Repayments are made from your Grab earnings on the first 27 days of the month. This helps you with your month end closing.

As a result, the repayment amount formula is based on your chosen loan amount divided by the tenure multiplied by the number of deduction days. For example: SGD 100,000/ (12 months * 27 days)

To check your pre-approved loan status, select “Apply Now” and input your Unique Entity Number (UEN).

You will receive funds within 5 business days after you submit your request, subject to GrabFinance’s approval.

You will be able to easily reconcile payouts and repayments via the GrabMerchant Portal. You will also receive a monthly Statement of Account. You may also request for a Statement of Account anytime at smelending.sg@grab.com.

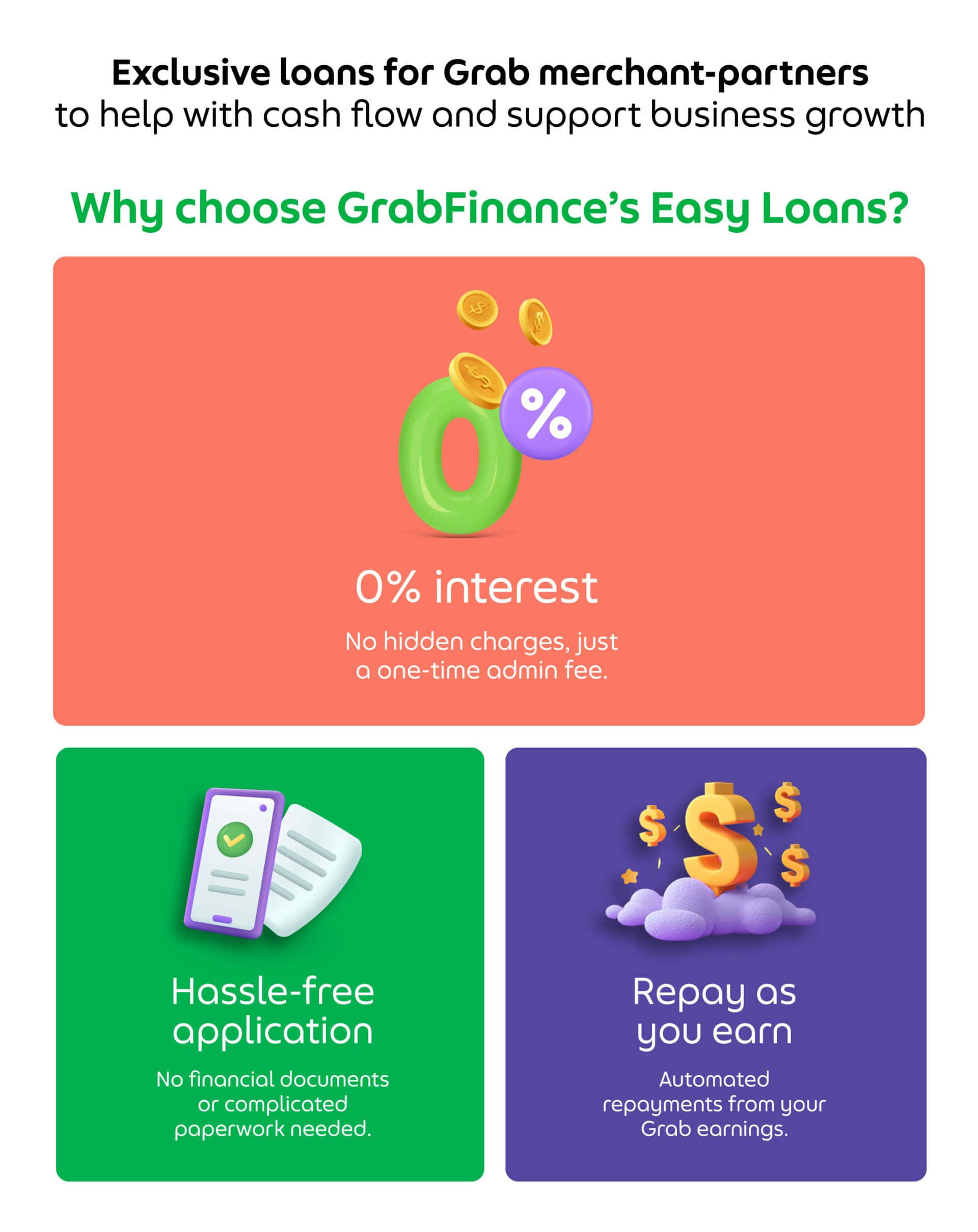

There is a one-time fee that will be deducted upfront from the loan amount.

