Click here for more info

Group Personal Accident is a free insurance exclusive for Grab partners to ensure they are protected while on the job. This insurance plan is automatically provided when Grab partners are active on a Grab job. Both you and your passengers are covered up to RM40,000* for accidental death, permanent disability, burns and medical expenses.

* Terms & conditions apply

Coverage: Personal Accident, Life, Permanent Disability

Coverage Eligibility: Grab partners, Passengers

Steps to claim:

- Download and complete the Personal Accident claim form

- Submit the form with the relevant supporting documents within 30 days after the accident (refer to documents checklist below according to your specific case type)

a. Online submission, email to: A&HClaimsConnect.MY@Chubb.com

b. Hard copy submission, post to:

Attn: A&H Claims Department

Chubb Insurance Malaysia Berhad

Registration Number: 197001000564 (9827-A)

Wisma Chubb

38, Jalan Sultan Ismail

50250, Kuala Lumpur

Malaysia

Customer Service Hotline: +60(3) 2058 3000 / 1800 883 226

(Mon –Fri 8.30am –5.30pm, excluding public holidays)

Email: Inquiries.MY@chubb.com

Documents checklist:

Accidental Death Claim

- A completed Personal Accident claim form

- Death Certificate

- Police Report

- Post Mortem/Autopsy and Toxicology Report

- Supporting proof of circumstances of death – including witness reports and newspaper articles (if available)

- Copy of driver’s license (if road traffic accident is involved)

- Incident Report lodged with Grab (including Trip Booking ID)

Permanent Disablement Claim

- A completed Personal Accident claim form

- Police Report

- Details of how and where the accident occurred and the injuries sustained

- All relevant Medical Reports from the attending Physician stating diagnosis or reason for treatment

- Copy of driver’s license (if road traffic accident is involved)

- Incident Report lodged with Grab (including Trip Booking ID)

Burns (Third Degree) Claim

- A completed Personal Accident claim form

- Police Report

- Details of how and where the accident occurred and the injuries sustained

- All relevant Medical Reports from the attending Physician stating diagnosis and degree of burns

- Copy of driver’s license (if road traffic accident is involved)

- Incident Report lodged with Grab (including Trip Booking ID)

Accidental Medical Expenses Reimbursement (AMER) Claim

- A completed Personal Accident claim form

- Original Medical Bills and Receipts

- All relevant Medical Reports from the attending Physician stating diagnosis or reason for treatment

- Details of how and where the accident occurred and the injuries sustained

- Police Report, if applicable

- Incident Report lodged with Grab (including Trip Booking ID)

