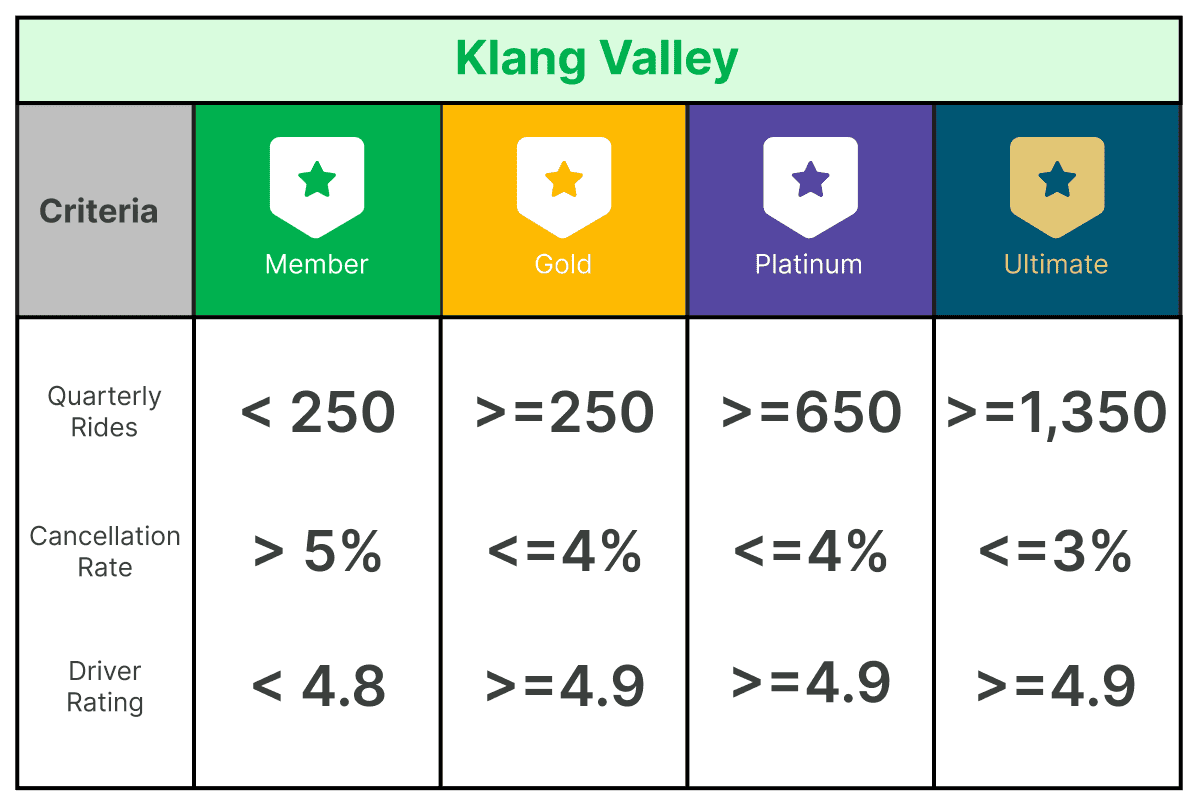

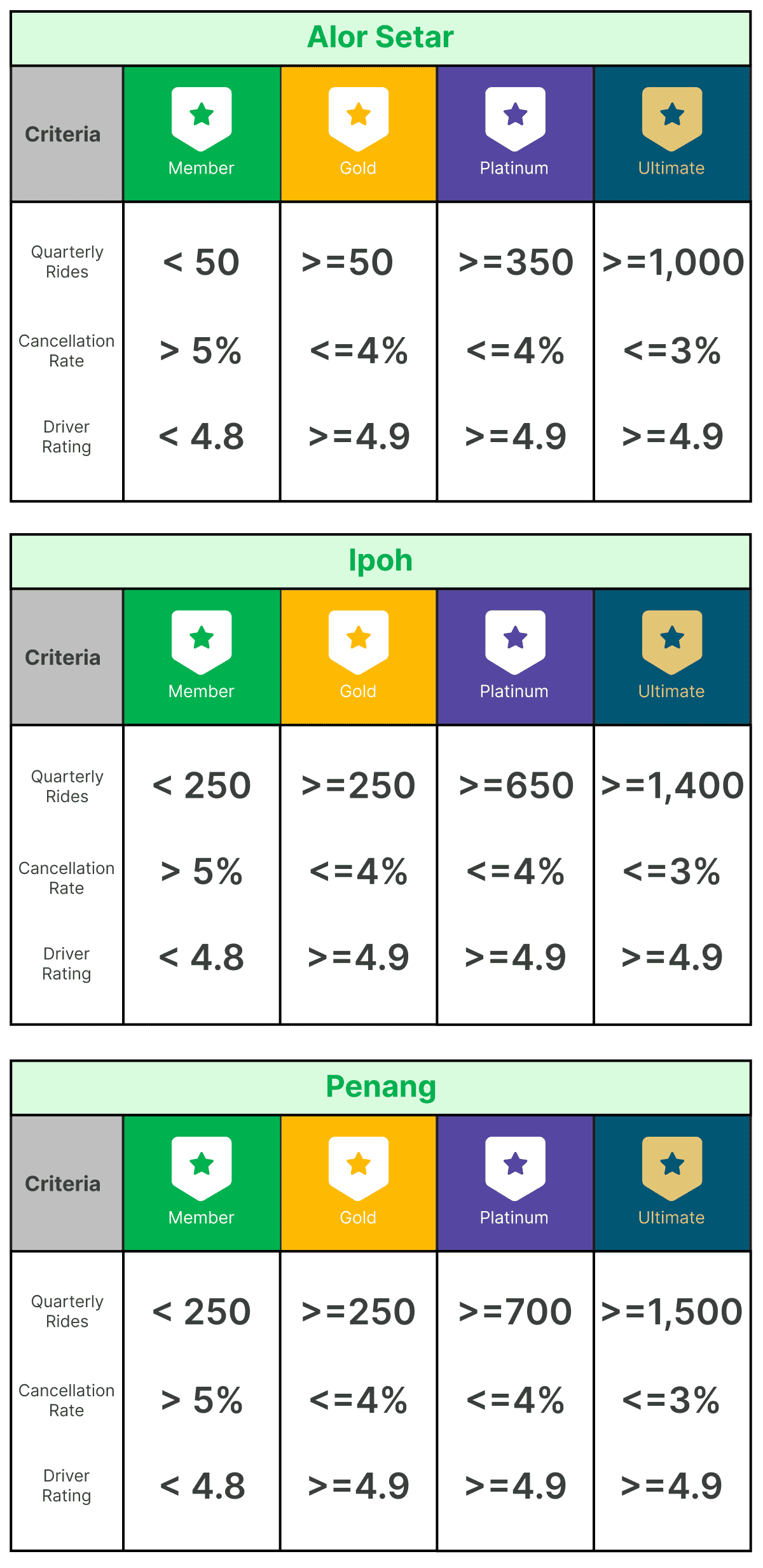

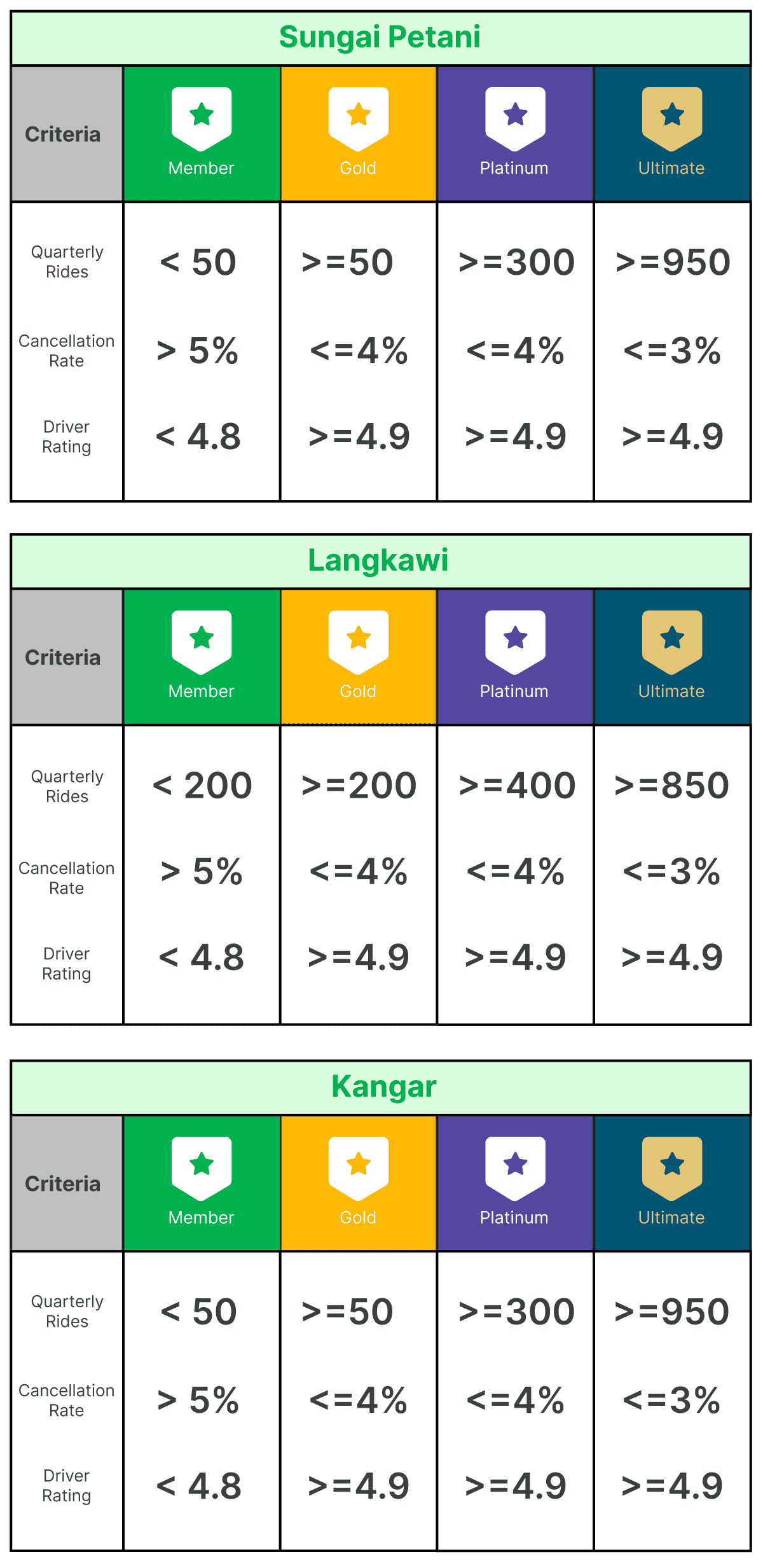

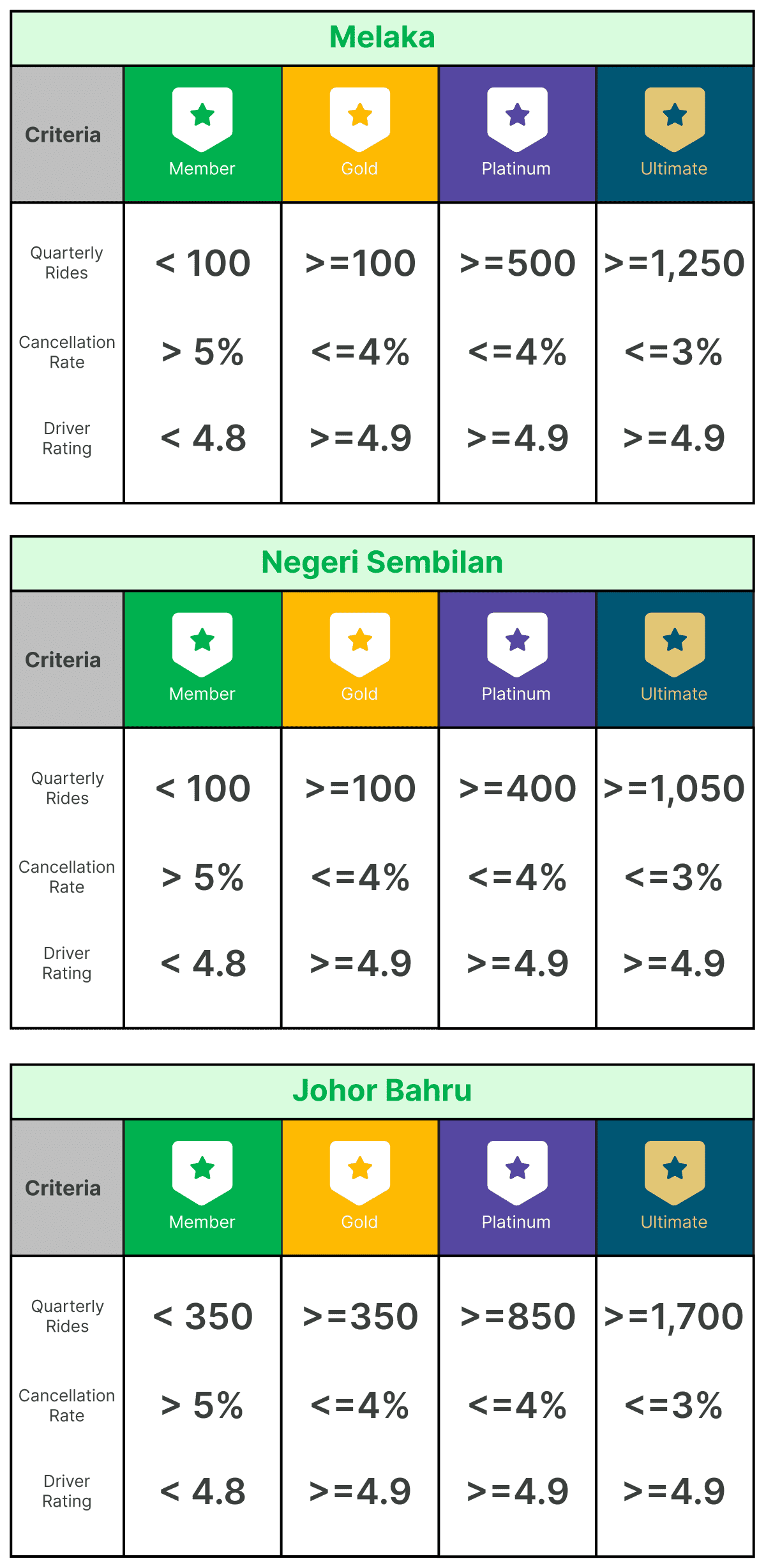

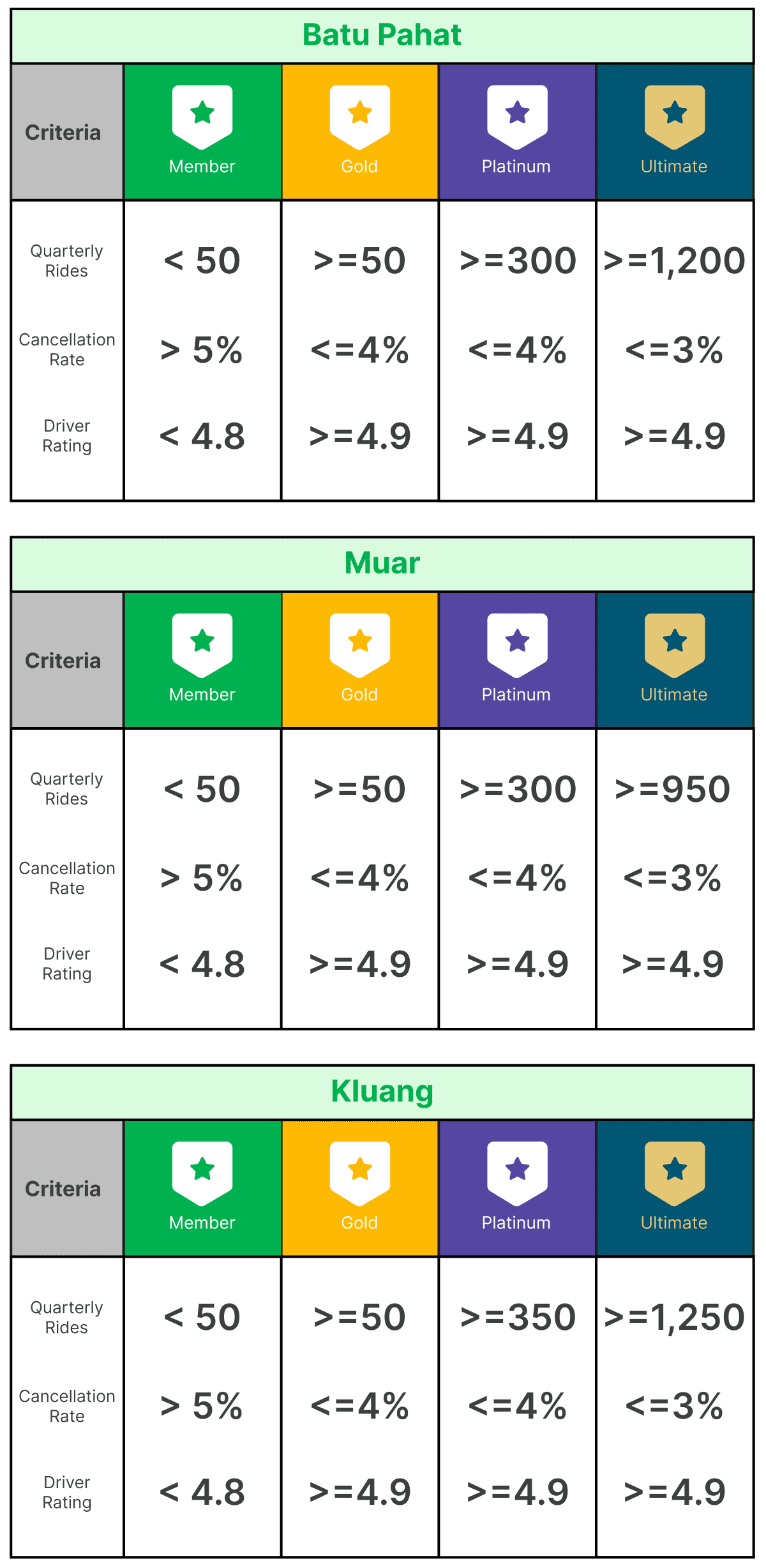

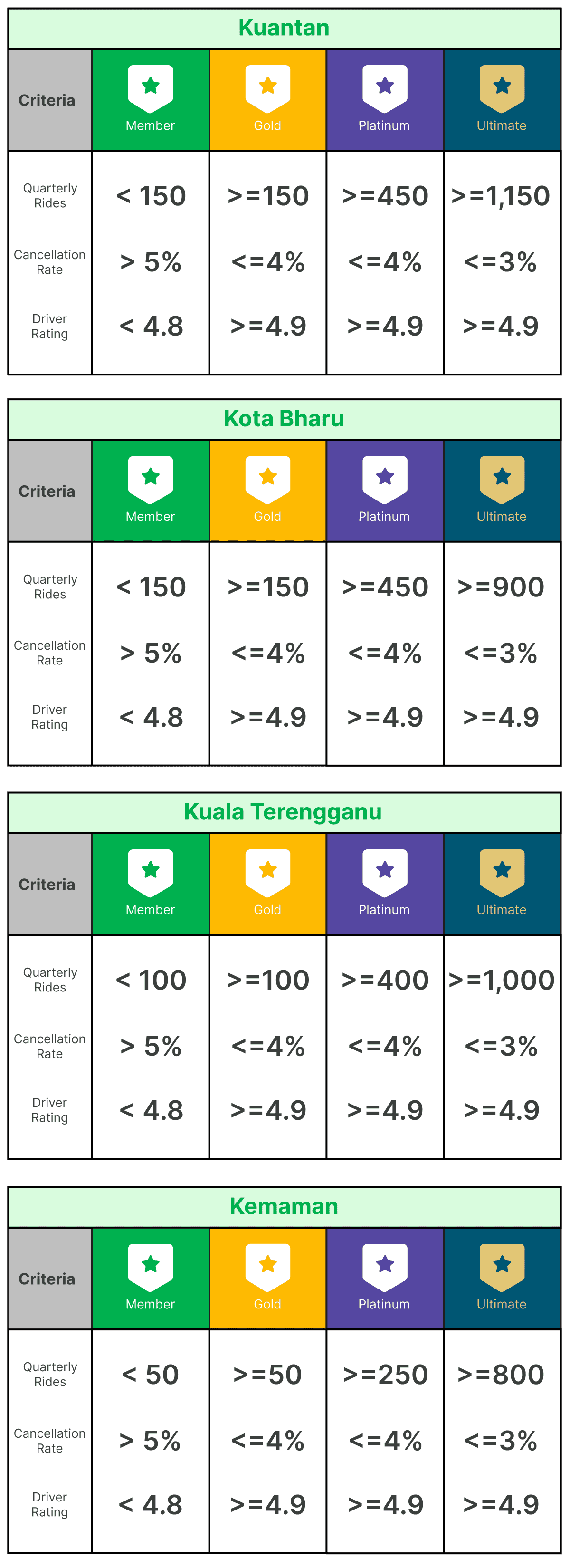

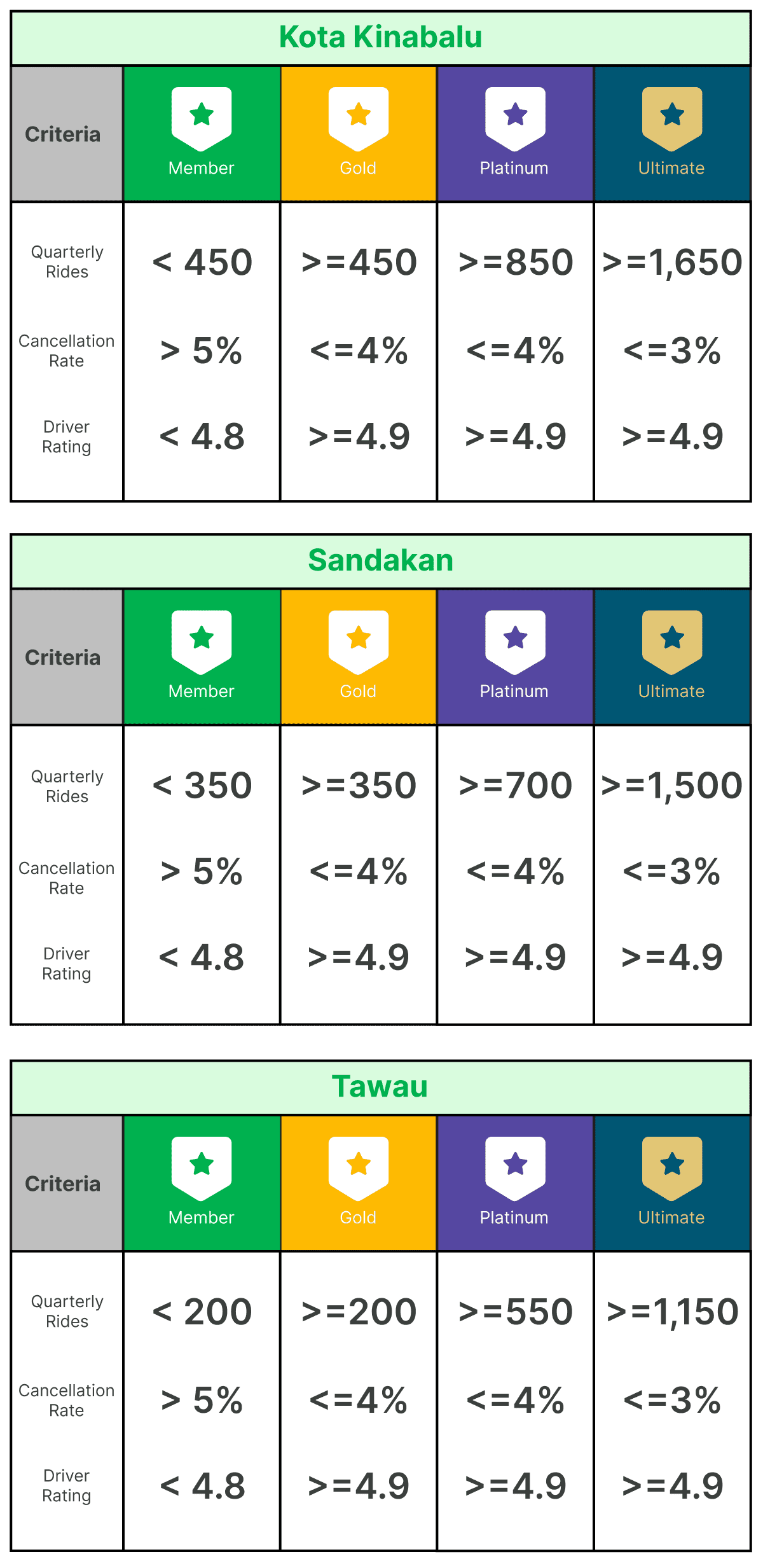

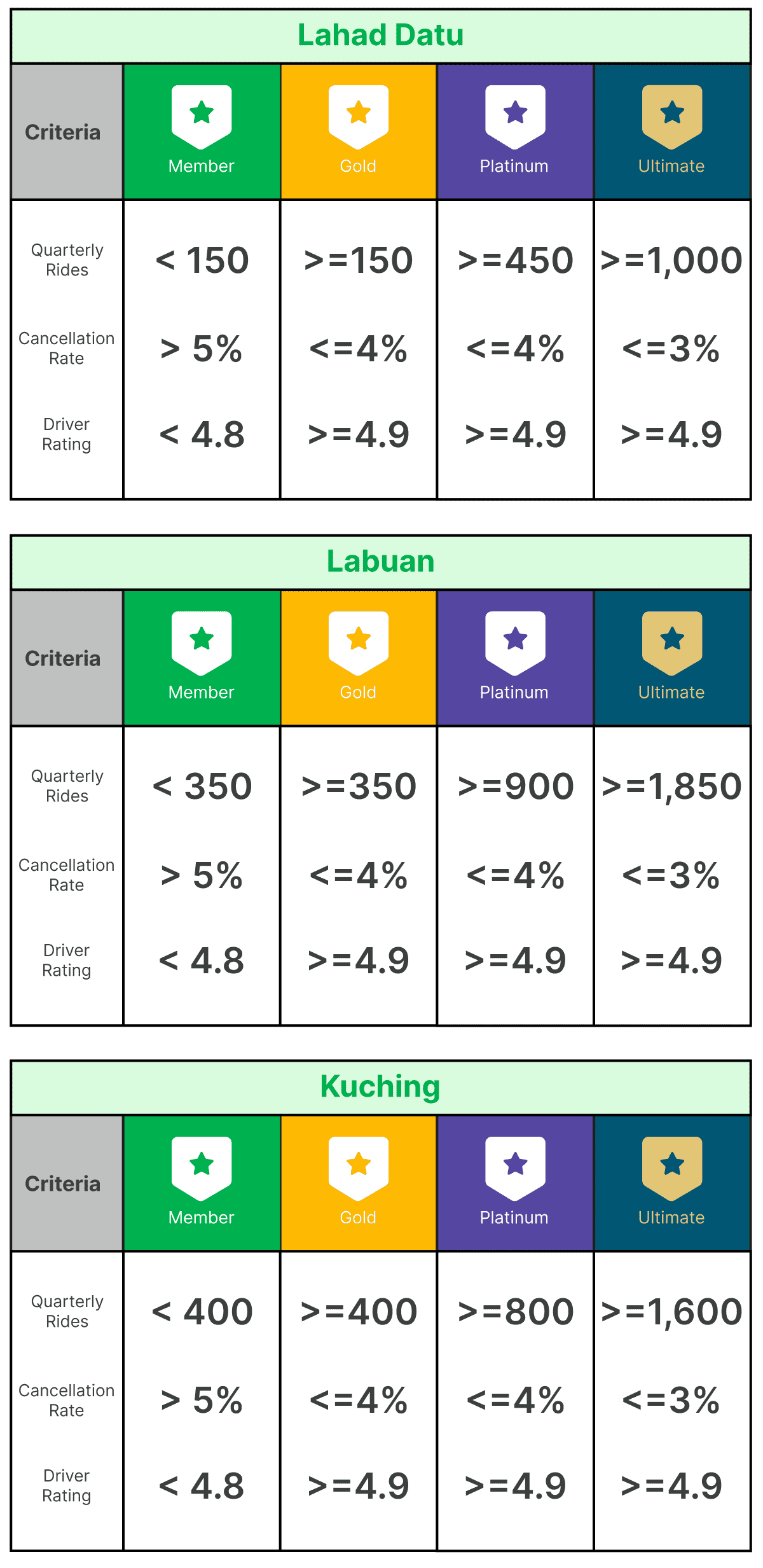

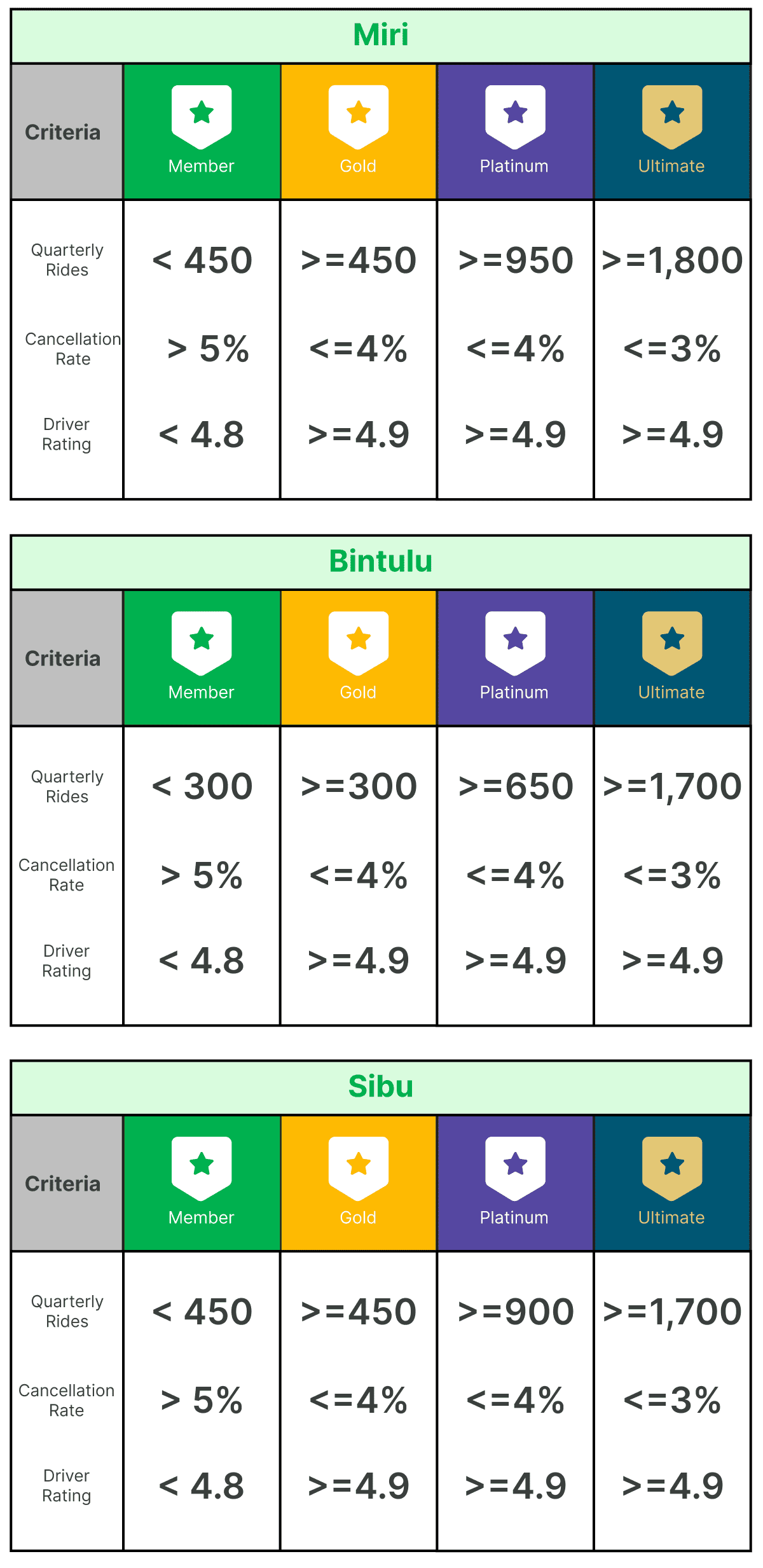

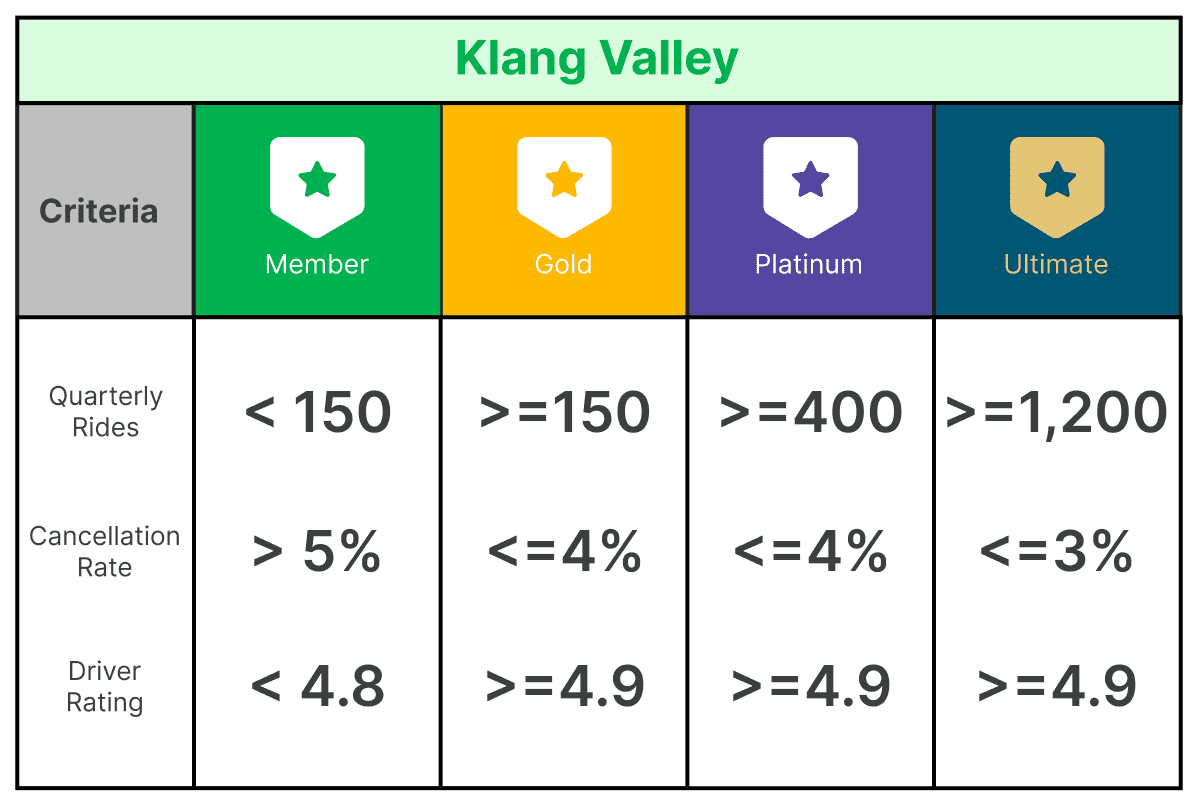

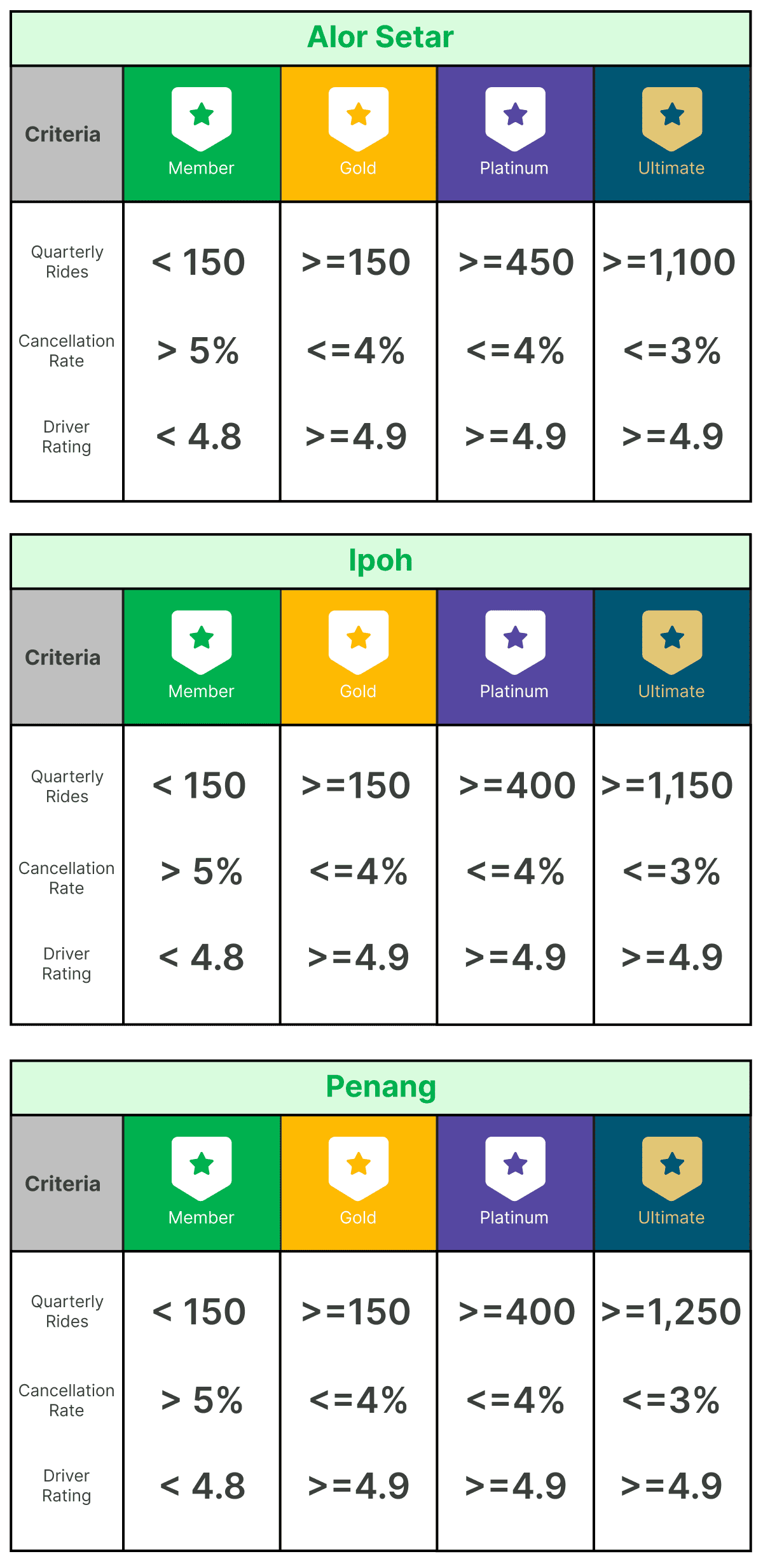

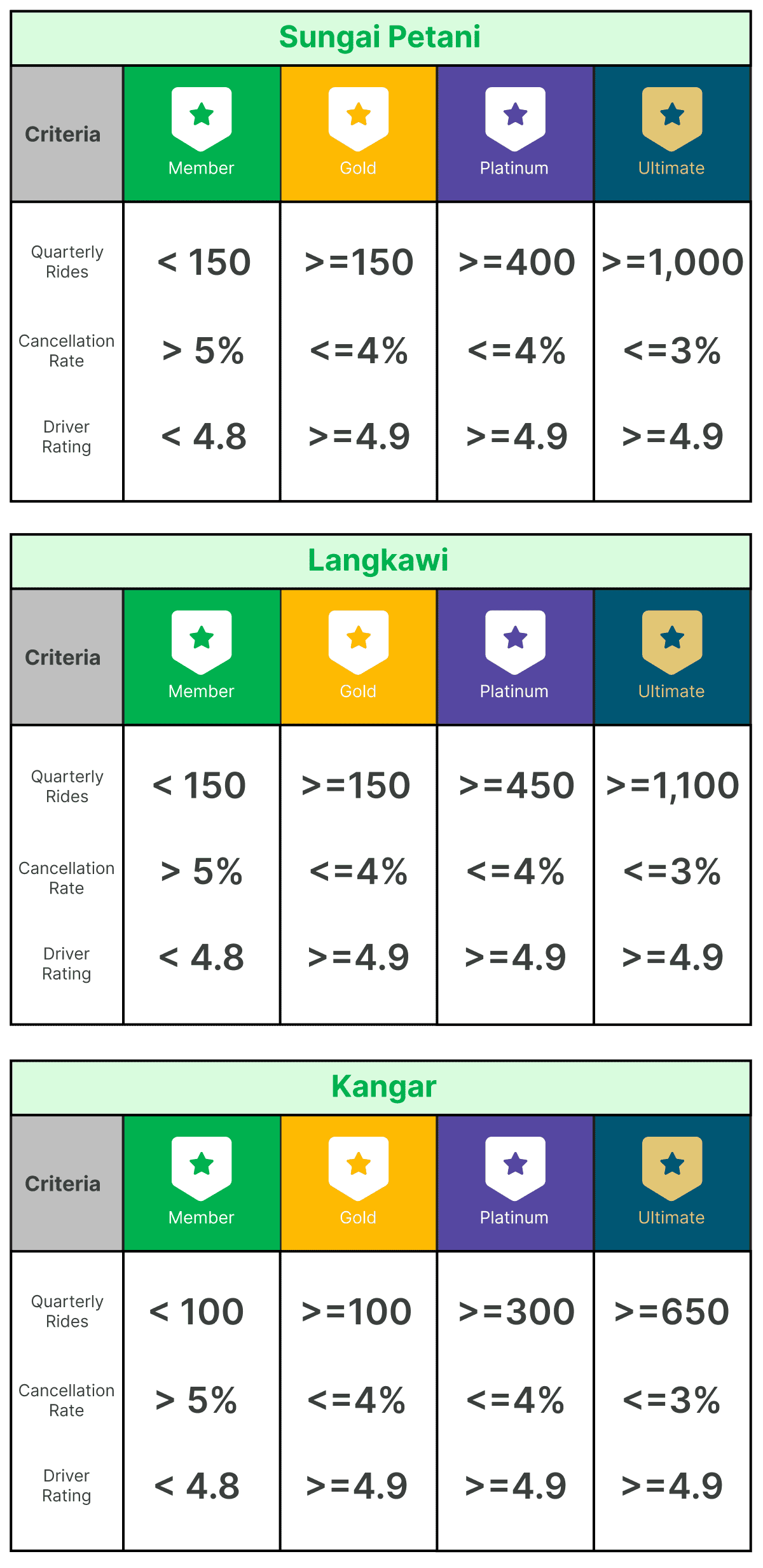

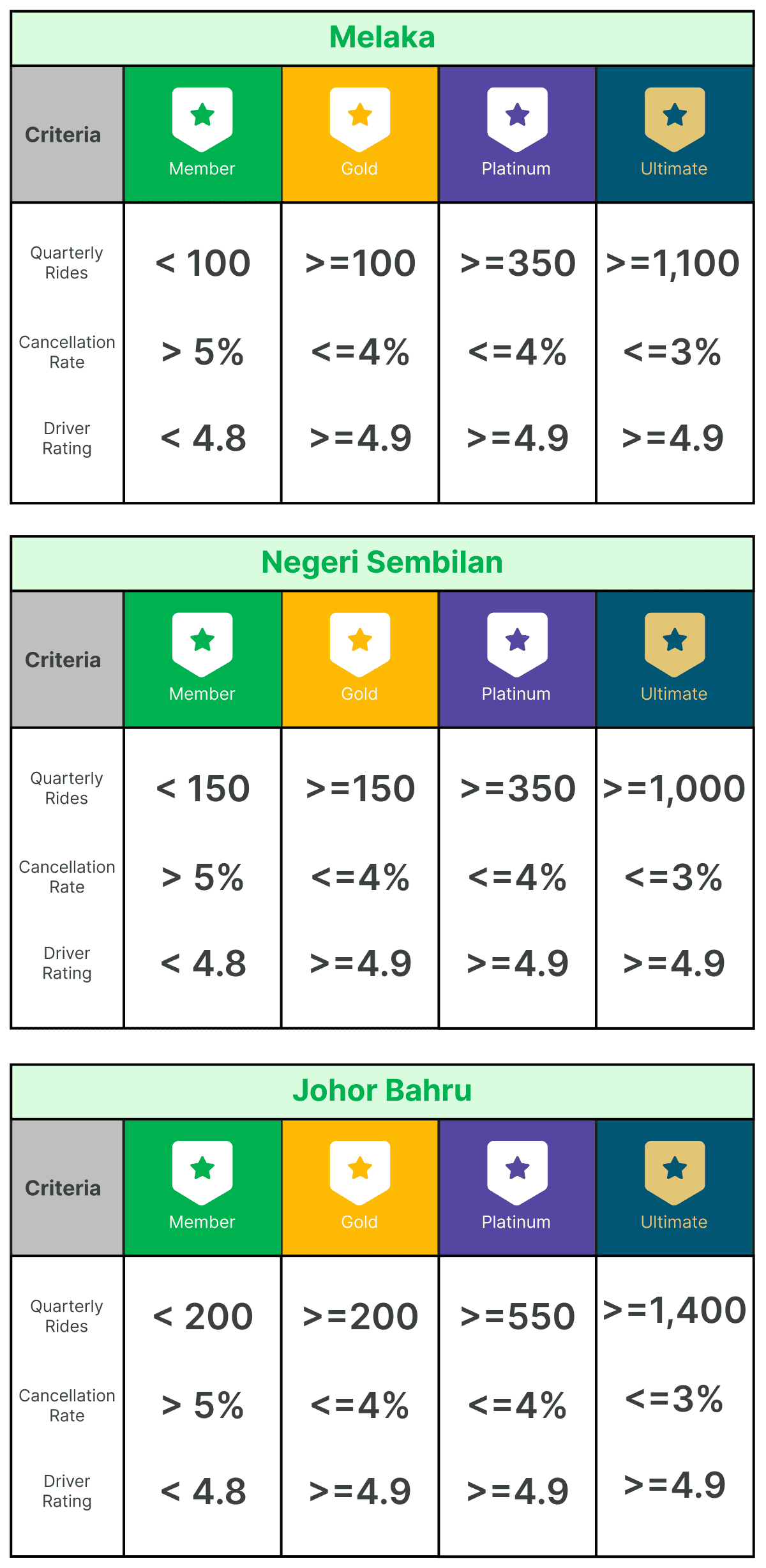

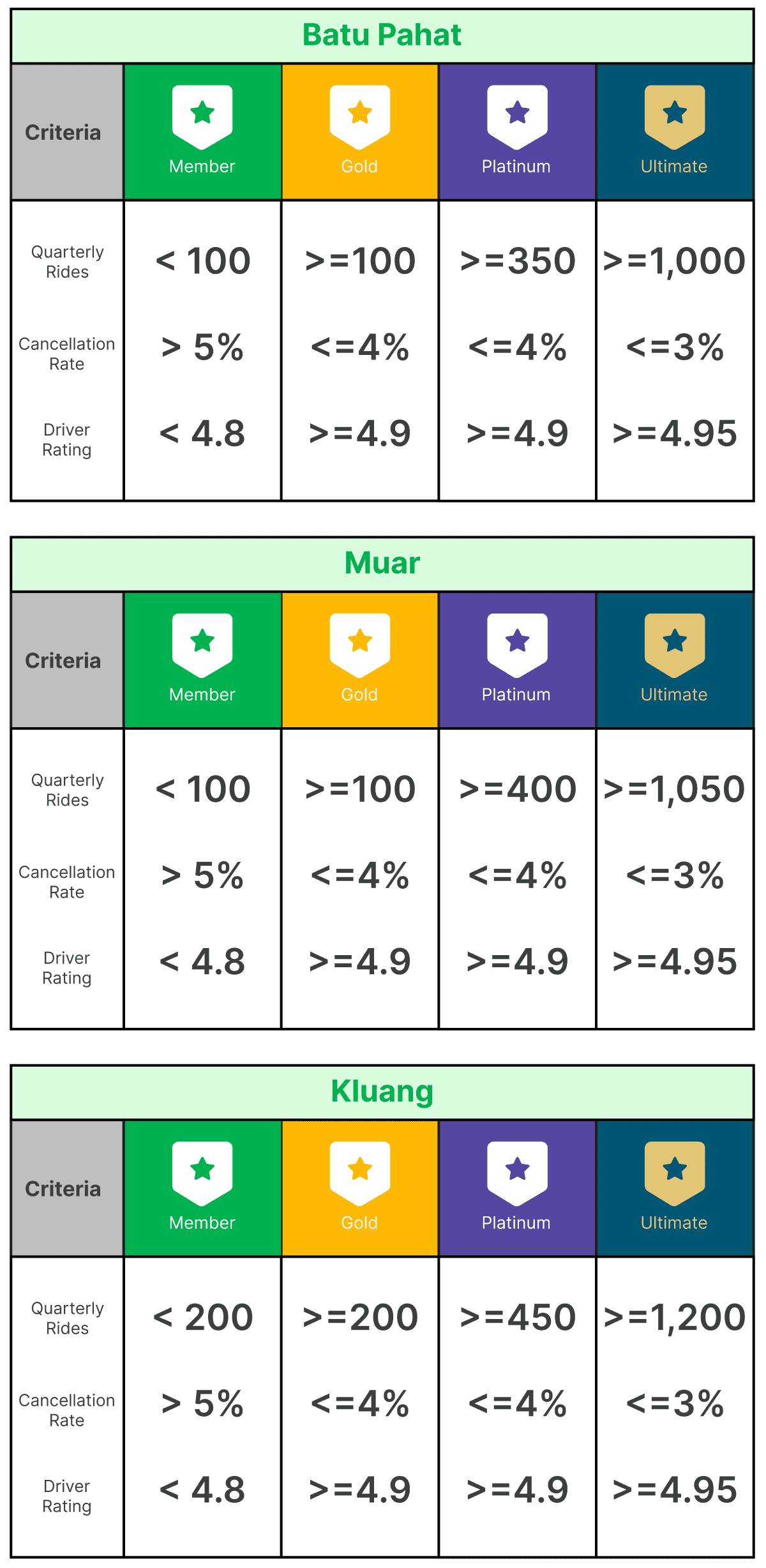

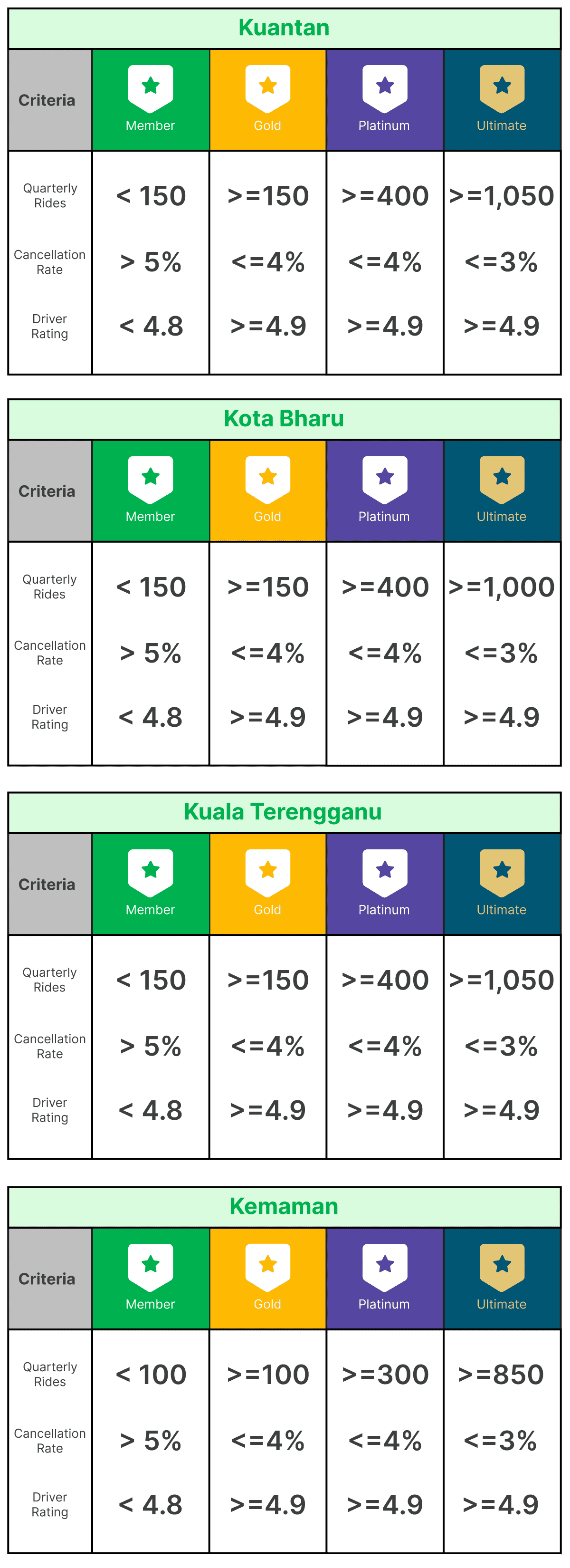

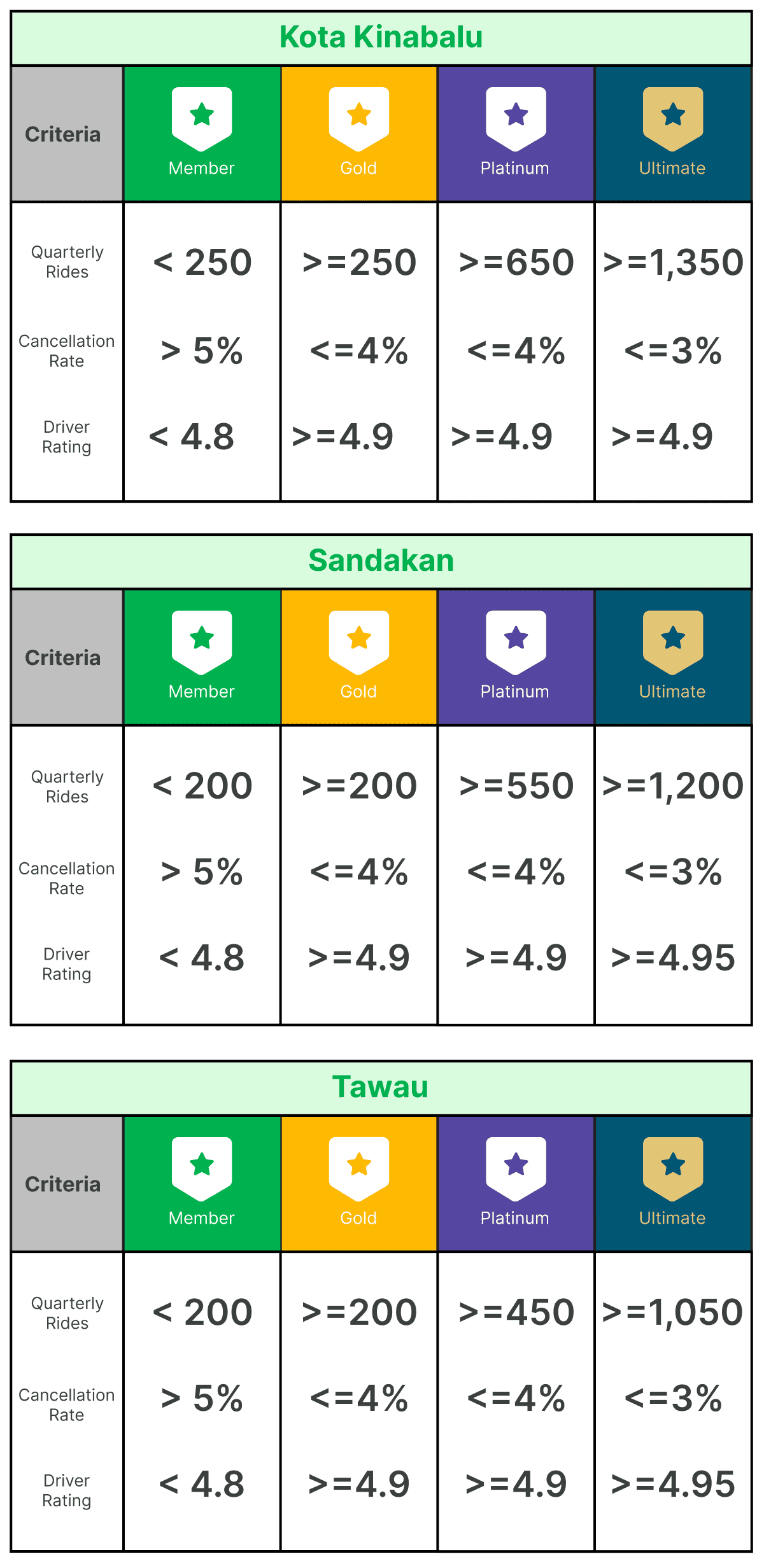

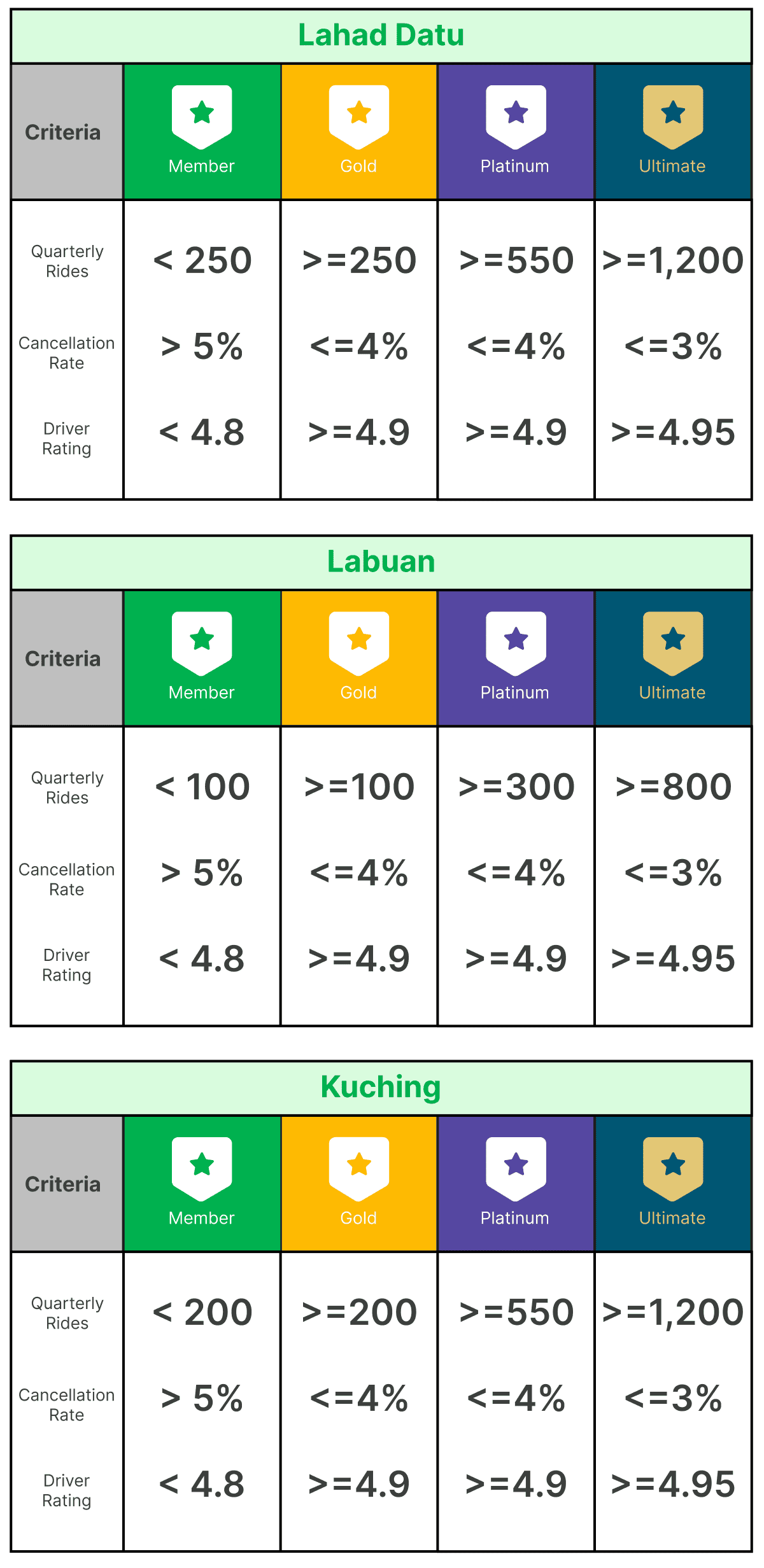

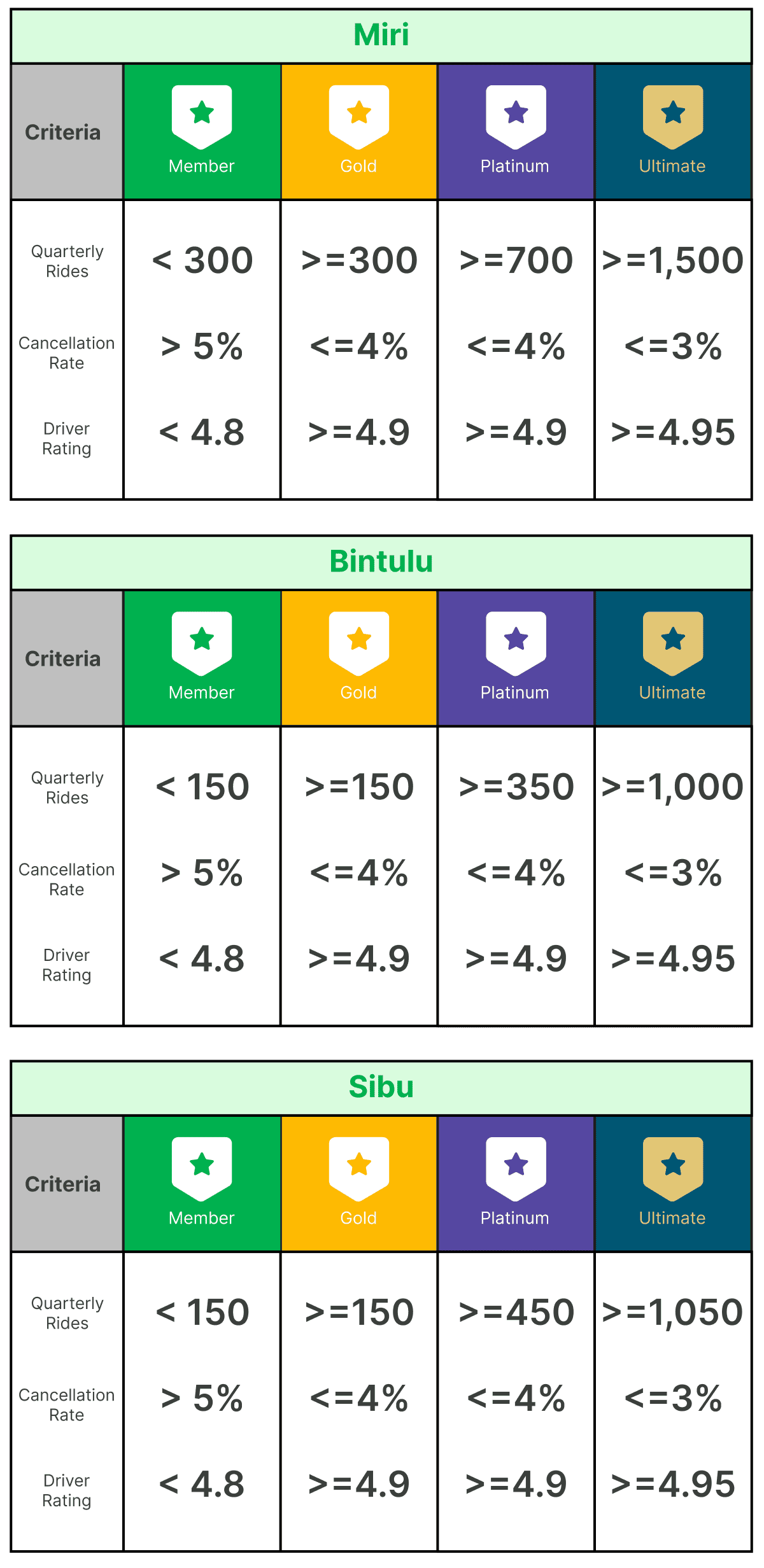

Tier Requirements