In order to provide you with a higher loan amount, your current loan is offered to you based on the earnings assessment of all the stores under your Merchant ID. Daily deductions may be made across all your stores, to help you manage your repayments.

Your repayments will be deducted in order of the highest earning to lowest earning store each day, until the daily amount has been repaid.

- In the event that Grab is unable to deduct the daily repayment amount from your highest earning store in full, the outstanding balance will be deducted from the next highest earning store.

- Scenario 1: Full deduction from the highest earning store. E.g. If daily repayment owed is $10, full deduction is executed from the highest earning store that has $10.

- Scenario 2: Full deduction across highest earning stores within same day. E.g. If daily repayment owed is $10 and no one store has $10, partial deduction is from highest earning stores: Store A for $7 and Store B for $3 to complete the $10 deduction.

- Scenario 3: Partial deduction from top highest earning stores E.g. If stores do not have enough earnings for the $10, partial deduction will be from the top earning stores: Store A for $3 and Store B for $3. The remaining $4 will be deducted the next day.

There are 2 ways on where you will be able to get a consolidated view of your daily deductions:

- Via the Grab Merchant Portal

- Step 1: Login to the Grab Merchant Portal

- Step 2: Select the date range you wish to check

- Step 3: Click on the Download

- Step 4: Open the csv file. It will showcase all the store transactions including the deductions for your loan.

- Upon request for a Statement of Account (SOA) by reaching out to GrabFinance at smelending.sg@grab.com.

However, do note that the SOA can only be requested within the first week of the month, and the turnaround time in receiving the SOA will be from 1 to 3 business days.

Fret not, the one-time fee will remain the same despite Grab deducting from multiple stores. We are still retaining the upfront one-time fee deduction from your approved loan amount.

At the moment, repayments will be automatically deducted from stores with the highest collection.

Repayments are made from your Grab earnings on the first 27 days of the month. This helps you with your month end closing.

As a result, the repayment amount formula is based on your chosen loan amount divided by the tenure multiplied by the number of deduction days. For example: SGD 100,000/ (12 months * 27 days)

To check your pre-approved loan status, select “Apply Now” and input your Unique Entity Number (UEN).

Yes you may. Alongside your request, you will need to provide us with 6 months of bank statements, NOA and CBS and a copy of your NRIC.

You will receive funds as soon as 24 hours after you submit your request, subject to GrabFinance’s approval.

You will be able to easily reconcile payouts and repayments via the GrabMerchant Portal. You will also receive a monthly Statement of Account. You may also request for a Statement of Account anytime at smelending.sg@grab.com.

There is a one-time fee that will be deducted upfront from the loan amount.

In order to provide you with a higher loan amount, your current loan is offered to you based on the earnings assessment of all the stores under your Merchant ID. Daily deductions may be made across all your stores, to help you manage your repayments.

Your repayments will be deducted in order of the highest earning to lowest earning store each day, until the daily amount has been repaid.

- In the event that Grab is unable to deduct the daily repayment amount from your highest earning store in full, the outstanding balance will be deducted from the next highest earning store.

- Scenario 1: Full deduction from the highest earning store. E.g. If daily repayment owed is $10, full deduction is executed from the highest earning store that has $10.

- Scenario 2: Full deduction across highest earning stores within same day. E.g. If daily repayment owed is $10 and no one store has $10, partial deduction is from highest earning stores: Store A for $7 and Store B for $3 to complete the $10 deduction.

- Scenario 3: Partial deduction from top highest earning stores E.g. If stores do not have enough earnings for the $10, partial deduction will be from the top earning stores: Store A for $3 and Store B for $3. The remaining $4 will be deducted the next day.

There are 2 ways on where you will be able to get a consolidated view of your daily deductions:

- Via the Grab Merchant Portal

- Step 1: Login to the Grab Merchant Portal

- Step 2: Select the date range you wish to check

- Step 3: Click on the Download

- Step 4: Open the csv file. It will showcase all the store transactions including the deductions for your loan.

- Upon request for a Statement of Account (SOA) by reaching out to GrabFinance at smelending.sg@grab.com.

However, do note that the SOA can only be requested within the first week of the month, and the turnaround time in receiving the SOA will be from 1 to 3 business days.

Fret not, the one-time fee will remain the same despite Grab deducting from multiple stores. We are still retaining the upfront one-time fee deduction from your approved loan amount.

At the moment, repayments will be automatically deducted from stores with the highest collection.

Forward Together

3 Media Close,

Singapore 138498