Because you are important to us, it is our top priority to ensure your peace of mind during your rides with Grab. This includes ensuring that you are protected from pick-up to drop-off, regardless of who is at fault in the event of an accident.

We work only with the top global insurers to innovate new solutions, and importantly, choose only the most reliable and relevant insurance products that fit your needs.

One of the first insurance products in which we are proud to announce is the Grab Group Personal Accident insurance that covers all Grab rides in the region. It is the first of its kind additional personal accident insurance for both drivers and passengers in the ridesharing industry.

WHO IS COVERED UNDER THIS POLICY?

Insured Persons covered under this Policy are:

(a) Eligible drivers who are registered with Grab

(b) Fare-paying passengers who have registered to be transported in a Grab registered vehicle.

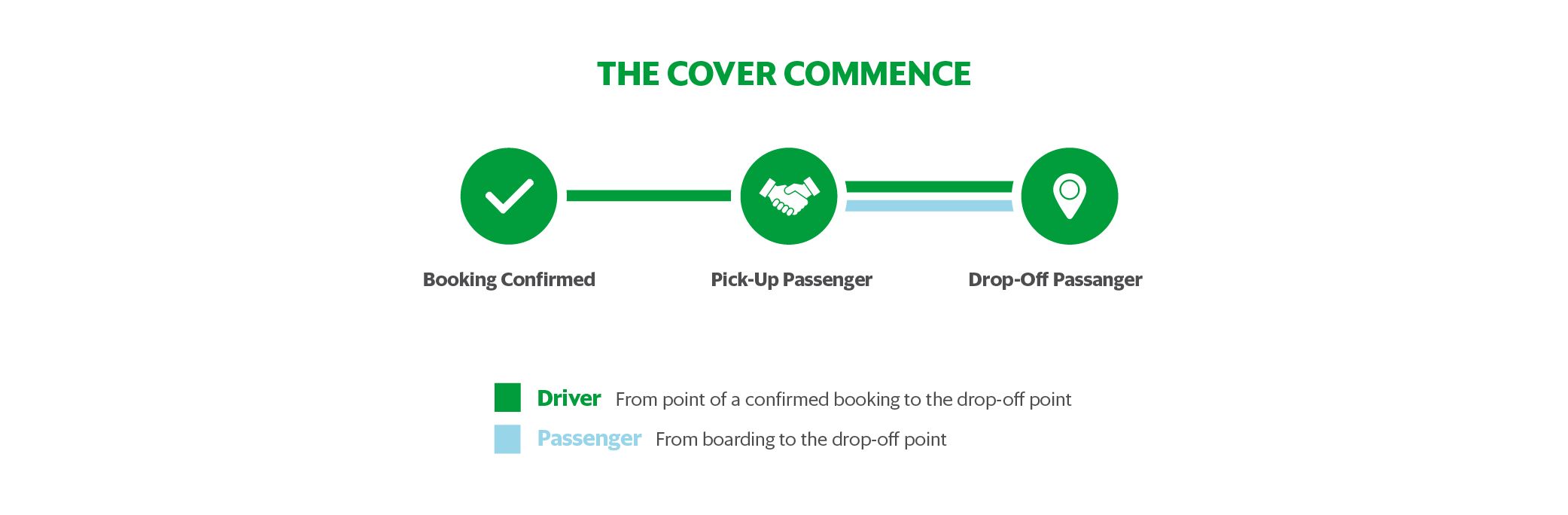

WHEN AND WHERE DOES THE COVER COMMENCE?

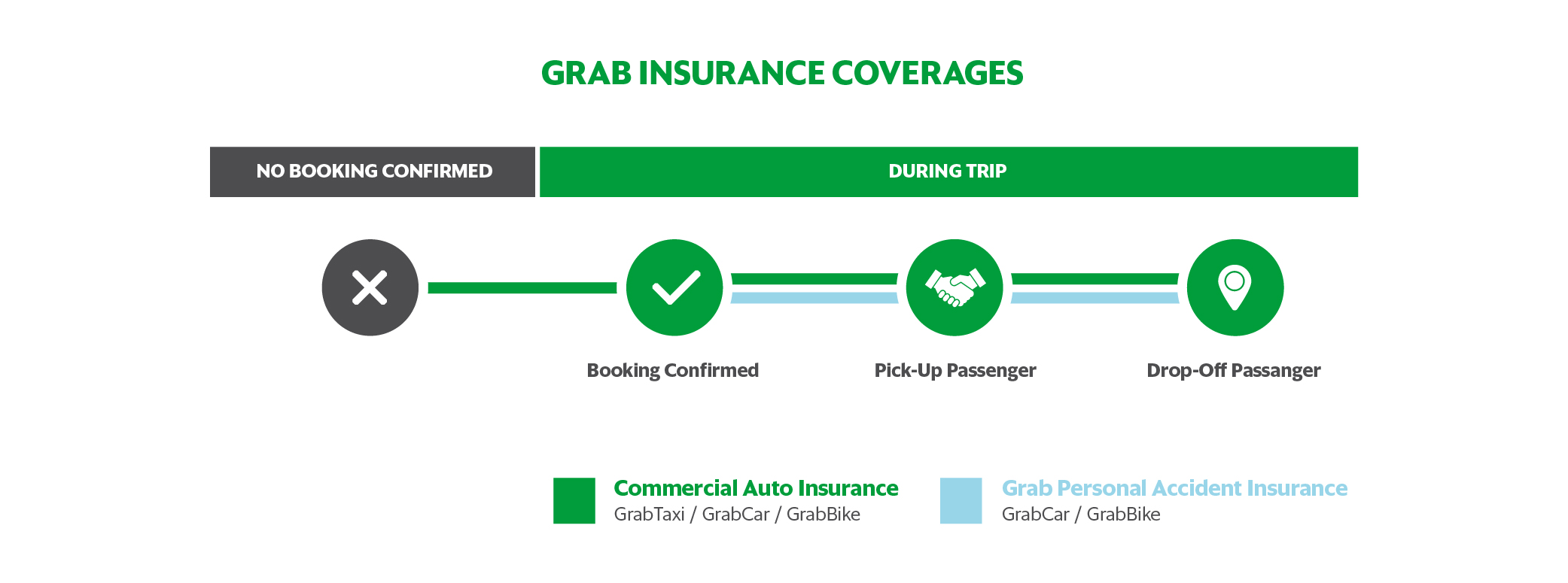

Whenever you are on a Grab booking, the Group Personal Accident insurance covers the trip in its entirety:

WHAT IS COVERED BY THIS POLICY?