To achieve the different tiers, every city will have their own target requirements, according to each city’s unique trends. Driver-partners and delivery-partners have 3 months to achieve the requirements listed.

Click on the regions below to find out the requirements of your own city.

Driver-Partners

Delivery-Partners

Tier Progression

How does the Tier refresh work?

Grab reserves the sole and absolute right to withdraw, alter, extend or terminate any aspect of the GrabBenefits programme, including the benefits offers, or amend any parts of the terms and conditions at any time without prior notice. In the event of any disputes arising directly or indirectly from the programme and its offerings, Grab’s decision shall be deemed final and conclusive.

GrabBenefits is a programme that looks into different aspects of our Grab partners’ well-being, while they continue to earn on Grab. It has three main branches – Protection, Savings and Academy. Partners get progressively better perks as they rise in their tier standings!

Perks

Click on the different tabs to see the rewards you will be entitled to receive!

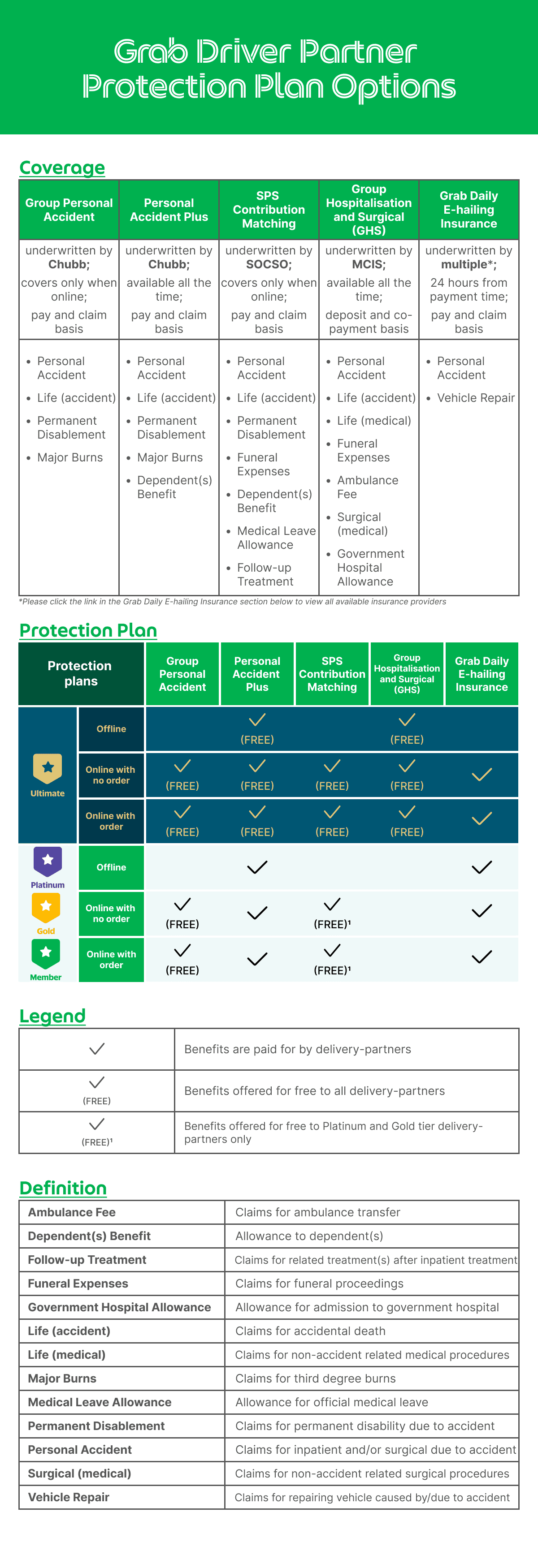

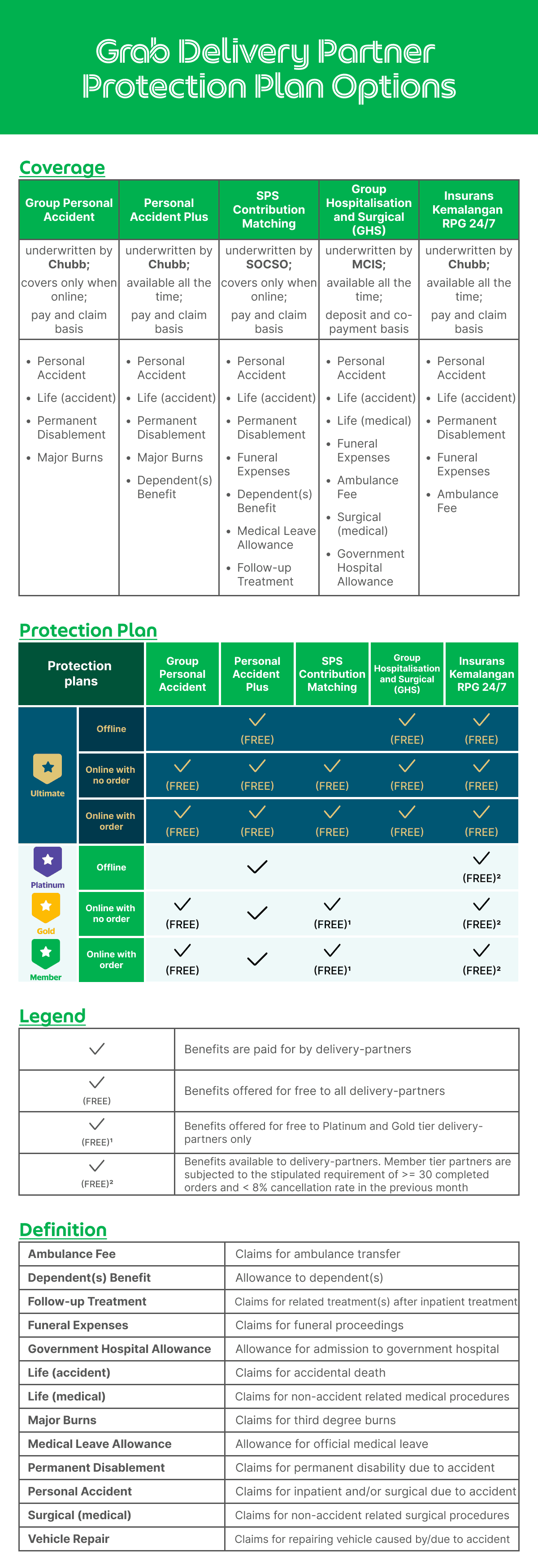

Protection

Click here for more info

Group Personal Accident is a free insurance exclusive for Grab partners to ensure they are protected while on the job. This insurance plan is automatically provided when Grab partners are active on a Grab job. Both you and your passengers are covered up to RM40,000* for accidental death, permanent disability, burns and medical expenses.

* Terms & conditions apply

Coverage: Personal Accident, Life, Permanent Disability

