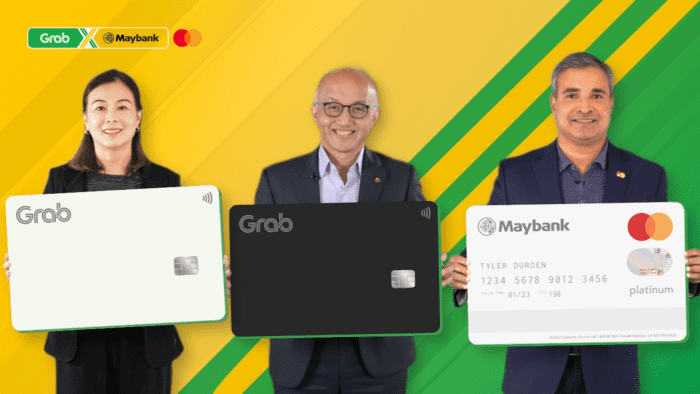

Maybank, Grab and Mastercard jointly launch the brand new Maybank Grab Mastercard Platinum to reward Malaysians for their mobile-first lifestyle

Packed with benefits, it’s 5X more exciting and rewarding for Grab users

Kuala Lumpur – Maybank, Malaysia’s largest banking group and market leader in credit cards, in partnership with Grab, ASEAN’s leading everyday super app, and Mastercard, a global technology company in the payments industry, today unveiled the Maybank Grab Mastercard Platinum – a card designed to provide Malaysians with even more ways to be rewarded for their mobile-first lifestyle and for using Grab services.

The Maybank Grab Mastercard Platinum is launched amidst a rapid change in the lifestyle of Malaysians with more and more relying on their smartphones and going online to acquire daily services, shop, and perform banking transactions. According to the Mastercard Impact Studies™ May 2020 edition, Malaysians are increasing their online activities – 75% are surfing online for news and entertainment, 50% for food deliveries, and almost half of those surveyed are shopping online.

Against the backdrop of a growing digital economy, and increasingly savvy, mobile-first consumers, the three organisations have joined hands to collaborate on a credit card which complements Malaysians’ changing lifestyle and reward them for their everyday

routine.

Packed with benefits, cardholders will be able to earn more GrabRewards points (GRP) faster and easier, which can be used to redeem any Grab or partner vouchers, offset bills and make payments. Cardholders can earn 5X GRP for every RM1 spent on Grab services such as rides, food deliveries, Grab e-wallet top-up and even online and in-store purchases at GrabPay partner merchants. In addition, cardholders will get 2X GRP for every RM1 spent overseas and for e-commerce purchases while all other transactions in Malaysia will earn them 1X GRP for every RM3 spent.

Upon approval, cardholders will also receive a welcome gift of 1000 GRP and an automatic Grab membership upgrade to Platinum tier for six months. Another RM50 Grab Vouchers are up for grabs if cardholders spend a minimum of RM300 in total on Grab rides, food

delivery or e-wallet top-up within the first 45 days.

Dato’ John Chong, Group Chief Executive Officer, Community Financial Services of Maybank said, “In the past 3 years, we have observed a strong e-commerce adoption among our cardholders; in the first 6 months of 2020 alone, more than 600,000 became first-time e-commerce users. The launch of the Maybank Grab Mastercard Platinum is yet another first for Maybank, as we continue to make good of our commitment to our customers to bring them new experience, constructive solutions, and relevant benefits that complement their lifestyle. Besides the strong propositions of the card, we have also introduced a fully digitalised application process on Maybank2u, with same-day online approval and instant issuance of a digital card upon approval to give our customers a differentiated experience.”

The digital card, built into the Maybank2u platform, can be used instantly to link to GrabPay for cardholders to start enjoying the rewards immediately. The fully digitalised process is currently only available to Maybank2u customers. For non-Maybank2u customers, application can be done via Maybank2u and the physical credit cards will be issued within 10 business days upon approval. Available in two colours, black and white, the specially designed cards sport a sleek, minimalist look. The Maybank Grab Mastercard Platinum is also the first dual-faced credit card in Malaysia.

Ari Sarker, Co-President, Asia Pacific, Mastercard said “COVID-19 has heightened the demand for cashless payments all around the world. The Mastercard Impact Studies™ 2020 have shown that more than ever Malaysians are now opting to use digital payments such as e-wallets, contactless cards and online payments to make everyday purchases. Maybank and Grab are amongst two of Southeast Asia’s most popular brands and Mastercard shares their values and focus on bringing choice and convenience that enable people to live and work seamlessly. The Maybank Grab Mastercard Platinum Card is a testament to what happens when likeminded forces come together and co-create a digital first solution for the country’s fast growing, digitally native consumers.”

“Undoubtedly, the pandemic has changed our day-to-day activities and consumer spending behavior. With Grab services considered as essential needs, we have seen a significant increase in usage across our services, especially for food, mart and on-demand delivery, and online transactions. As the economy reopens with an emphasis on cashless payments as a convenient and hygienic alternative form of payment and coupled with the attractive benefits that comes with the Maybank Grab Mastercard Platinum credit card, we are optimistic of the uptake for it. This is the first of its kind by Grab in Malaysia, and as a homegrown tech enabler and proponent of the digital economy, we firmly believe that like-minded partnerships such as ours with Maybank and Mastercard will elevate the importance and drive the adoption for cashless payment in Malaysia,” said Ooi Huey Tyng, Managing Director, GrabPay.

Malaysians with a minimum annual income of RM36,000 are eligible to apply for the Maybank Grab Mastercard Platinum, which comes with lifetime annual fee waiver. The application can be done via the Maybank2u website, starting today. For more information, please visit www.maybank2u.com.

-END-