Our personal insurance is designed to compensate the Insured for bodily injuries arising from a Grab accident, no matter who is at fault. Grab will reimburse the Insured for the following types of claims, up to the limit specified in the Policy (up to IDR 50 million for GrabCar and GrabBike passengers).

Accidental Death

An insured person sustains an injury during the covered trip that results in death. A funeral allowance is provided as an additional death benefit.

Permanent Disablement

An insured person sustains an injury during the covered trip that results in a permanent disability. We will compensate based on the degree of impairment or disability, as set out by the policy regarding the relevant percentage for each part of the body.

Medical Expenses

An insured person sustains an injury during the covered trip that incurs expenses for medical treatment. We will reimburse the insured person for any such medical expenses for treatment within 30 days of the Accident and up to the maximum of a further 30 days (from the date of that first treatment) for follow-up treatment, up to the limit specified by the insurance policy.

Notes:

If the Insured Person becomes entitled to a reimbursement of all or part of the above claims from any other source, we will only be liable for the excess of the amount recoverable from such other source.

General exclusions apply, e.g. war, military service or operations, any willful or unlawful act, all complications arising from pregnancy-related or pre-existing medical conditions, the influence of alcohol or drugs, engaging in racing on wheels and dentistry.

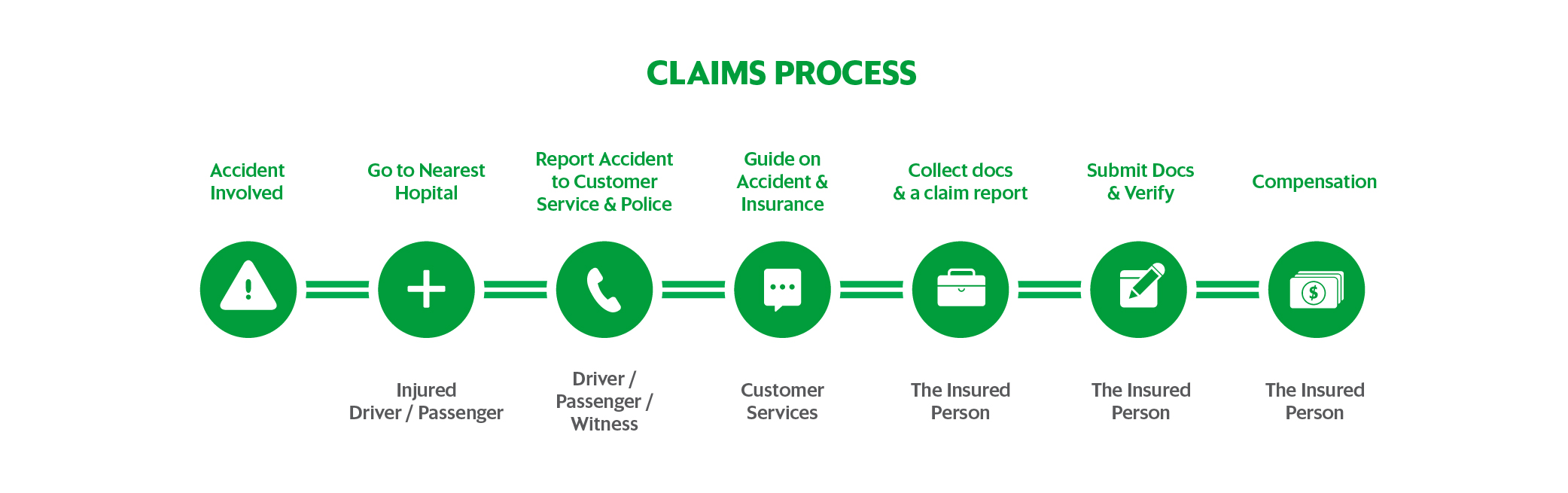

HOW TO REPORT ACCIDENTS AND CLAIMS?

Please report any accident to our customer service and the police immediately if you are involved in an accident during a GrabCar trip. Our customer service are available 24/7 to respond to any issue. You may be required to answer several questions (Who, What, When, Where, Why & How) to ascertain the accident information:

TERM OF APPLICATION:

Our customer service will then advise you about the claim process, as well as all the relevant documents necessary for filing a claim with the insurance firms.

NOTICE AND PROOF OF CLAIM

All accidents shall be reported to the insurance firm by submitting the claim report within the stipulated agreement period, no later than 30 days of the accident occurring.

All the relevant proof and documents necessary, such as the medical certificates, original final hospital/medical bills, medical reports (if any), police report/ accident report, proof of Grab booking, etc. must be submitted to the insurance firm.

Our insurance policy is available in all cities across the six Southeast Asian countries in which we operate. Some countries may have specific local requirements that have been modified or additional terms of the insurance policy. Nevertheless, all policies are similarly structured in principle.

Suggestions or comments? Write to us at safety.id@grab.com – we look forward to hearing from you.

Last updated on February 25, 2016 I Write by Grab Safety Team