Coverage Eligibility: Grab partners, Passengers

Steps to claim:

- Download and complete the Personal Accident claim form

- Submit the form with the relevant supporting documents within 30 days after the accident (refer to documents checklist below according to your specific case type)

a. Online submission, email to: A&HClaimsConnect.MY@Chubb.com

b. Hard copy submission, post to:

Attn: A&H Claims Department

Chubb Insurance Malaysia Berhad

Registration Number: 197001000564 (9827-A)

Wisma Chubb

38, Jalan Sultan Ismail

50250, Kuala Lumpur

Malaysia

Chubb Customer Service Hotline: +60(3) 2058 3000 / 1800 883 226

(Mon –Fri 8.30am –5.15pm, excluding public holidays)

Email: Inquiries.MY@chubb.com

For Grab-related support, please visit our Help Centre.

Documents checklist:

Accidental Death Claim

- A completed Personal Accident claim form

- Death Certificate

- Police Report

- Post Mortem/Autopsy and Toxicology Report

- Supporting proof of circumstances of death – including witness reports and newspaper articles (if available)

- Copy of driver’s license (if road traffic accident is involved)

- Incident Report lodged with Grab (including Trip Booking ID)

Permanent Disablement Claim

- A completed Personal Accident claim form

- Police Report

- Details of how and where the accident occurred and the injuries sustained

- All relevant Medical Reports from the attending Physician stating diagnosis or reason for treatment

- Copy of driver’s license (if road traffic accident is involved)

- Incident Report lodged with Grab (including Trip Booking ID)

Burns (Third Degree) Claim

- A completed Personal Accident claim form

- Police Report

- Details of how and where the accident occurred and the injuries sustained

- All relevant Medical Reports from the attending Physician stating diagnosis and degree of burns

- Copy of driver’s license (if road traffic accident is involved)

- Incident Report lodged with Grab (including Trip Booking ID)

Accidental Medical Expenses Reimbursement (AMER) Claim

- A completed Personal Accident claim form

- Original Medical Bills and Receipts

- All relevant Medical Reports from the attending Physician stating diagnosis or reason for treatment

- Details of how and where the accident occurred and the injuries sustained

- Police Report, if applicable

- Incident Report lodged with Grab (including Trip Booking ID)