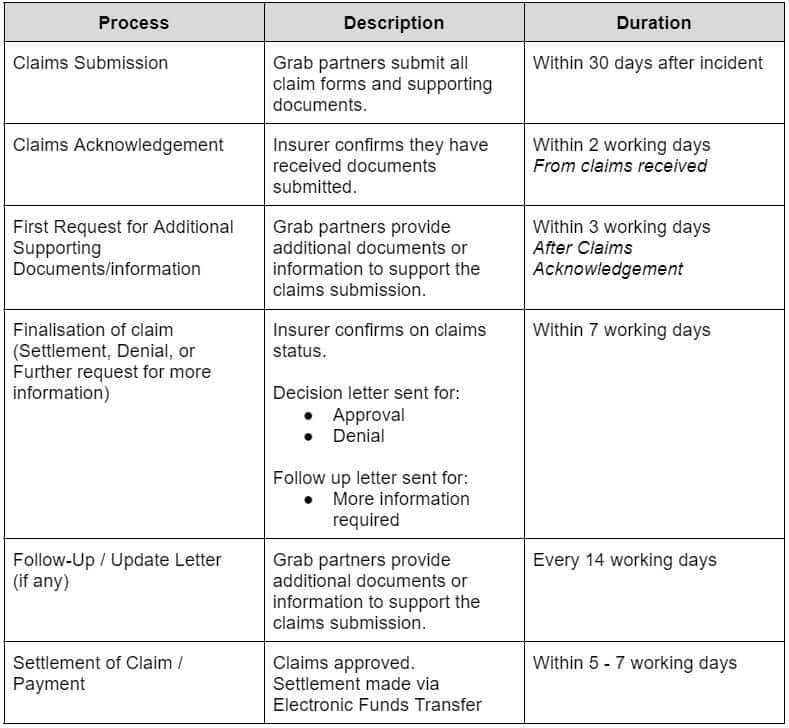

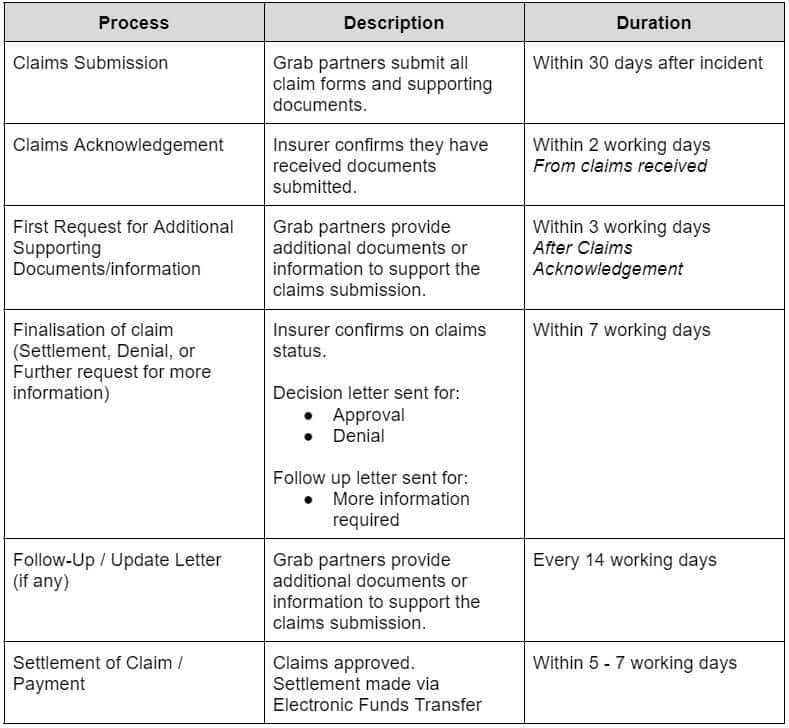

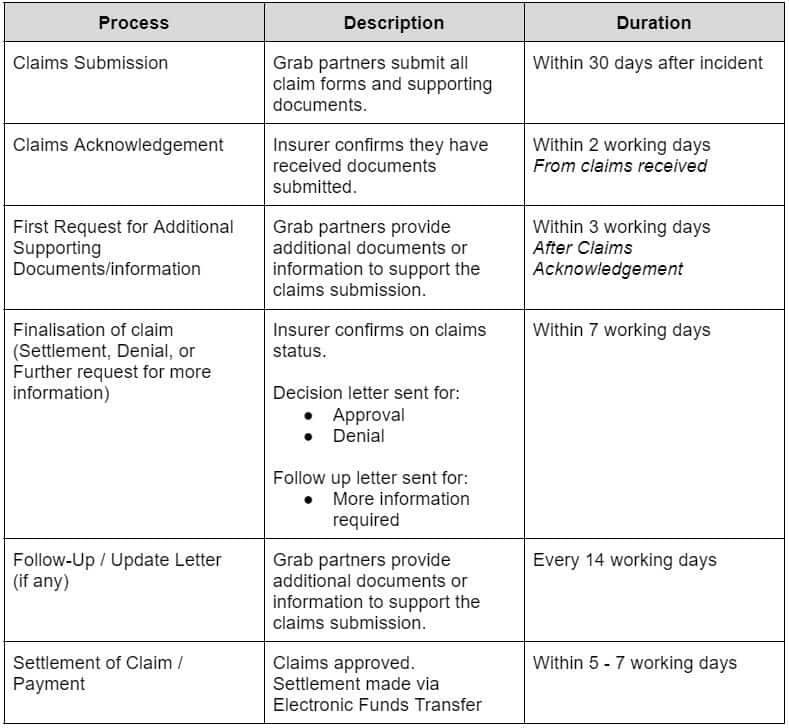

Claims – Standard Operating Procedure