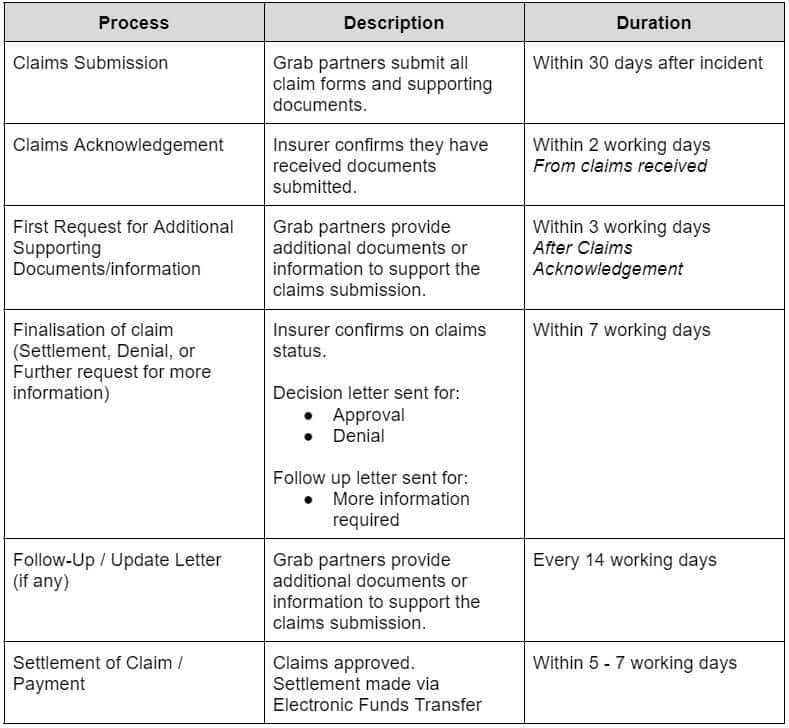

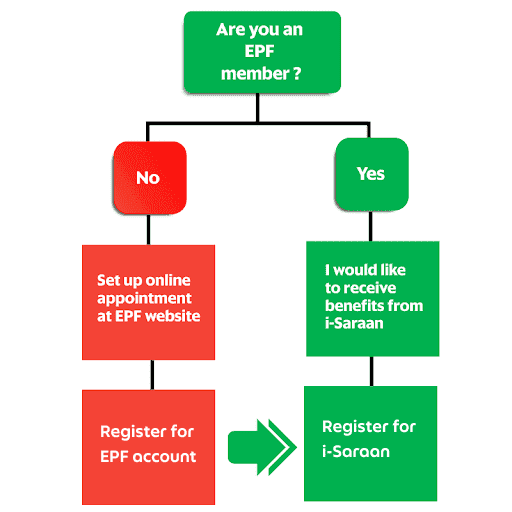

Claims – Standard Operating Procedure

Click here for more info

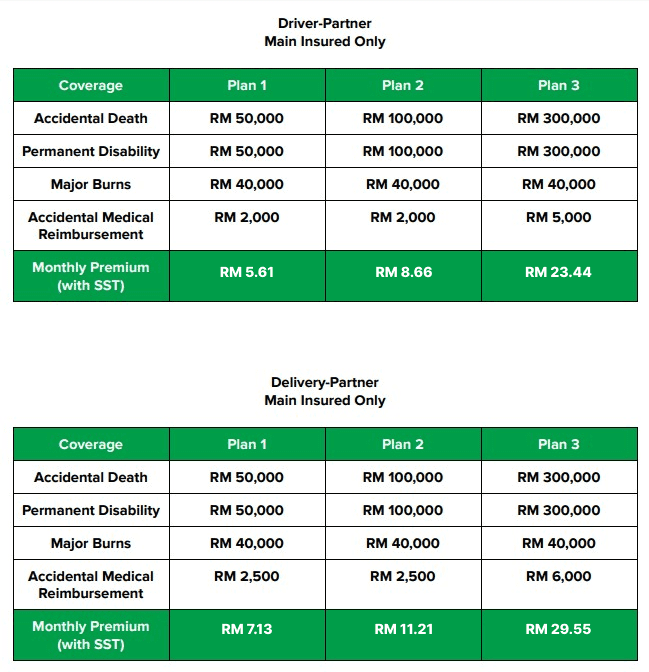

Personal Accident Plus is a low-cost insurance plan specially designed for our Driver & Delivery-Partners to keep them and their family safe anytime, anywhere. With the right plan, this insurance can cover Grab partners, their spouse and kids up to RM300,000* for on and off-the-job accidental death and permanent disability.

* Terms & conditions apply

Coverage: Personal Accident, Life, Permanent Disability

Coverage Eligibility: Grab partners, Spouse, Dependent Children (under 19 years old or under 23 years old and a full-time student)

Steps to claim:

- Download and complete the Personal Accident claim form

- Submit the form with the relevant supporting documents within 30 days after the accident (refer to documents checklist below)

a. Online submission, email to: A&HClaimsConnect.MY@Chubb.com

b. Hard copy submission, post to:

Attn: A&H Claims Department

Chubb Insurance Malaysia Berhad

Registration Number: 197001000564 (9827-A)

Wisma Chubb

38, Jalan Sultan Ismail

50250, Kuala Lumpur

Malaysia

Chubb Customer Service Hotline: +60(3) 2058 3000 / 1800 883 226

(Mon –Fri 8.30am –5.15pm, excluding public holidays)

Email: Inquiries.MY@chubb.com

For Grab-related support, please visit our Help Centre.

Documents checklist:

- A completed Personal Accident claim form

- Original receipts for any expenses that are being claimed

- Any reports that have been obtained from the police, a carrier or other authorities about an accident, loss or damage

- Any other documentary evidence required by Chubb under this Policy that is reasonably required to assess the claim such as any additional medical or other certificates/reports/documents.

With SPS Contribution Matching (SPS Gig 4.0), self-employed Grab partners can receive insurance protection under the SOCSO Self-Employment Protection Scheme (SPS) programme. This scheme offers comprehensive protection for individuals in the event of a self-employment injury during work-related activities.

Click here for more info on the SOCSO Self-Employment Protection Scheme (SPS) programme

SPS Contribution Matching (SPS Gig 4.0) is a subsidy where Grab partners will only have to pay 10% (RM23.30) from a contribution rate of RM232.80 under Contribution Plan 2.

Grab partners are eligible for 12 months (1 year) protection after payment has been received. The remaining 90% (RM209.50) will be borne by the government.

Sponsorship For Grab Partners!

Click here for more info on the SPS Contribution Matching (SPS Gig 4.0) subsidy

There are two (2) ways to enroll and contribute for free:

1. Enroll and contribute RM23.30 to SOCSO by yourself as soon as possible, and complete 100 trips in any quarter this year before 30 November 2024. After you complete the 100 trips, Grab will reimburse up to RM23.30 back into your cash wallet.

2. Complete 100 trips in any quarter this year before 30 November 2024, and Grab will enroll and sponsor your part of the contribution once you meet the said requirement.

Scenario examples:

Please note that for (2), you will not be covered under SOCSO until Grab enrolls and sponsors your contribution. We strongly advise that you enroll on your own as early as possible to avoid being fined under Act 789 and to ensure protection when you are on the road.

How do I apply for the SOCSO Self-Employment Protection Scheme (SPS) programme?

You can apply and pay through several channels:

1. Online via the Matrix Portal

2. Download and access the SOCSO phone app

3. Set an appointment at the nearest SOCSO office

How do I make a claim if I’m involved in an accident?

Contact SOCSO at 1 300-22-8000 or go to your nearest SOCSO office.

FAQ

1. How do I enroll under SPS Matching Contribution and get Grab to sponsor my SPS contribution to SOCSO?

There are two (2) ways to enroll and contribute for free:

(a) Enroll and contribute RM23.30 to SOCSO by yourself as soon as possible, and complete 100 trips in any quarter this year before 30 November 2024. Once you complete 100 trips, Grab will reimburse the amount you contributed back into your cash wallet.

(b) Complete 100 trips in any quarter this year before 30 November 2024, and Grab will enroll and sponsor your contribution once you meet the said requirement.

Please note that for (b), you will not be covered under SOCSO until Grab enrolls and sponsors your contribution. We strongly advise that you enroll on your own to ensure protection when you are on the job.

2. What do I need to do if I want to register myself?

You will need to make a request via the Matrix Portal or SOCSO app, or make an appointment at any nearby SOCSO branch nationwide.

3. Is it compulsory for me to contribute to SOCSO?

Yes, under Act 789, two (2) sectors are compulsory to be registered, namely the Passenger Transport sector and the Goods or Food Transport sector. Any Self-Employed Person (OBS) who is self-employed or involved in earning a living in both sectors is required to register with SOCSO.

4. What are the implications if I fail to contribute to any SOCSO protection plan?

Legal action including prosecution in court can be taken against any Self-Employed Person (OBS) who is found to have failed to register, and if convicted can be sentenced to two (2) years imprisonment or fined up to RM 10,000.00 or both.

5. I have an existing SOCSO coverage but it is NOT SPS Gig 4.0. Do I still need to apply for it?

Yes, the law requires you to enroll and contribute for the specific sectors you are employed in. Click here for more info on the different sectors.

6. Can I transfer ownership of my coverage if I am no longer involved in the gig economy?

No, you cannot transfer ownership of this coverage.

7. What would happen if I didn’t register Grab as a platform provider during my registration or renewal of the SOCSO scheme?

We will be unable to validate your registration details with SOCSO, which would result in us not being able to perform the reimbursement. Please ensure that you have correctly updated Grab as your platform provider upon registration/renewal of SPS Gig with SOCSO.

8. Will I be reimbursed if I enroll and contribute to the other SPS Gig 4.0 plans (Plan 1/3/4) by myself?

Yes, we will still reimburse you as long as you complete 100 trips in any quarter this year before 30 November 2024. However do note that for any plans (Plan 1/2/3/4), you will only be reimbursed up to RM23.30.

9. When will I receive my reimbursement and how can I check?

Grab partners will receive their reimbursement after they complete 100 trips in one quarter, and in the first month of the following quarter. For example, Grab partners who completed 100 trips in between January – March (Q1) 2024, will receive their reimbursement in April (first month of Q2) 2024. To check, Grab partners can refer to their cash wallet transactions in the driver app and the weekly statements that are emailed weekly.

10. Do I need to opt in to anything to receive this SPS Gig 4.0 coverage or reimbursement?

No opt-in required. Qualified Grab partners will automatically receive the reimbursement or be enrolled for free after the 100 trips requirement is completed. Grab partners can however, choose to not let Grab enroll on their behalf by opting out. Click here to opt out.

11. Is this sponsorship offered to all Grab partners?

This sponsorship is only offered to Grab partners who are not taxi drivers. This is because the Ministry of Transport has announced that they will cover the remaining 10% for taxi drivers. Click here for reference.

Click here for more info

Group Hospitalisation & Surgical (GHS) is a free medical protection plan that provides comprehensive coverage. The coverage benefits range from hospital care to surgical expenses up to an annual limit of RM10,000, which can be utilised in non-accident related events. This plan is guaranteed for all Ultimate Tier Grab Partners.

Coverage: Personal Accident, Life, Permanent Disability, Post Death

Coverage Eligibility: Ultimate tier Grab partners that have opted-in.

Insurance Panel: General Practitioner Clinics, Specialist Clinics, Hospitals

Steps to claim:

- Download and complete the applicable claim form from the MCIS webpage

- Download and complete the E-Payment Application Form

- Submit both soft and hard copies of the completed forms and required supporting documents within 30 days after the accident / treatment via email and post to MCIS Life (refer to documents checklist below)

For claims RM1,000 and below:

Submit your documents via the MyMed application.

- Login to your MyMed application

- Tap on the ‘Utilization’ tile

- Tap on the ‘Claim Submission’ tile

- Select the respective category you are submitting the claims for and fill in the information required.

For claims above RM1,000:

Submit your documents to MCIS Life directly via one of the following methods:

- Online submission: Email to groupeb@mcis.my

- Hard copy submission: Post to

Attn: Claims Department

MCIS Insurance Berhad

Wisma MCIS, Jalan Barat,

46200, Petaling Jaya,

Selangor, Malaysia

Documents checklist:

Inpatient (Admitted to Hospital)

- Hospital & Surgical Form

- Referral Letter

- Original Official Receipt (inc. deposit and refund)

- Original Hospital Itemised Bill / Discharge Note

- Police Report (For Accident-related Cases)

- E-Payment Application Form

Pre & Post Hospitalisation

- Pre / Post Hospital Treatment Form

- Original Official Receipt

- Original Hospital Itemised Bill / Discharge Note

- E-Payment Application Form

Click here for more info

Grab Daily E-hailing Insurance is a daily-renewable coverage plan that provides protection to Grab Partners for 24 hours whenever they are online and driving with Grab for transport jobs. This provides them with the flexibility to only purchase the insurance whenever they are online, without the need for an annual e-hailing insurance.

Grab has partnered with a range of selected insurance companies to offer an innovative and flexible product that is suitable for our driver-partners.

Coverage: Personal Accident, Life, Vehicle Repair

Coverage Eligibility: Grab driver-partners only

Steps to claim:

- Contact Grab Support to obtain your selected insurer’s contact details.

- Contact your selected insurer for advice on next steps and documents to submit.

Documents checklist:

Subject to advice from respective insurers.

Click here for more info

RPG 24/7 Personal Accident Insurance is a free insurance exclusive for Grab delivery-partners to keep you safe anytime, anywhere, even when you’re not on any Grab jobs. This insurance plan is automatically provided to active delivery-partners*.

* Subject to fulfilment of minimum performance criteria.

Coverage: Personal Accident, Life, Permanent Disability, Post Death

Coverage Eligibility: Grab delivery-partners only

Insurance Panel: General Practitioner Clinics, Specialist Clinics, Hospitals

Steps to claim:

- Download and complete the Personal Accident claim form

- Submit the form with the relevant supporting documents within 30 days after the accident (refer to documents checklist below)

a. Online submission, email to: A&HClaimsConnect.MY@Chubb.com

b. Hard copy submission, post to:

Attn: A&H Claims Department

Chubb Insurance Malaysia Berhad

Registration Number: 197001000564 (9827-A)

Wisma Chubb

38, Jalan Sultan Ismail

50250, Kuala Lumpur

Malaysia

Chubb Customer Service Hotline: +60(3) 2058 3000 / 1800 883 226

(Mon –Fri 8.30am –5.15pm, excluding public holidays)

Email: Inquiries.MY@chubb.com

For Grab-related support, please visit our Help Centre.

Documents checklist:

Accidental Death Claim

- A completed Personal Accident claim form

- Death Certificate

- Police Report

- Post Mortem/Autopsy and Toxicology Report

- Supporting proof of circumstances of death – including witness reports and newspaper articles (if available)

- Copy of driver’s license (if road traffic accident is involved)

- Incident Report lodged with Grab (including Trip Booking ID)

Permanent Disablement Claim

- A completed Personal Accident claim form

- Police Report

- Details of how and where the accident occurred and the injuries sustained

- All relevant Medical Reports from the attending Physician stating diagnosis or reason for treatment

- Copy of driver’s license (if road traffic accident is involved)

- Incident Report lodged with Grab (including Trip Booking ID)

Burns (Third Degree) Claim

- A completed Personal Accident claim form

- Police Report

- Details of how and where the accident occurred and the injuries sustained

- All relevant Medical Reports from the attending Physician stating diagnosis and degree of burns

- Copy of driver’s license (if road traffic accident is involved)

- Incident Report lodged with Grab (including Trip Booking ID)

Accidental Medical Expenses Reimbursement (AMER) Claim

- A completed Personal Accident claim form

- Original Medical Bills and Receipts

- All relevant Medical Reports from the attending Physician stating diagnosis or reason for treatment

- Details of how and where the accident occurred and the injuries sustained

- Police Report, if applicable

- Incident Report lodged with Grab (including Trip Booking ID)

Claims – Standard Operating Procedure

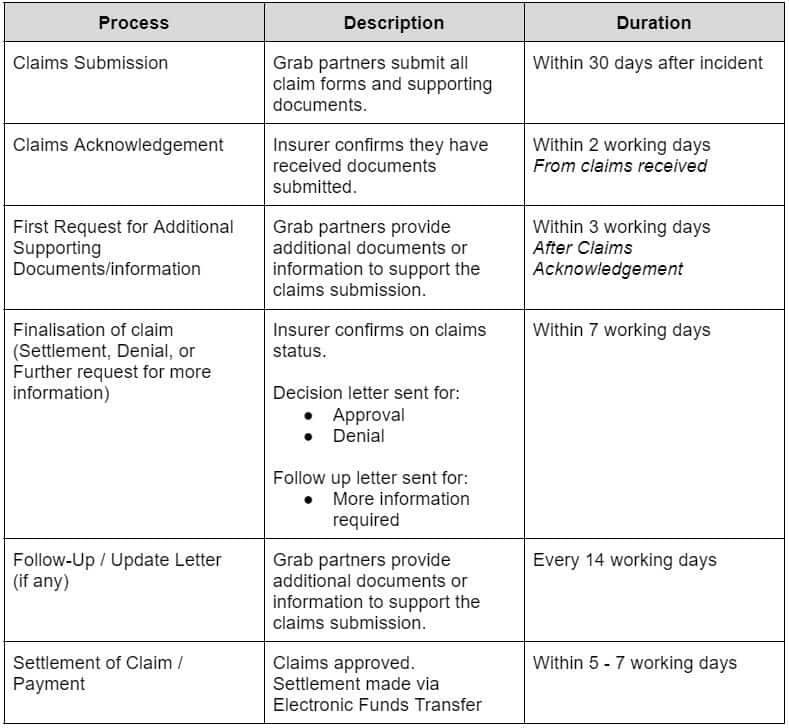

i-Saraan is a voluntary contribution scheme for EPF members who are self-employed and may not earn a fixed income. Through this scheme, Grab partners of all tiers will earn additional annual contributions from the government.

As of 2024, all Grab partners* that register for i-Saraan will receive from the Government:

- 15% annual contribution (up to RM500) of your own personal contributions

- Death Benefit RM 2,500 (Subject to Terms & Conditions)

- EPF dividend on total retirement savings annually

- Tax Exemption

*Opted-in under i-Saraan program only (Please opt-out from i-Suri before opting-in under i-Saraan)

For more info, please click here.

Grab reserves the sole and absolute right to withdraw, alter, extend or terminate any aspect of the GrabBenefits programme, including the benefits offers, or amend any parts of the terms and conditions at any time without prior notice. In the event of any disputes arising directly or indirectly from the programme and its offerings, Grab’s decision shall be deemed final and conclusive.

GrabBenefits is a programme that looks into different aspects of our Grab partners’ well-being, while they continue to earn on Grab. It has three main branches – Protection, Savings and Academy. Partners get progressively better perks as they rise in their tier standings!

Ultimate Exclusive Redemptions

As an Ultimate tier partner, don’t miss out on these exclusive rewards just for you!

Group Hospitalisation & Surgical (GHS) – FREE Protection Plan

As a gig worker, you may be perceived as having a high-risk occupation by insurance providers, and this may affect the coverage you receive or if you are able to receive coverage at all…

Our solution: Group Hospitalisation & Surgical (GHS) – MyMedKad by GrabInsure!

GHS is our brand new medical protection plan that makes comprehensive coverage readily available to you! GHS is offered to all Ultimate tier partners for FREE*, with an annual limit of RM10,000!

With GHS, you will get:

- Comprehensive Coverage – Outpatient treatment in hospital, inpatient hospital stays, surgical expenses, permanent disability & follow-up treatment coverage

- Convenience – Simple sign-up process

- Accessibility – FREE for Ultimate tier partners

For more info about GHS, please click here.

* For the duration you maintain your Ultimate tier standing.

- Ensure that your phone number on the Driver App and Grab App match

- Subscribe to the GrabUnlimited plan on your Grab App*

New subscribers will enjoy their first 2 months for free - A rebate of RM3.90** will be credited to your Driver Wallet the following month

Eg: Subscribe in January, receive your rebate in February

*Rebate will not be credited to your Driver Wallet if the phone numbers do not match.

**The monthly rebate does not apply to new subscribers while they are still on their first 2 free months.

Redeem your free lubricant* from the PETRONAS Shop webstore throughout the quarter.

The reward will be activated on your GrabBenefits section in the quarter that you are an Ultimate tier partner.

Note:

- Look out for the notification in your Driver App Inbox.

- Only ONE (1) unit of lubricant is redeemable per Ultimate Grab partner each quarter.

- Redemptions can only be made online through the PETRONAS Shop webstore, and not through physical petrol stations.

- To select the most suitable lubricant for your vehicle, you may refer to the PETRONAS Recommender.

- For steps to redeem, please click here.

*reserved on a first come, first served basis.

Enjoy up to 2 free meals* each month at selected Grab Partner Pit Stops.

The reward will be activated on your GrabBenefits section during the quarter you are an Ultimate tier partner.

For partners in cities that do not have a Grab Partner Pit Stop location yet, we are working on onboarding merchant-partners soon!

To see the full list of participating merchant-partners, click here.

*Limited, available on a first come first served basis.

Personal Accident Plus insurance covers accidental death, third degree burns as well as reimbursements for medical expenses.

Ultimate tier partners can enjoy a monthly rebate of RM5.61 (driver-partners) / RM7.13 (delivery-partners) for their subscription to the Personal Accident Plus insurance coverage plan.

Monthly rebates will be made in the following month.

Eg: Subscribe/renew your plan in January, receive your rebate in February

Opt-in to this plan from your Driver App.

Grab reserves the sole and absolute right to withdraw, alter, extend or terminate any aspect of the GrabBenefits programme, including the benefits offers, or amend any parts of the terms and conditions at any time without prior notice. In the event of any disputes arising directly or indirectly from the programme and its offerings, Grab’s decision shall be deemed final and conclusive.

GrabBenefits is a programme that looks into different aspects of our Grab partners’ well-being, while they continue to earn on Grab. It has three main branches – Protection, Savings and Academy. Partners get progressively better perks as they rise in their tier standings!

Your tier will be based on your performance from the previous quarter. You must fulfil all requirements for the specific tier to be eligible for it.

No, the target is for one quarter, that is over a course of 3 month periods.

Tier refresh will take place between the 1st to 7th of every January, April, July and October. If you think there may still be an error with your tier after the 7th, you may reach out to us via the Help Centre.

Your tier would depend on your total performance achieved for the remaining duration of the quarter (from February to March).

No, your tier will not be downgraded for the whole 3 months of Quarter 2.

Your tier will only be refreshed for Quarter 3, depending on which targets you manage to achieve in Quarter 2.

You will be contacted by a Grab representative for clarification and/or investigation based on Grab’s Code of Conduct, and they will advise on your tier standing.

You may need to complete your re-education first before being reactivated. Your tier will not be reinstated until the next quarter refreshes.

Your new target will follow according to the city you are moving to. You can carry over your number of completed trips and continue to drive towards the new target.

You will automatically be able to view the rewards on GrabBenefits in your Driver App once you complete your first booking.

If the date is past the 7th of the refresh month, please reach out to us via the Help Center.

The reward may have been fully redeemed by other Driver-partners / Delivery-partners already. But don’t worry, we will continue to add more new rewards.

Grab reserves the sole and absolute right to withdraw, alter, extend or terminate any aspect of the GrabBenefits programme, including the benefits offers, or amend any parts of the terms and conditions at any time without prior notice. In the event of any disputes arising directly or indirectly from the programme and its offerings, Grab’s decision shall be deemed final and conclusive.

G-02 Ground Floor, Block A,

Axis Business Campus,

No 13A & 13B Jalan 225,

Section 51A, Petaling Jaya,

46100 Selangor.

Business Registration:

MyTeksi Sdn. Bhd. - 201101025619

GrabCar Sdn. Bhd. - 201401013360

Enjoy 9% (RM8) Rebate at

AEON

- Valid from 15 Jan 2022 – 28 Feb 2022

- Minimum spend: RM88

- Limited to 62,500 redemptions

- TWO(2) redemptions per user throughout the campaign

1. Campaign period is from 15 January 2022 (12:00am) – 28 February 2022 (11.59pm).

2. GrabPay users are eligible for a “RM8 rebate” in your “My Rewards” when you spend a minimum of RM88 on a single receipt via GrabPay Wallet.

3. The offer of “RM8 rebate” is limited to a total of 62,500 redemptions throughout the campaign period.

4. Offer is valid for TWO (2) in-store redemptions with a cap of ONE(1) redemption per user per day throughout the campaign. Shared across AEON Co, AEON BiG, AEON MaxValu Prime, and AEON Wellness throughout the campaign period.

5. The “RM8 rebate” will be awarded instantly with a minimum transaction of RM88 with GrabPay at all outlets of AEON Co, AEON BiG, AEON MaxValu Prime, AEON Wellness; The rebate can be found under “My Rewards”. Rebate must be redeemed by clicking “use now” under “My Rewards” 30 days from the date of issuance.

6. The campaign will cease once all redemptions have been fully awarded or at the expiration of the campaign period, whichever is earlier.

7. Offer is based on a first come first served and while stocks last basis only.

8. Grab and AEON Group shall not be under any obligation to inform users, on any communication channels once the offer has been fully redeemed.

9. Offer is only available for AEON Co, AEON BiG, AEON MaxValu Prime, and AEON Wellness physical stores purchases at cashier counter only via GrabPay Wallet; offer is not applicable for online or GrabMart purchases.

10. Offer is not exchangeable for cash or replacements.

11. Offer is not valid with any other voucher, discount or promotion.

12. Grab and AEON Group reserve the right to alter, extend or terminate the promotion, or amend the terms and conditions at its sole discretion at any time without prior notice. In case of any disputes directly or indirectly arising from the promotion, the decision of Grab and AEON Group shall be final.

13. These terms and conditions shall be governed by the laws of Malaysia and any dispute arising out of or in connection with promotion shall be referred to the exclusive jurisdiction of courts of Malaysia.

14. This rebate is non-transferable to any party.